I want to quickly apologise for the lack of updates. I've had an annoying flu over the last several days. The dry cough doesn't really want to go away either, so to be quite honest, it doesn't put you in the mood for work. Let us go through the markets to see some of the recent developments.

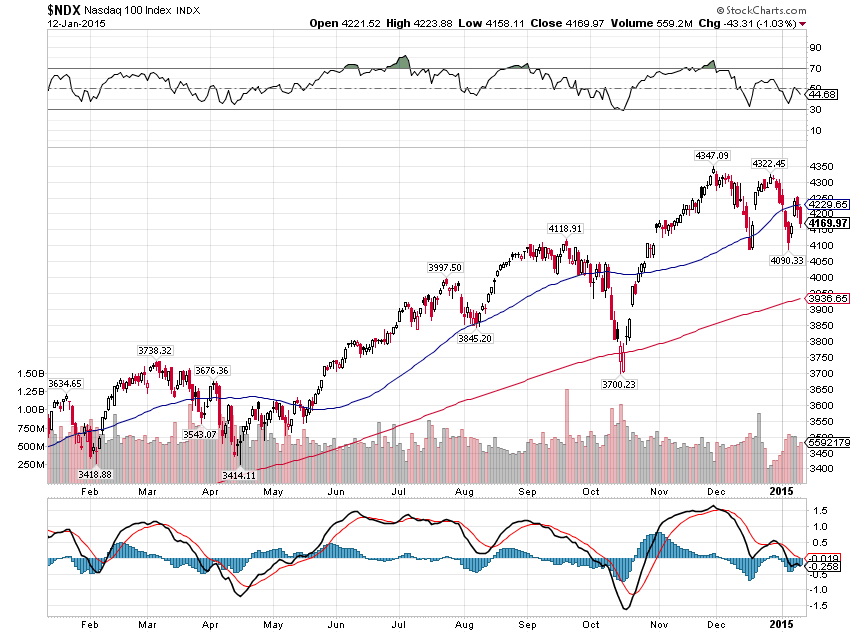

Chart 1: Despite constant bullish commentary not all is well in US stocks

Source: Stock Charts

Run of the mill opinions in the consensus camp are that US equities will produce another decent performance in 2015, rising anywhere between 10 to 15 percent. However, if history is any guide, this might not be a slam dunk bulls expected it to be. Dow Jones is currently up 6 years in the row, so to go into a 7 year winning streak would be a feat not match since 1870s I believe.

In general, the year has started of on a bad note. Despite the fact that majority of the US indices made a new all time highs in late December, the leader of the overall bull market and an investor darling - Nasdaq 100 - actually failed to confirm this upside move. Furthermore, the tech heavy index once again broke below its 50 day moving average over the last two trading days.

