by Sharon Fay, AllianceBernstein

Plunging oil prices since mid-2014 have led many equity investors to shun energy stocks. We think that’s a mistake. By studying the aftermath of previous oil shocks, we believe investors can gain insight to prepare for a possible rebound.

In recent weeks, the oil price has recovered from a trough. Brent crude has climbed 32% from a low of US$45.25 on January 26 to nearly US$59.79 on February 20. And investors have pumped $4.9 billion back into US-domiciled energy sector exchange-traded funds (ETFs) in December and January, according to data from Strategic Insight.

But timing a big rebound isn’t easy. The recent uptick in the oil price has been driven by an accelerated decline in US drilling activity, a squeeze on short positions and events in the Middle East—which can all change quickly. Since so many variables affect the oil price, another leg down might yet precede a more sustained recovery.

It’s better to take a long-term view. As my colleagues explained in a recent blog, we believe that over time, the underlying dynamics of production will push oil prices back up again.

Revisiting Past Oil Price Shocks

Understanding the context of an energy shock is the first step to investing. Some are driven by supply issues, while others are caused by demand. For example, in early 1986, oil collapsed after Saudi Arabia flooded the market with excess supply. But in 2009, oil prices tumbled on concerns that a global economic slowdown would undermine demand.

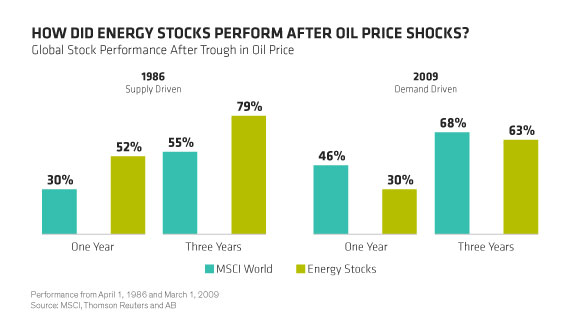

So what happened to energy stocks? In 1986, global energy stocks outperformed the broader market for a year and three years after the oil price bottomed (Display, left). By contrast, in 2009, energy stocks underperformed the broader index (Display, right). US stocks posted similar patterns in both cases.

Taking a closer look, we find that the performance of energy subsectors was varied (Display). Equipment and services companies surged in 2009, yet lagged behind production companies in 1986. Refiners and marketing groups stagnated after the 2009 episode. These observations highlight the need to take a selective approach to the energy sector by evaluating how current conditions may unfold and affect diverse companies in an oil price recovery.

Dividend Yields Are Elevated

Today, the situation is largely driven by supply. Energy stocks are trading at extremely low valuations and dividend yields are extremely high. For example, the dividend yield of the three US oil majors versus the S&P 500 hasn’t been higher than today for 20 years. This implies a fear that companies may be forced to slash payouts to shareholders.

These trends can help investors make informed choices today. First, look for energy companies with a structure and a business model that are likely to work well even without a full recovery of oil to US$100 a barrel or more. Some exploration and production companies, as well as integrated groups, can do well with oil above US$70 a barrel, our research suggests. Our checklist includes companies with high quality oil fields, lower-cost production and resilient balance sheets to support dividends. Companies that don’t depend on capital spending to generate earnings also have a much better chance of maintaining dividend payouts through stressful times.

Be Selective With Services

Second, be selective with oil services companies. Some investors have started to move back into services, recalling the sharp rebound in 2009. But that was a demand crisis. Today, even if oil starts to bounce back, we think it could take a while for companies to ramp up new supply that will increase demand for services, thereby suppressing profitability in the subsector for longer. However, some services groups are technical leaders, which play a vital role in the long-term development of deep water fields, where most incremental oil supplies are found. These companies also tend to have strong balance sheets that should help them through the current downturn.

Third, the outlook for refiners and marketing companies is complex. These businesses are not as sensitive to oil prices as other parts of the sector. Here, profits are driven mainly by spreads—between oil prices as well as between crude prices and product prices. Currently, global overcapacity in refining could constrain profitability even if demand begins to pick up. Still, some US refiners have big cost advantages and could benefit from wider spreads between US and global supplies, as well as from a buildup of crude because US producers aren’t allowed to export.

Avoiding the energy sector is a risky strategy that could leave investors behind in a recovery. Yet investing in energy sector ETFs mean that an investor will have indiscriminate exposure to the energy sector at a time when a discriminating approach is especially important. By focusing on valuation, cash flows and business-specific fundamental analysis, we believe that investors can gain conviction to reconnect with energy stocks for a long-term recovery.

This blog was originally published in InstitutionalInvestor.com

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Sharon Fay is Head of Equities at AB (NYSE:AB).

Copyright © AllianceBernstein