by Cullen Roche, Pragmatic Capitalism

My recent post on the Efficient Market Hypothesis brought about the usual pushback from “passive” index fund advocates. As an advocate of low fee indexing I find this debate incredibly frustrating and it appears as though years of industry misinformation has muddied the waters here. Passive indexing advocates tend to argue that I am just moving the goal posts, but that’s not really true at all. In fact, I’d argue that most indexers don’t actually understand what playing field we’re on. For example, in the Seeking Alpha comments section one reader wrote:

active… passive… whatever. people who say they are “passive indexers” mean that they buy index funds or ETFs and do not trade them. it is a description of their behavior. they purchase them, perhaps dollar cost average, then wipe their hands of it.

This is absolutely not true. And we know it can’t be true because a stock picker can also buy stocks and not trade them. This is essentially what Warren Buffett does. He is as tax and fee efficient as it gets. Being a “passive investor” does not just mean that you’re relatively inactive, low fee and tax efficient. That is not the differentiating aspect between “active” and “passive”. The correct distinction between active and passive is trying to “beat the market” versus trying to “take the market”. That is, an indexer would tell you that they are just trying to take the market return while the stock picker would say they are trying to beat the market return within which that stock trades. But this clarifies why the passive vs active distinction is precisely wrong and nothing more than good marketing sold by firms who are trying to take assets from high fee stock picking mutual funds.

“Passive investing means taking the market return while active investing means trying to beat the market return. Passive does NOT mean being inactive since a stock picker can obviously also be inactive and tax and fee efficient.”¹

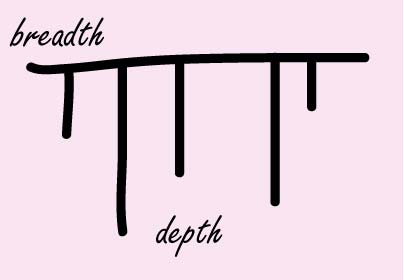

You see, at the aggregate level there is only one portfolio of outstanding financial assets. I’ve said this a million times here and gone into great detail in explaining it (which is why it’s frustrating that so few people get my point – I must be very bad at explaining this). This portfolio is “the market”. Anything within this aggregate is a micro slice within “the market” just like GE is a slice within the S&P 500. The kicker is, when one chooses to own an “index” like the S&P 500 they are simply picking an index of 500 stocks inside of the global aggregate of financial assets in a more diversified way than the stock picker. US stocks are only 18% of the world’s financial assets so this is hardly the equivalent of owning “the market” of global financial assets. And no, US stocks are not highly correlated or representative of all of the world’s outstanding stocks.

Indexers invariably deviate from global cap weighting. So, if the global cap weighting of stocks and bonds is 45/55 (as it roughly is at present) then anyone who deviates from that allocation is making an active decision that makes them nothing more than a more diversified version of the stock pickers that so many indexers demonize. That is because once you deviate from global cap weighting you are essentially saying that “the market” is wrong for some reason. And you are claiming that you can do better than that portfolio. You are implementing the same type of asset picking inside the global financial asset portfolio that a stock picker implements inside of a more micro index. And as I showed in this study, it’s very common for famous index fund advocates to underperform the GFAP even as they criticize “active” stock pickers.

This simple point shows that there is no distinction in the active vs passive debate as long as we assume that we’re being tax and fee efficient. We are all active investors to some degree. And I would argue that people who use the term “passive investing” do not fully understand the scope of the discussion here. They are, more likely, trying to sell you a product that has been marketed as “passive” because this term has come to be known as being superior to active (thanks in large part to erroneous studies such as the one cited above). And that’s why this discussion matters. Not only is it important to understand macro portfolio construction for what it is, but it’s important to avoid fund companies and advisors who sell these ideas for a higher fee than you could otherwise obtain through similar portfolio construction approaches.

¹ This research piece has a nice definition that is consistent with my position here:

Active Management – The Practice of picking individual stocks based on fundamental research and analysis in the expectation that a portfolio of selected stocks can consistently outperform market averages.

Passive Management – The practice of buying a portfolio that is a proxy for the market as a whole on the theory that it is so difficult to outperform the market that it is cheaper and less risky to just buy the market.

Copyright © Pragmatic Capitalism