by Ben Carlson, A Wealth of Common Sense

A reader asks:

Does it make sense to equal weight the Europe and Pacific ETFs as opposed to just buying the entire EAFE index fund? How has this strategy done historically?

This is a great question because so many U.S. investors have a home bias within their portfolio and probably don’t spend enough time thinking about their foreign stock market allocation.

The MSCI EAFE index is generally used as a broad benchmark of the developed foreign stock markets. EAFE stands for Europe, Australia and the Far East. But you can also break out this index by the two largest regions — the MSCI Pacific Index which includes mainly Japan, Singapore, Hong Kong, Australia and New Zealand or the MSCI Europe index which includes places like the UK, Germany, France, Spain, Italy, Sweden and Switzerland.

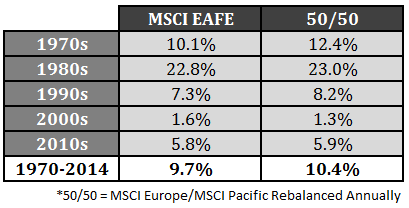

The historical data for all three of these markets is available going back to 1970 on the MSCI website. Here are the historical annual returns by decade and in total for the EAFE and a 50/50 split between the Pacific and European countries:

The 50/50 allocation showed better overall performance for the entire period and outperformed the EAFE in every decade but one. Volatility was actually lower in the 50/50 allocation as well, but it was a minor difference (22.3% vs. 21.9%). One of the biggest reasons that the 50/50 split outperforms the MSCI EAFE is because of the rebalancing bonus.

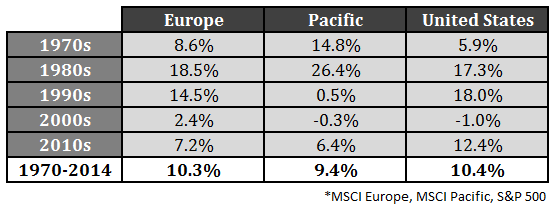

These rebalancing benefits are even more pronounced when you combine foreign and U.S. stock markets. Here are the annual returns for the MSCI Europe and Pacific indexes along with the S&P 500:

The interesting takeaway from these numbers is that if you were to take a simple equal-weighted portfolio of all three markets with an annual rebalance, the return jumps to 10.6% — higher than any of the three individual markets on their own.

How is this possible you might ask?

In a word, diversification. The leaders and laggards changed from decade to decade and even year to year. Here are the breakdowns by how often each of the three markets was the top performer each year going back to 1970:

- Pacific (40%)

- Europe (27%)

- United States (33%)

Breaking this down even further, 60% of all annual periods saw all three markets rise at the same time. But all three were only down in the same year 16% of the time. Two markets were down with one in positive territory 11% of the time while two out of the three showed annual gains 13% of the time.

So it does appear that historically there have been benefits to diversifying the international portion of your portfolio more broadly by breaking things up. But there is a catch here. This strategy requires discipline. An investor would have been selling Pacific-based stocks during the 70s and 80s to buy U.S. and European shares which were relatively underperforming. During the 90s that trend reversed and you would have been buying more Pacific stocks and selling U.S. shares when rebalancing. The past few years investors would have been selling the U.S. markets and buying abroad.

It’s not easy for investors to force themselves to adhere to a strict rebalancing plan which is required when implementing a broadly diversified portfolio. It comes down to how many funds you can stand within a portfolio from the perspective of monitoring and ongoing maintenance. For certain investors it’s just easier to keep things simple by investing in a single international fund.

As always, it depends on the investor’s tolerance for complexity and ability to implement a long-term strategy. It doesn’t really matter how you allocate your portfolio within the different asset classes if you don’t have a process in place that allows you to efficiently extract as much performance as you possibly can from each.

Further Reading:

Global Diversification: Accepting Good Enough to Avoid Terrible

How Diversification Smooths Investment Cycles

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense