You’ve no doubt heard the old Wall Street adage that says stocks take the escalator up, and the elevator down.

It’s true. Climbing the wall of worry takes time. But when they pull the rug, you better watch out. Selling happens fast. Sounds simple enough, right?

However, what this old saw doesn’t mention is that stocks don’t usually take an unexpected dive from their highs. Instead, you’ll probably see a topping process as opposed to a single, obvious event.

Tops– whether we’re talking cyclical or secular ones– are portrayed as bulls simply passing the baton to the bears. But we have to remember that we’re dealing with a battle of human emotions. In reality, a bullish investor isn’t going to turn bearish overnight. It’s a fight– not an exchange.

Changes in perception are extremely difficult and painful for most investors. And they happen in waves. Not every investor will flip from bullish to bearish at the same moment. That’s why we tend to see more rounded, uncertain tops that usually feature a couple of false breakdowns and failed rallies to new highs– whether we’re talking about the major averages or an individual company or sector.

With that in mind, I think it’s time to start talking about a potential top in biotech stocks. To clarify, I’m not interested in debating whether or not we’re in a biotech bubble (irrelevant) or if what we’re seeing right now is a potential short-term or long-term correction in the sector. Frankly, I don’t really care. If I’m trading, it doesn’t matter if biotechs drop 20% or 80%. Either way, I don’t want to own them when they’re going down.

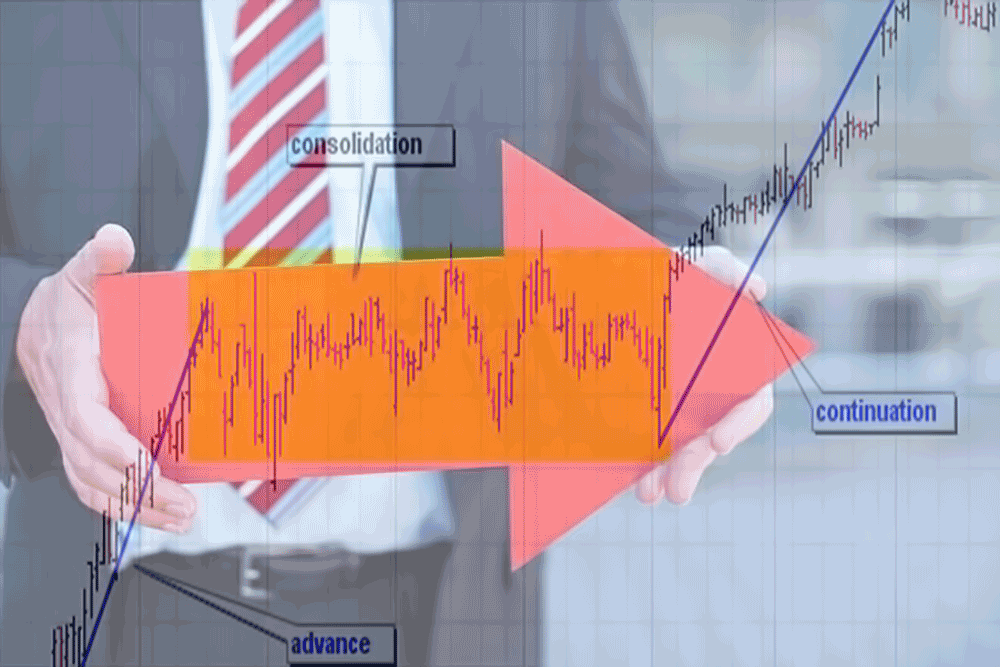

OK? Great. Let’s break down a chart:

- In late March, we see a parabolic move complete with an exhaustion candle that finishes the day near its lows.

- After heavy selling, we get a nice retest of the 50-day moving average that has been so reliable for the past six months.

- Then, failure to make new highs in late April on a low-volume rally.

- High-volume selling and the first meaningful drop below the 50-day moving average since October 2014.

- Intraday retest of the 50-day moving average failed.

I don’t need a billion different indicators on my chart to see that this group is getting weaker by the day. Any way you slice it, this isn’t a space I want to be long right now.

Taking it a step further, it’s important to note investors’ reactions if this pullback continues or worsens. This will give us clues as to where we are in the correction process.

Early stage (correction not yet generally accepted as anything more than a pullback):

“I hold the strongest stocks in this group– they probably won’t be affected.”

“What we’re seeing here is some healthy profit-taking.”

“This is only a temporary setback.”

“These stocks need to blow off some steam anyway.”

Awareness stage (technical correction identified/confirmed):

“Drug X is a game changer. This stock will rebound quickly once investors come to their senses.”

“Company X is superior to 90% of the other stocks in this industry. Its products are flying off shelves and propelling huge growth.”

“Anyone selling now is crazy. I”m backing up the truck.”

Later stage (non-financial media has figured out these stocks are down big; biotech headline hits USA Today front page):

“The selling is way overdone.”

“Wake up people! This stock is cheap as hell. Have you seen its updated price-to-sales ratio?”

—

Follow me on Twitter

Photo by Mohanraj

Copyright © Greg Guenthner, CMT