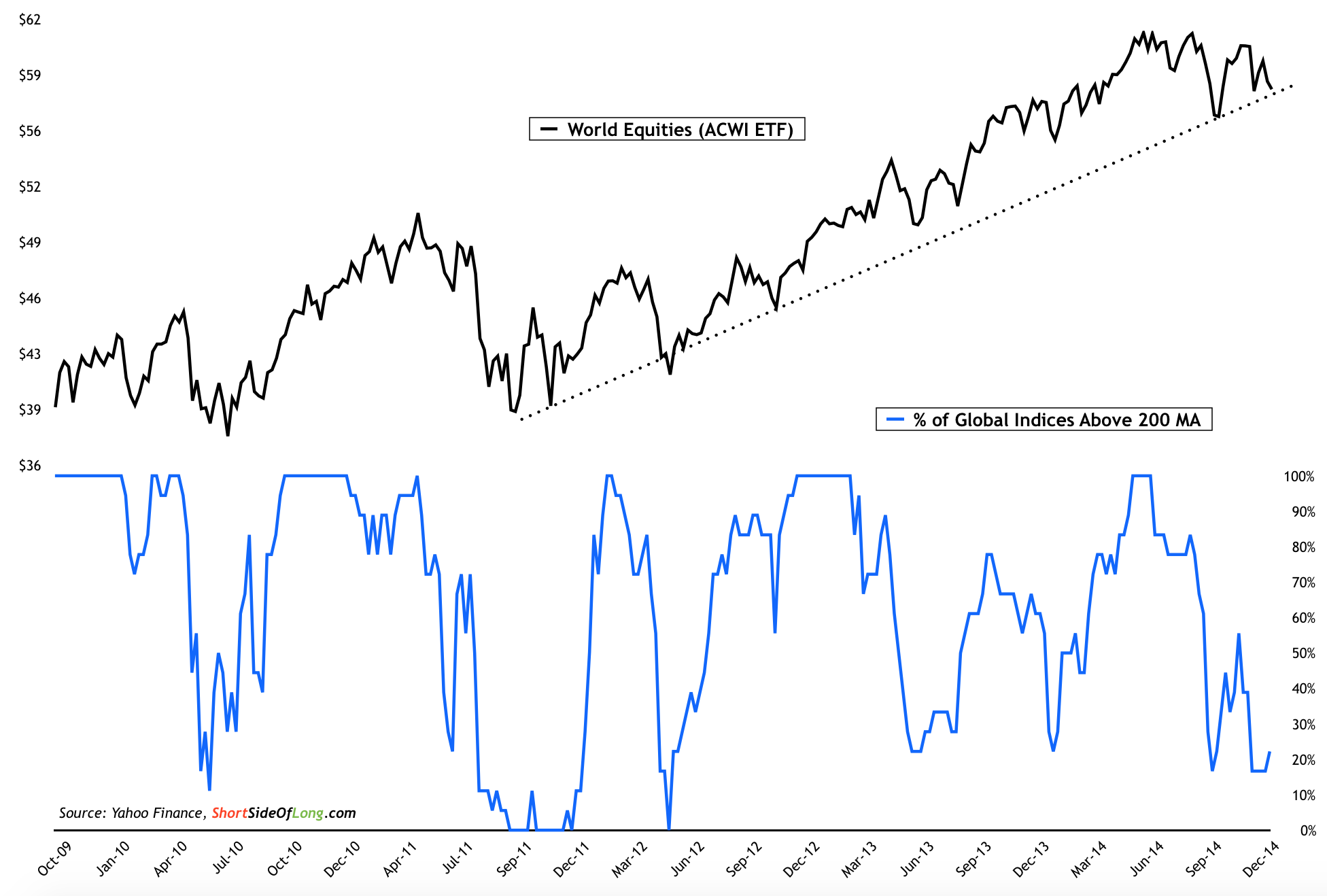

Chart 2: Majority of the international stock markets have been struggling

Source: Short Side of Long

And while some potential trouble could be brewing in the US, as seen in Chart 1, the fact is that majority of the international stock markets have been struggling since June of 2014. While the All Country World Index remains in the uptrend, mainly thanks to the outperformance by the S&P 500, consider that less then 25% of the global indices priced in USD are trading above their respective 200 moving averages. In other words, three quarters of global stock markets are currently in a downtrend.

