KEY TAKEAWAYS

- Greece is unlikely to maintain its debt repayment schedule without a resolution.

- A default and a Greek exit may add volatility to the equity markets, but do not appear to present a systemic risk at this point..

by Burt White, Chief Investment Officer, LPL Financial

There is no question that Greece is tangled economically and politically in Europe. This was by design — the adoption of the euro was intended to be permanent, as was membership in the European Union (EU).* These entanglements are being tested by the ongoing crisis regarding Greece, its debt, and its ability to continue to use the euro as its currency. Though much has been — and will continue to be — written about this situation, we can reduce the problem to three basic issues.

· Will Greece default on its debt?

· Should Greece default, is the financial system at risk?

· Can Greece stay in the Eurozone? Does it matter?

WILL GREECE DEFAULT ON ITS DEBT?

It’s hard to gauge the current progress of discussions. Even as the current round of negotiations approaches the next deadline (June 5), the picture is muddled: the Greek government says a deal is at hand, but that claim is rejected by some international officials.

Greece is running out of money; and without a resolution in coming days, it will likely be unable to make its scheduled June payments, the first of which is due Friday, June 5, 2015. There have been short-term fixes for these deadlines, including the Greek government transferring cash from local governments, delaying pension payments, and borrowing additional funds. The issue appears to have reached a critical point [Figure 1].

*Article 50 of the Treaty on European Union does provide a right to withdraw from the EU, though the process is largely undefined.

The Difference Between the EU and the Eurozone

The European Union (EU) is an association of 28 countries that have created a common market, with free movement of goods and people across national borders. These countries have harmonized many laws regarding labor, environmental, and other social policies. The euro is the currency used by 19 of those 28, a currency created by the European Central Bank (ECB) rather than a national monetary authority. The countries that use the euro as their currency are referred to collectively as the Eurozone.

Greece has no realistic way to fulfill these obligations without substantial concessions from its creditors. It is possible that there will be a solution requiring Greece to enact a severe austerity program in exchange for further funding from the international community. However, it seems unlikely that this is a viable long-term solution. Ultimately, we believe Greece will need to restructure its debt, which qualifies as a default. It would not be the first time. In 2012, Greece reached agreements with private holders of its bonds to restructure its debt, effectively reducing the par value of its bonds by €100 billion ($130 billion given the exchange rate at that time). When all factors are considered (the change in face value, interest rates, and extension of maturity), private debt holders saw a reduction in value of approximately 70%.

SHOULD GREECE DEFAULT, IS THE FINANCIAL SYSTEM AT RISK?

One of the concerns about Greek default is its potential impact on broader financial institutions. To monitor the risks created by Greece, LPL Research reviews a set of indicators that signal stresses in the financial markets. These include absolute and relative performance of the bonds from other highly indebted nations (Spain, Portugal, and Italy), several indicators measuring European interbank lending, credit default swaps (essentially insurance contracts against government defaults), and the performance of European banks relative to the broader market. Taken together, we believe these indicators should provide a good early warning signal should the markets fear broader financial risk from a potential Greek default. At this point, we are not seeing signs of strain.

The global financial system is far less entangled with Greece than it was during prior crises. Currently, over 80% of Greek government debt is held by governmental and central bank agencies. Given how little debt private investors hold, we believe the global financial system can weather a second Greek default.

CAN GREECE STAY IN THE EUROZONE? DOES IT MATTER?

It appears that a Greek default is inevitable; whether Greece stays in the Eurozone is less certain. Greece can default and retain the euro. The converse is not true; leaving the euro would guarantee default. It seems to LPL Research that Greece should leave the euro, the so-called “Grexit.” Leaving would allow Greece’s currency to devalue. As a more independent country, it would also allow Greece to do the basic economic restructuring necessary, such as improving tax collection. The fact is, Greece was not ready to join the euro when it did and would not be considered ready now. Politicians and central bankers in Europe had been adamant on the commitment of countries to retain the euro. In the past few days, several officials, most notably International Monetary Fund (IMF) Managing Director Christine Lagarde, have acknowledged that Greece might leave the euro. The fact that “Grexit” is being openly discussed indicates that it is more probable than would have been the case a few months ago.

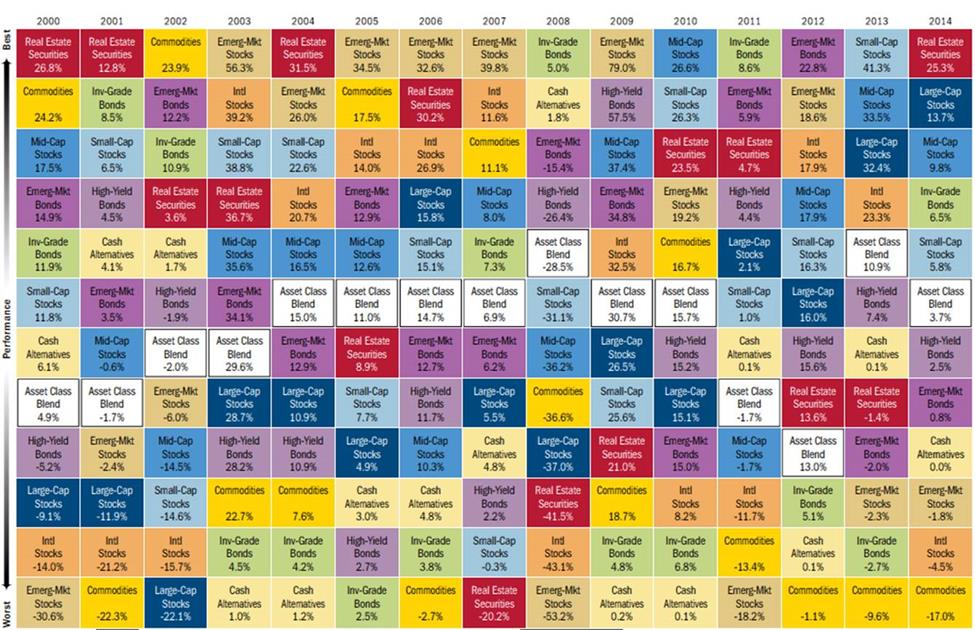

The biggest risk of a Greek default and possible exit from the Eurozone is the impact it would have on other countries and their markets. We can see the fear created by this “contagion” effect in 2011. Figures 2, 3, and 4 show the stress on the bond markets in many highly indebted countries in Europe, including Spain, Portugal, Greece, and Italy. Though Greek yields spiked the highest, reflecting fears of a default, all four countries felt the impact. When we examine these statistics today, we see the market reacting to Greece, but only to Greece, at this point.

The European economy has also been getting stronger. One key measure of European economic health, loans from banks to the private sector, recently turned positive. This measure indicates increased economic activity in the region. However, it is difficult to gauge the impact of Greece leaving the euro on market psychology.

CONCLUSION

After years of discussion, the final end to the Greek debt issue may be in sight. The result seems likely to be a significant, but organized, default and a Greece that is less entangled in Europe, regardless of the decision to remain in the Eurozone. A default and Grexit may add volatility to the equity markets, but do not appear to present a systemic risk at this point.

Weekly Market Commentary 06012015

Copyright © LPL Financial