by Michael Batnick, The Irrelevant Investor

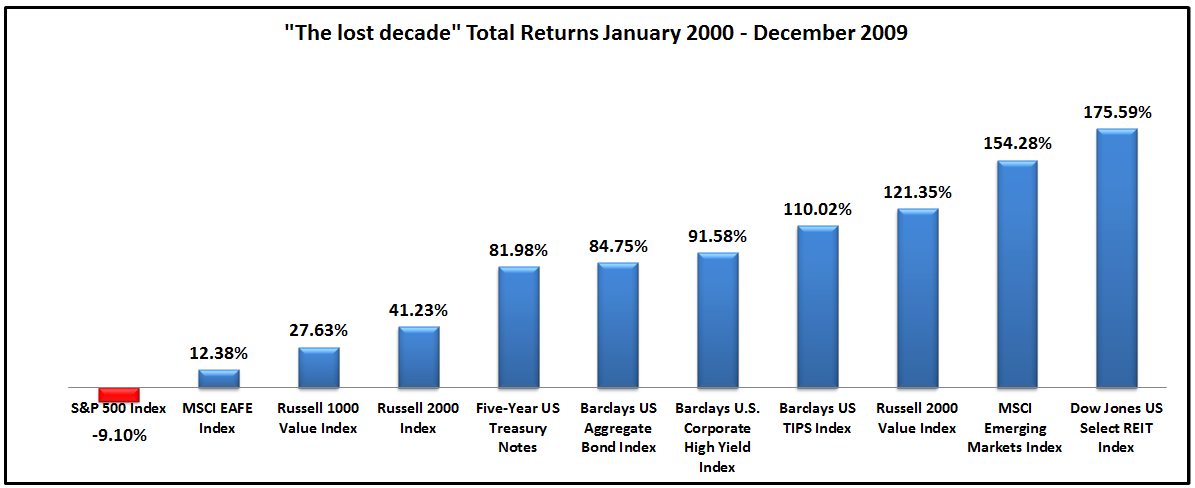

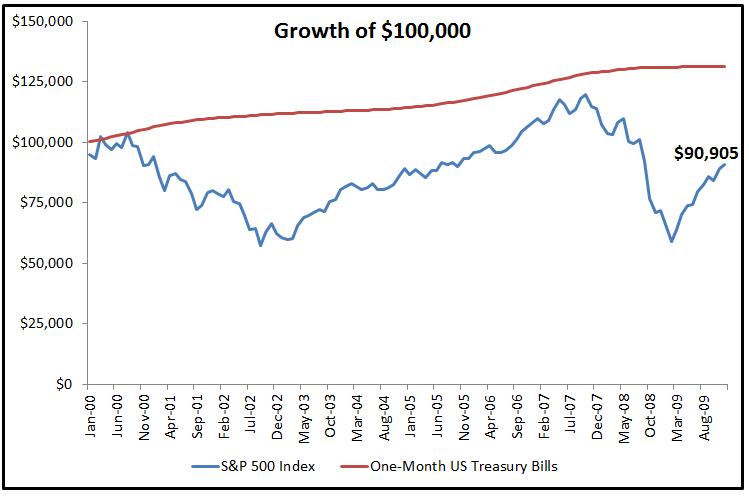

The period from 2000 through 2009 is referred to as a “lost decade” for U.S. stocks. Over this period, investors were not rewarded with an equity risk premium, they were better off in risk-free treasury bills. Not only were they not rewarded, they were punished by two peak-to-trough crashes of greater than fifty percent.

While all that is true for the S&P 500, there were other areas of the market that delivered excellent returns over the same period of time. Emerging Markets were up 154%, U.S. bonds were up over 80% and U.S. Reits were up 175%!

"Don’t put all your eggs in one basket" is understood by everyone inside and outside of the financial world. So if we understand diversification is the only free lunch in investing, why don’t more people do this?

The answer is discipline. Holding a diversified portfolio can be an arduous task, as it was in the mid to late nineties when everyone around you was becoming an overnight millionaire. We’re experiencing something similar now as U.S. stocks have been outperforming for years while international stocks have been nothing but a big drag on returns.

The evidence shows that a diversified portfolio works over time and unfortunately time can be a huge mental hurdle for many investors.

Follow me on Twitter

Copyright © The Irrelevant Investor