by William Smead, Smead Capital Management

Our experience tells us that Crouching Tigers, while appearing contentious and dangerous, often have hidden assets. These assets can potentially turn out-of-favor common stocks into future winners. At Smead Capital Management, we run all of our stock selection through our eight criteria. Determining the source of value among companies that meet the eight criteria, however, comes in three main forms. First, value usually comes in the form of a meritorious company, which fits our criteria, falling deeply out of favor for one reason or another. Think a JPMorgan (JPM) or an Aflac (AFL).

Second, value can come from investors treating shares of an extremely meritorious company like any average company in an index. We would put Amgen (AMGN) and Pfizer (PFE) in that category. A third category of value for us comes from a “sum-of-the-parts” analysis, which exposes valuable hidden assets. Here we find opportunity if a big spread exists between that sum and the market price of the shares.

Our discussion today zeroes in on the third category. We will review three of our holdings—Gannett (GCI), HR Block (HRB) and News Corp (NWSA)—and disclose what we consider to be their hidden assets by viewing them as Crouching Tigers.

Gannett owns 46 network-affiliated television stations along with 84 daily newspapers and has a large digital presence through owning Cars.com and Careerbuilder.com. To broadcast HDTV, Gannett owns extremely high-quality spectrum which doubles as the coveted spectrum needed by the cellular industry in the U.S. The company’s market cap on April the 23rd of 2015 was around $8.2 billion.

The federal government is on a big campaign to repurchase spectrum in order to resell it to cellular companies for the purpose of keeping a strong level of competition in the cell phone market in the U.S. Most of that spectrum is owned by network-affiliated local TV stations like the ones owned by Gannett. Here is how the New York Times reports this process on April 17 of 2015 in an article titled, “Jackpots for Local TV Stations in F.C.C. Auction of Airwaves”:

With Americans increasingly turning less to over-the-air television broadcasts and more to their mobile devices, the federal government wants to devote a bigger portion of the airwaves that carry communications signals to mobile phone data.

As it turns out, some of the most desirable airwaves — those able to travel far distances and through buildings and trees — are in the hands of America’s local television stations. The government is seeking to pay stations billions of dollars to move off those airwaves, and then it plans to sell those airwaves to wireless carriers.

The pleasant problem for Gannett is that you only want to sell your spectrum if it doesn’t interrupt your ability to broadcast. In this circumstance, spectrum is effectively “water-front property” and the auctions give us a picture of what the stations are worth to one buyer, the Federal Government of the United States. As the rights (licenses) to this airspace gets scarcer and more valuable, there comes a point at which you can both value the business or get greedy and take the offer. The President and CEO of CBS weighed in on this subject in December of 2014:

In fact, he said it could present a ‘great opportunity’ for CBS,” B&C reports. “Moonves said that he was seeing numbers that indicated spectrum could be worth in the $200 million range per station — the FCC has provided a range of prices, conceding they were high-end estimates. It is conducting outreach efforts to broadcasters, including a chart with some median high-end pricing. New York, for example, is $280 million, though that is a starting price, not what any particular broadcaster might be willing to sell at, which will determine the actual payout.”

Moonves is quoted by Deadline.com saying at the conference: “We’re not saying it’s an absolute ‘no’ when you see [the numbers].

If Gannett’s TV stations averaged $200 million in spectrum value today, it means that they have hidden assets with a value of $9.2 billion and a common stock which most investors consider a Crouching Tiger. And this doesn’t include their digital assets or their publishing business!

The best part of Gannett’s position is that they don’t have to do anything with their spectrum unless the price they get paid today is a compelling premium to the net present value of the future profits from running the TV stations. In other words, if the TV business does well, it’s good for Gannett and if it’s not good, the spectrum they own goes way up in value as folks use more data in the cellular world. This is our kind of risk-reward relationship, a reward-reward relationship.

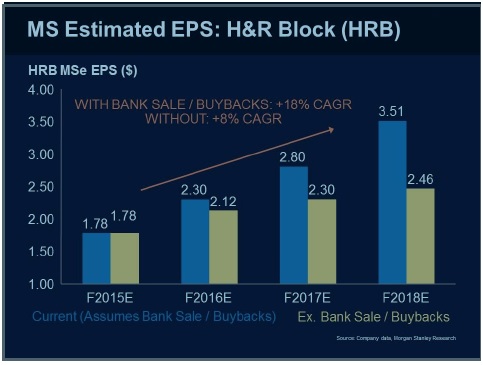

We think another Crouching Tiger with hidden assets is H&R Block. The company owns a bank and has a hidden asset in the capital on their balance sheet which can’t be used to benefit shareholders. While they own a bank, they are regulated by the Federal Reserve Board. These regulators restrict stock buybacks and dividend increases. In a recent analysis of HRB by Morgan Stanley, they project that if their bank is sold it would free up of about a billion dollars in capital. Their estimates for future profits at HRB, shown below, compare earnings with and without the bank sale.

Thomas Allen and Ken A Zerbe, CFA, the analysts at Morgan Stanley concluded that the 2018 fiscal year earnings for HRB could be 40% higher with the capital freed up. We at Smead Capital believe HRB shares could be a Crouching Tiger over those years, as the stock market discounts the growing profits and dividends.

The last of the “hidden assets” are stored at News Corp (NWSA), which emerged from the remnants of the split between the broadcasting and entertainment business of Twentieth Century FOX and the publishing assets of News Corp in 2013. News Corp owns Dow Jones, whose most visible assets are the Wall Street Journal and Barron’s. News Corp also owns media properties in Australia and the United Kingdom. Recently, it announced an effort to add to those holdings. Our sum of the parts analysis is below:

As you can see above, this is a stellar balance sheet company, and is available at a sizable discount to its parts. Warren Buffett has said many times, “Our job is to decide whether and the market’s job is to decide when.”

In conclusion, let us reiterate that there are many forms of value investing effectively used in the market place. At the moment, there seems to be some “hidden assets” among our companies which could turn their common stocks into wealth creating Crouching Tigers.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management