by Joseph Rosenblum, AllianceBernstein

Crude oil prices have fallen sharply since last summer, a bright spot for American consumers. Major oil-producing states aren’t as happy, because the loss in tax revenue is impacting budgets and economies. Some states will face real hardship; others will emerge relatively unscathed.

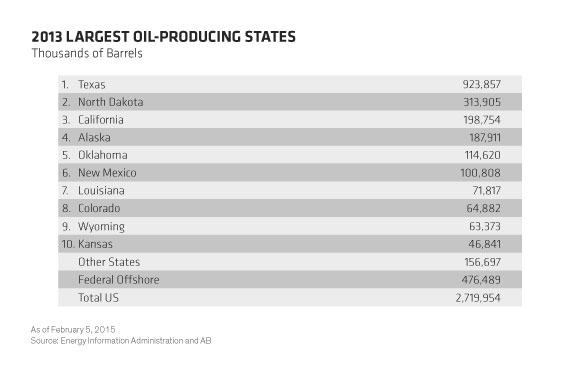

Of the 10 largest oil-producing states in the US (Display), Alaska’s state budget will be most severely affected, with New Mexico and Wyoming next in line. The rest of the top ten receive less than five percent of their revenues from oil taxes. In terms of the overall economic impact, North Dakota will see the largest hit; we expect the price crash to drive the state into recession in 2015. In California, Colorado and Kansas, diverse economies should limit the impact. The other largest producers will face a moderate economic shock.

Here’s our more specific take on a few of the top oil producers:

Texas will be affected—but not as much as you’d think. Texas is the largest oil producer in the US, but declines in oil revenues should have only a modest negative effect on its budget. Two reasons: Texas has strong reserve funds, and revenues from other key sectors, such as healthcare and high tech, should help offset the loss.

Texas legislators are also smart about how they allocate oil money; they don’t rely on it for the basics. Texas oil and gas producers paid $3.6 billion in taxes in 2013 (4.5% of state revenues), but most of that figure was dedicated to emergency savings and highway funds.

As for budget reserves, Texas has amassed the highest balance in its history, giving it unprecedented flexibility to weather the oil price challenge. The rainy-day fund currently has a balance of more than $8 billion—about 9% of total spending.