by Cam Hui, Humble Student of the Markets

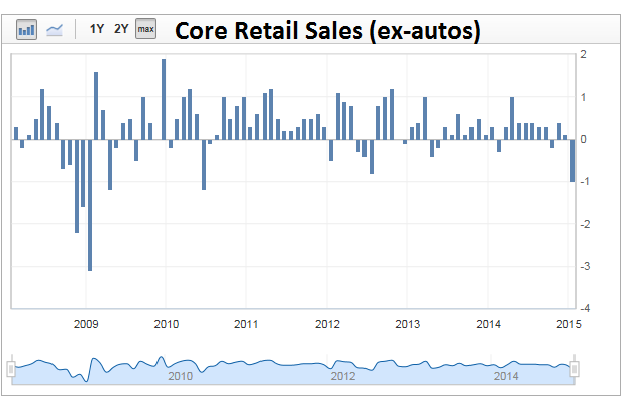

This Thursday, we will see the Retail Sales report. Despite the drop in energy prices, retail sales haven't exactly been setting records. The Street estimate for MoM Core Retail Sales (ex-autos) is -0.4%.

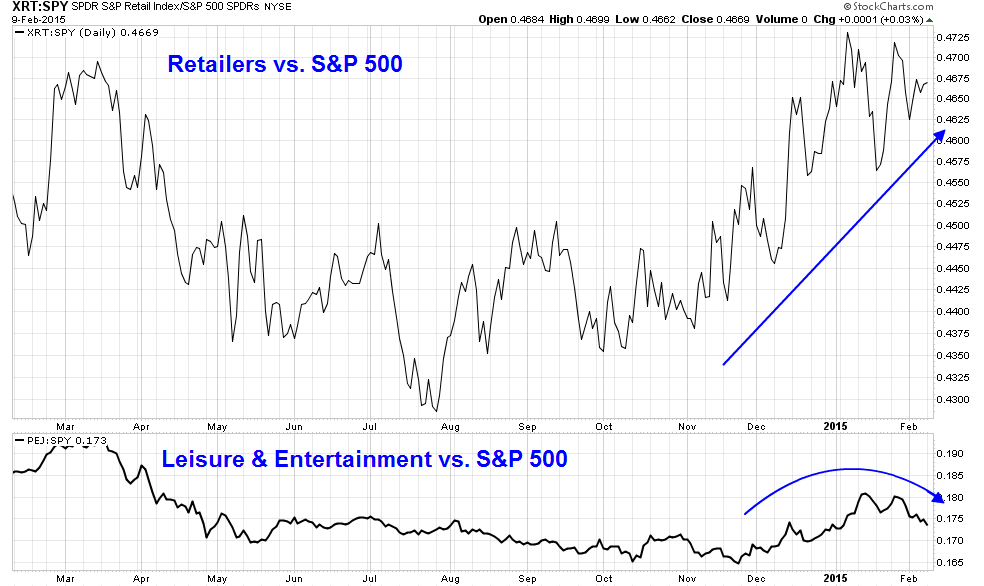

On the other hand, retailing stocks have been in a solid relative uptrend when compared to the market. The bottom panel shows the relative performance of the Leisure and Entertainment group, which seems to be starting to roll over.

What's happening to the American consumer? Where are the savings from lower gasoline prices?

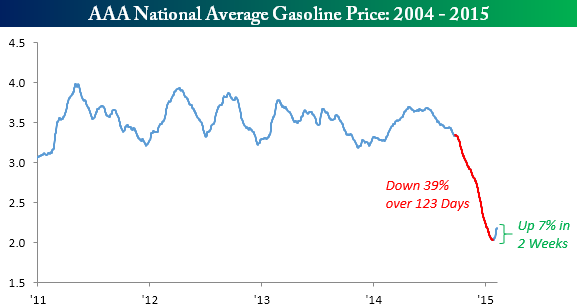

The surprising answer is...more gasoline (via Marketwatch):

Plunging prices are encouraging Americans to drive more often and buy more trucks. At the same time, faster economic growth and a big influx in hiring over the past year means more Americans are now taking part in the daily commute.

The result: sharply higher demand for gasoline, argues Nicholas Colas, chief market strategist at ConvergEx.

“We’ve finally discovered where American consumers are spending some of the savings from lower gasoline prices: they are buying more gasoline,” he said in a new report.

For one thing, Colas points out the amount of gasoline supplied to the U.S. market was up 6.3% in January compared with a year earlier.

What’s more, the number of miles Americans drive annually was on track to surpass 3 trillion in 2014 for the first time since a record 3.04 trillion in 2007 — the year before the Great Recession started. (The government estimates miles driven via thousands of electronic sensors on main public roads.)

As gasoline prices have ticked up in the last couple of weeks (chart via Bespoke), what will happen to consumer confidence, which will get released on Friday?

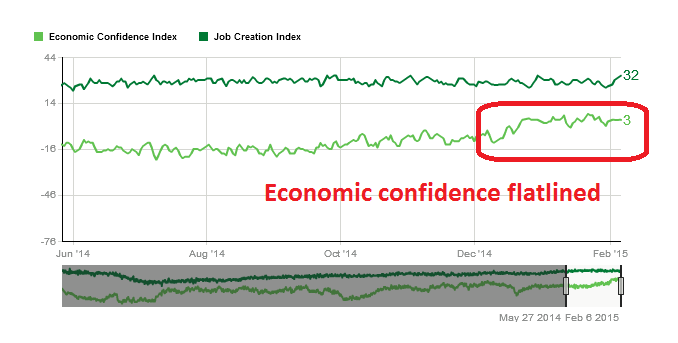

The latest Gallup tracking poll shows that economic confidence has flatlined since oil prices tanked in December:

As the above chart of relative performance of retailing stocks indicates, expectations are rising for consumer spending. Watch this space for possible disappointment.

Copyright © Humble Student of the Markets