by Cullen Roche, Pragmatic Capitalism

Felix Salmon wrote a nice explanation to his 2010 video saying you should sell your stocks. Basically, he admits that he made a mistake. That’s a pretty unusual thing to see from a high profile pundit so kudos to Felix for that. But he also finishes his piece with a salient point:

I still think that the optimum stock allocation is much lower than most financial advisors would recommend.

I’m a financial advisor and I couldn’t agree more. After all, if you plug in Modern Portfolio Theory style thinking to most people’s risk profiles you almost invariably end up with a stock heavy portfolio. That’s a pretty incredible thing when you consider that the global financial asset portfolio (GFAP) of equities is about 45%, but the vast majority of people who are risk profiled by an advisor will end up with a stock heavy portfolio.

This is even more absurd when you think about the fact that the 60/40 stock/bond portfolio has become THE benchmark for the entire financial industry despite the fact that the GFAP is almost the exact opposite weighting. How in the world can 60/40 be the benchmark in a world where we know, for a fact, that 45/55 is the actual outstanding market cap weighting of stocks and bonds?

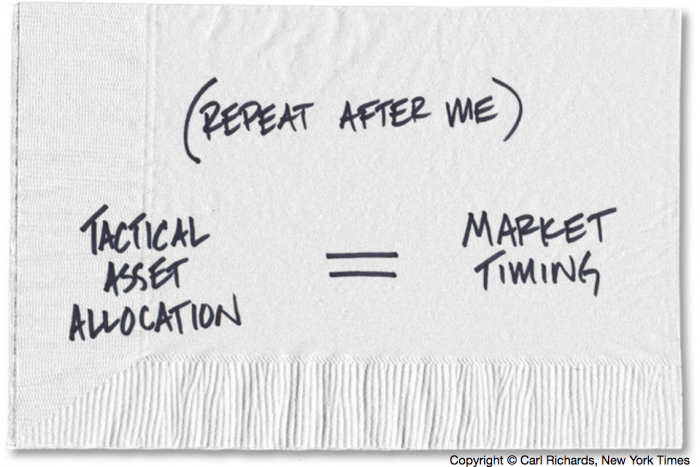

I think the reason is simple. The idea of “investing” has been sold to people as some sort of high risk & high reward pursuit. So we inevitably end up thinking about “the stock market” when we think about asset allocation. In reality, we should be thinking about the full menu of options out there and they’re much more expansive than just stocks. We actually shouldn’t even think about “investing” as “investing”. We should think of it purely as an allocation of savings. But the allure of “market beating” returns and getting rich in the markets is too powerful to convince people to pursue a more pragmatic approach.

Anyhow, I could beat up on Modern Portfolio Theory all day long and I’ll spare you the regurgitation of many of the points that I regularly make here about it. But Felix is right – stocks are consistently overhyped. We don’t need opinions there. We just need to look at the actual markets for confirmation about that.

Copyright © Cullen Roche, Pragmatic Capitalism