Low Bar For Q1/15 Earnings Season

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

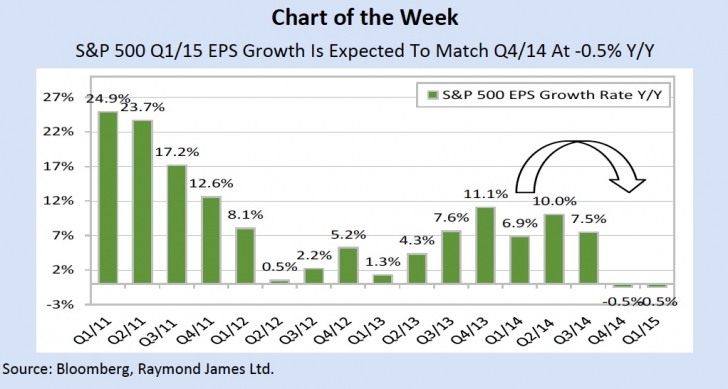

• As of quarter-end, analysts were forecasting S&P 500 Index (S&P 500) Q1/15 operating EPS of US$27/share, which if realized, would equate to a 0.5% Y/Y decline in earnings. This would match the disappointing Q4/14 growth rate and represent the first back-to-back quarters of negative growth since the financial crisis.

• We see three central factors driving the weakness in US corporate earnings: 1) weaker US economic activity in Q1/15; 2) the stronger US dollar; and 3) weak oil prices.

• Not surprisingly, the energy sector is expected to see the largest earnings decline of -38% Y/Y. The utilities and telecom sectors are also expected to deliver weak earnings growth of -34% and -21%, respectively. The information technology and industrial sectors are expected to deliver the highest Y/Y growth rates of 36% for both sectors.

• With expectations low for Q1/15 earnings results, any upside surprises would be positive for stocks, and could lead to the S&P 500 breaking out of its recent range. However, if results come in below the already lowered bar, then the likelihood of a pullback significantly increases. This is particularly true for this quarter given: 1) the elevated valuation levels for the S&P 500 with the index trading at 18.3x trailing earnings (see March 27, 2015 report); and 2) the S&P 500 has not experienced a 10% correction (on a closing basis) since mid-2011. Clearly, a lot is at stake for this earnings season, which either way is likely to result in increased volatility over the next month.

Read/Download the complete report below: