by Jesse Felder, The Felder Report

I recently wrote that, “the single greatest mistake investors make is to extrapolate recent history out into the future.” As an example of how dangerous this natural tendency is, I shared a bit of Warren Buffett’s warning from late 1999 in which he wrote that the amazing returns from the stock market during that period had led to investor expectations rising far too high. He forecast that the coming decade would not be nearly as rewarding as investors were hoping it would be. Clearly, the “lost decade” that followed vindicated this idea.

Recently, the Wall Street Journal ran a story about investor expectations once again becoming “delusional.” And with the 200% gain in the stock market over the past six years we probably shouldn’t be surprised. When stocks return 20%+ per year for a few years investors become accustomed to it. It’s only natural to extrapolate recent history into the future even if it is also extraordinarily dangerous to your financial health.

Earlier this month, Nautilus Research shared on twitter the chart below which shows exactly how dangerous this natural tendency really can be:

SPX rallies 200% in 6 Years $SPY pic.twitter.com/K7igRB9puh

— Nautilus Research (@NautilusCap) March 5, 2015

This is only the fourth time in history the stock market has risen 200% over a six year period. Exactly six years ago, when I wrote that the market presented investors with an ‘opportunity of a lifetime,’ I was rip snorting bullish but still never dreamed the following six years would be so rewarding.

And while it may be difficult to base anything on only 3 previous occurrences, returns after each of these amazing runs were lackluster at best. History has not been kind to investors acting on their natural tendency to extrapolate.

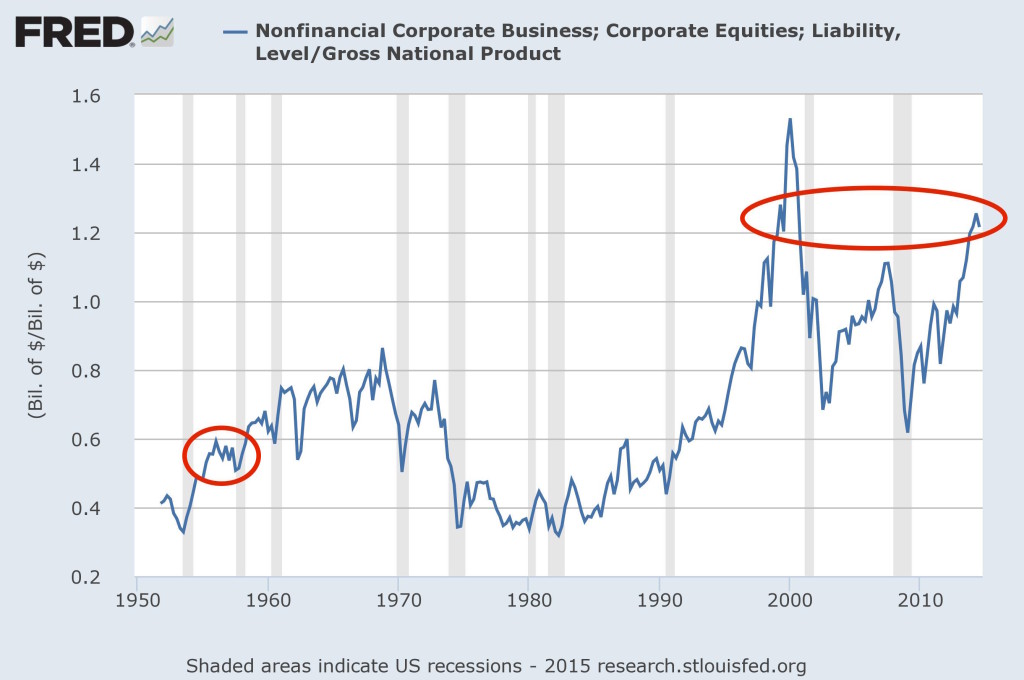

In fact, only the 1955 occurrence shows a positive subsequent return on a 2, 3 or 5-year time frame. The one thing that sets this occurrence apart, however, is that valuations back then, based on Warren Buffett’s favorite metric (total market capitalization-to-gross national product), were about half what they are today.

As I wrote previously, today’s stock market is priced just as high as it was in November 1999 when Buffett wrote his warning in Fortune. For this reason, the April 1999 occurrence in the Nautilus study is probably much more relevant to our current situation than the 1955 one. And there is good reason to believe that this market is even more insidious than the one that peaked 15 years ago this month.

The stock market today is calling to investors just as the sirens of Greek mythology called to sailors drawing them into their rocky shores only to be shipwrecked. Extrapolating the fantastic recent returns into the future despite all the evidence against it is succumbing to the stock market’s perfidious seduction. And history suggests that’s almost a sure way to shipwreck.

Copyright © The Felder Report