by Jeff Skoglund, AllianceBernstein

The plunge in oil prices has hurt many highly-leveraged energy companies and their creditors. But it also reinforced an important lesson that investors and asset managers probably learned when they were schoolchildren: Always do your own homework.

In recent years, too many investors lost sight of that lesson. With interest rates pinned near record lows, many chased returns on high-yield bonds and put off thorough credit analysis until later. In fact, it seems a fair number of investors dispensed with analyzing credit risk altogether, relying instead on the major credit ratings agencies to do the job for them.

In our view, that’s a risky strategy—especially now that we’re moving into the later stages of the credit cycle, when underwriting standards tend to slip and poor-quality junk bond issues surface.

Bursting the High-Yield Energy Bubble

The recent plight of high-yield energy companies is a case in point. Spurred by technological advances, energy companies borrowed aggressively to finance massive investment into oil and gas exploration and production.

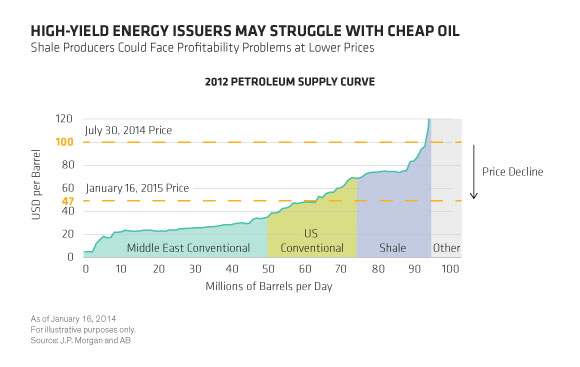

Ratings agencies assigned ratings based on the assumption that increasing demand from emerging markets and an improving global economy would keep prices in the $75-to-$100 range. That was enough reassurance for the many yield-hungry investors who willingly financed the expansion.

As we know now, prices didn’t stay in that range. Over the last half of 2014, they plunged from around $100 a barrel to less than $50. Suddenly, the exploration and production operations of many highly-leveraged companies were no longer profitable (Display). And their risky position was made worse by the added cost of servicing their outstanding debt.

The Value of Primary Independent Research

The lesson here is a simple one: Outsourcing your credit analysis—to the ratings agencies or anyone else—is risky business. Credible high-yield managers must, in our view, need to conduct independent research. That means the ability to analyze potential credit risks over the entire lifespan of a security.

As it turns out, primary research and strong internal underwriting are particularly important in a sector as variable as energy. For instance, a closer look at the shale plates and oil reserves scattered across North America would have revealed vastly different geological features and production capabilities. In one, a $10 million investment might generate an internal rate of return of 15%. In another, that same $10 million might only generate a 5% return. In other words, not all wells were alike, and the oil each would produce vary significantly.

Risk Analysis Critical as Credit Cycle Ages

This isn’t a new lesson. It’s one that gets learned, forgotten and relearned over and over again, particularly in the high-yield market. For instance, speculative investment poured into telecom companies around the turn of the century as they borrowed to lay high-speed network cables. But investors suffered massive losses because they miscalculated the demand growth required to earn a return on these investments.

With the credit cycle entering its later stages, disciplined credit selection is more important than ever. We still think there are opportunities in high yield, particularly outside the energy sector, and think pulling out would be a mistake.

But investors shouldn’t disregard credit risk just because default rates outside the energy sector are still low. In-depth internal underwriting can help avoid the speculative bubbles in high yield without foregoing the opportunities.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Jeff Skoglund is Director of Global Credit Research for Fixed Income at AB (NYSE:AB).

Copyright © AllianceBernstein