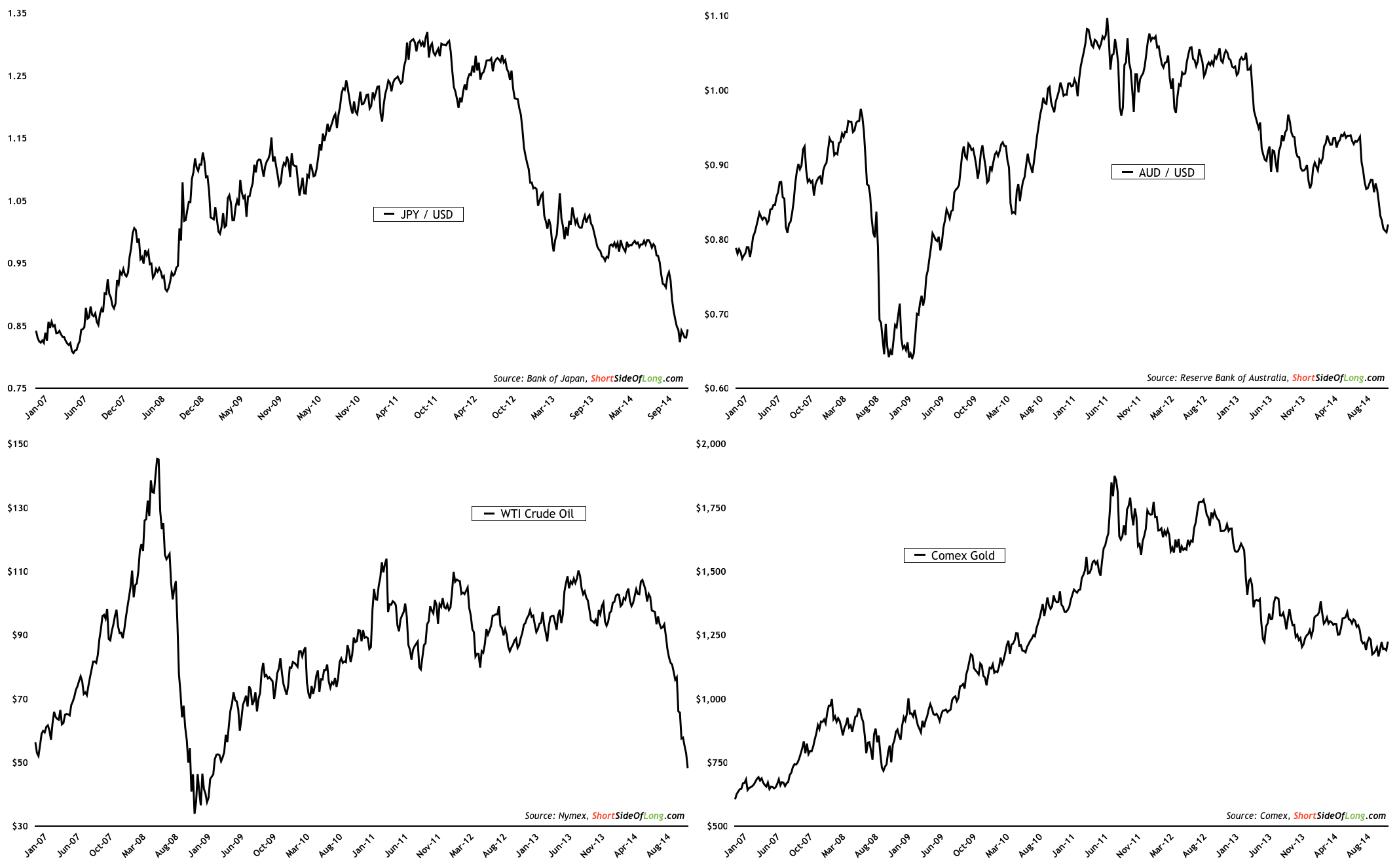

Chart 3: For months USD strength has been nothing short of amazing!!!

Source: Fin Viz (edited by Short Side of Long)

If there is one asset class to blame for all of the recent weakness, it has to be the US Dollar. The rally in the reserve currency has been nothing short of amazing, and interestingly since the rally began in June of 2014, many asset classes have suffered. These include commodities such as Crude Oil, major foreign currencies such as the Euro and the Yen, emerging market currencies such as the Ruble and intentional share markets from Europe to Asia.

I believe that majority of the damage is now done. From contrary perspective, US Dollar could top out and starts its correction quite soon. Daily Sentiment Index recorded 98% bulls last week, only the second time it has done so in almost a decade. The only other time we had similar amount of bulls was in May 2010, just weeks before the greenback topped out as Eurozone bailed out Greece.

Chart 4: A correction in the US Dollar could help many different assets

Source: Short Side of Long

If the correction in the US Dollar would occur in coming weeks, it might boast many different asset classes. Firstly, the dramatic crash in Crude Oil could finally find some sort of footing. Stabilisation in energy prices could help energy stocks as well. Foreign currencies such as Japanese Yen and Australian Dollar find themselves at major historical support levels of 120 yen and 0.80 cents, so both of these could rebound for awhile.

Emerging market currencies have been under pressure recently, so a peak in the greenback could stabilise these currencies and put a bid under the extremely cheap emerging market equity complex. Finally, as already discussed in previous posts, Gold has been holding up well despite the Dollar rally. Therefore, Dollar weakness might only further strength Gold as it attempts to break out into a new uptrend.

Copyright © The Short Side of Long