As the Nasdaq Composite Index hit the 5,000 mark for the first time in 15 years, many are asking if we’re seeing another bubble. Heidi Richardson doesn’t think so because today’s investors realize that earnings matter.

by Heidi Richardson, Global Investment Strategist, Blackrock

The Nasdaq this week has slipped below the 5,000 high-water mark it reached last week. The last time it hit above 5,000 was in March 2000.

Back then, investors were riding high, only to suffer a sickening fall as the technology-heavy index lost half its value by year-end. Fifteen years later, investors are worried another bubble may be on the horizon. But much has changed since the turn of the century. And while some sectors may appear over-valued, we believe others still have room to grow.

Y2K versus today

At the dawn of the new millennium, sock puppets and “burn rates” were all the rage. It seemed all a company needed to do was add an “e” to the front of their name or a “.com” to the end to pull in investments. However, companies like Pets.com, despite clever commercials, failed completely.

Today, earnings matter. In a slow-growth world, investors generally favor industries and companies that have the potential to deliver solid earnings, not just because they’re trendy. Mature tech is a good example because, as I’ve mentioned in other blog posts, it is poised to benefit from the pro-cyclical environment and an expected increase in capital expenditures.

Let’s take a look at five things that have changed in the last 15 years:

1. The Nasdaq Composite Index itself looks very different now.

Y2K: Tech reached as high as 65% of the index, and telecom was 12%.

Today: Tech represents 43% and telecom is less than 1%, offering more diversified exposure with other sectors.

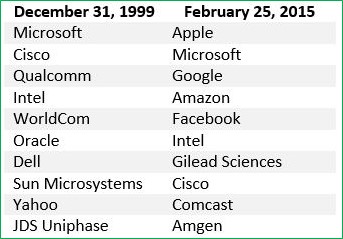

2. Dominant names are different. In fact, only three of the top 10 stocks, based on market cap, remain the same.

Y2K: Apple, which had just introduced a basket of fruit-colored iMacs, was not even among the 10 largest Nasdaq stocks. And its market cap was around $22 billion.

Today: Apple is the most valuable company in history at more than $750 billion as iPads and iPhones are everywhere you turn.

3. New entrants have come on the scene.

Y2K: Mark Zuckerberg would have been applying for a driver’s license.

Today: Facebook is a household name globally and one of the largest companies in the world by market cap.

4. Strong earnings growth helps keep valuations attractive.

Y2K: Earnings were nonexistent for many Nasdaq companies, and according to index data its price/earnings ratio at times exceeded 200 through multiple expansion.

Today: Nasdaq stocks currently trade at about 23 times earnings.

5. The climb has been strong and steady.

Y2K: Nasdaq rallied 95% from the October 1999 low to the March 2000 high.

Today: The index’s rise has been more gradual, only 21% from October 2014 to March 2015. (Source: BAML)

Top Ten Nasdaq Stocks by Market Cap, Then & Now

Source: Nasdaq

But, one thing that remains from Y2K is the iShares U.S. Technology ETF (IYW), which launched in May 2000. Today, the fund includes mature technology firms that survived the bubble to become among the 100 largest U.S corporations by revenues. And IYW does not contain telecom stocks.

Nasdaq’s latest 5,000 tally is garnering a lot of attention, and rightfully so. But the quality of mature technology companies today appears to be more solid than they were in 2000. We learned the hard way—earnings matter.

Sources: Bloomberg, unless otherwise noted.

Heidi Richardson is a Global Investment Strategist at BlackRock, working with Chief Investment Strategist Russ Koesterich. She is also the lead investment strategist for iThinking. You can find more of her posts here.