by Jesse Felder, The Felder Report

Can we please stop bashing forecasters already? There is a small but influential faction of bloggers/financial talking heads out there that love to bash everyone who doesn’t invest exactly along their prescribed investment philosophy which is usually some sort of “passive” methodology, writing off non-conformists to their style as “forecasters” (or, even worse, “active managers”).

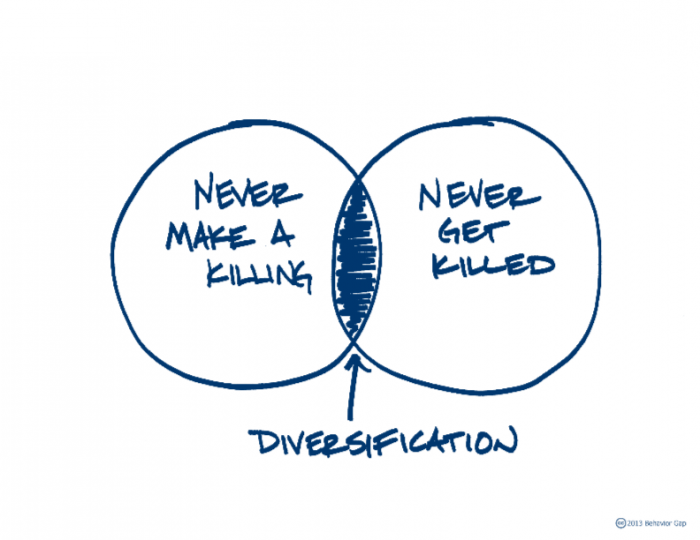

First of all, there is no such thing as “passive investing.” Picking an asset allocation is, by definition, active investing. Second, there are problems with passive investing they just don’t want to discuss but back to the topic at hand…

Yes, I agree that most forecasts are almost worthless. Just take a look at how many analysts and market gurus were calling for higher interest rates on the long bond in 2014 (nearly all of them), for example. The only “worth” in these sorts of forecasts was in their contrarian message – buying long-dated treasuries turned out to be a great trade.

But I think it’s absolutely imperative to realize that EVERYTHING is a forecast – even a so-called “passive investment portfolio.”

If you tell me to own a total stock market fund over the next decade (or any index fund, for that matter) you are making a forecast about what sort of return you expect it to generate over that time. Clearly, you wouldn’t tell me to own this sort of fund if you believed that stocks were likely to fall 40% over the coming decade (like the San Fran Fed recently suggested may be a real possibility). No, you believe that I will likely receive a positive return, after inflation, or why take the risk of owning equities at all? It’s a forecast, plain and simple.

At the end of the day, then, trashing forecasters is simply a way of saying that THEIR forecast is not as valuable as YOURS. And if you want to make that argument then I’d like to know WHY you think yours is better rather than just bashing the other guy’s.

Ultimately, to be truly honest with individual investors and our own forecasting ability, we should be telling them that the most successful models suggest that, from current prices, they will likely receive a negative real return over the coming decade from equities. And at 1.75% on the 10-year treasury, they can’t reasonably expect anything more from that asset class. Those are forecasts based purely on facts and statistics and it’s probably the best we can do.

But you can’t play this game without making a forecast. In fact, you can’t even sit out of the game without making one because even that decision is a forecast (that cash is likely to do better than any other asset class). So, with all due respect, please STFU about it; it’s disingenuous. Stop bashing forecasters and instead tell us why you believe YOURS is so much better than anyone else’s.

Copyright © The Felder Report