by William Smead, Smead Capital Management

Those of you who follow us at Smead Capital Management know that we believe in the idea that good markets die on too much affection and continue due to a lack of affection. You also know that we want to own wonderful companies for a long time and do so through regular stock market corrections/bear markets over the years. Since the stock market bottom in March of 2009, this secular bull market has climbed on a wall of worry and on a lack of optimism. With the U.S. stock market starting the year on a down note, we thought it would be appropriate to consider the arguments of smart people who are warning investors and possibly resurrecting the wall of worry in large-cap U.S. stocks.

Two of the most respected and successful investors who use macroeconomic theory opened the year with major pronouncements. First, Jeff Gundlach, head of Doubleline Capital, was interviewed in Barron’s. He argued that underwhelming U.S. GDP growth and the slowdown around the world could take the ten-year Treasury bond down to a 1.3% interest rate. This caused folks to worry that the economic growth might not support earnings like optimists believe. Here’s an excerpt from Barron’s:

GUNDLACH ISN’T PARTICULARLY sanguine about the prospects for U.S. stock markets. Early in the year, rebalancing of diversified institutional portfolios from stocks to bonds will create some price undertow for equities, he claims. Also, he worries that gross-domestic-product growth for next year and 2016 is unlikely to hit the 3%-plus annual targets that forecasters are assuming. That’s because the deflationary tide unleashed by a slowing world economy and excess capacity will begin to lap against U.S. shores by the middle of 2015. A strengthening dollar won’t help U.S. competitiveness.

Second, Bill Gross, who now plies his trade at Janus, came out with his monthly letter. Bill and his former firm, PIMCO, popularized the term “new normal” to describe the miserable economic environment left to us from the financial meltdown and existing debt overhang. In his latest letter, he pointed his gun straight at common stock investors, proclaiming the end of the secular bull market in stocks. Here is how he wrote it:

So I’ll leave the specific forecasting for a few weeks’ time and sum it up in a few quick sentences for now: Beware the Ides of March, or the Ides of any month in 2015 for that matter. When the year is done, there will be minus signs in front of returns for many asset classes. The good times are over.

…Nevertheless, there comes a time when common sense must recognize that the king has no clothes, or at least that he is down to his Fruit of the Loom briefs, when it comes to future expectations for asset returns. Now is that time and hopefully the next 12 monthly “Ides” will provide some air cover for me in terms of an inflection point. Manias can outlast any forecaster because they are driven not only by rational inputs, but by irrational human expressions of fear and greed. Knowing when the “crowd” has had enough is an often frustrating task, and it behooves an individual with a reputation at stake to stand clear. As you know, however, moving out of the way has never been my style so I will stake my claim with as much logic as possible and hope to persuade you to lower expectations for future returns over the next 12 months.

The problem with acting on the advice of these respected macro-economic theorists is that it is a regurgitation of the advice they and other respected economists have given for the last four years (in Gundlach’s case) and six years (in Gross’s case). It is also the same basic argument that has kept most institutional and high-net-worth individuals under-invested in U.S. large-cap stocks. Here is what Gundlach said in an interview with Barron’s writer, Jonathan Laing, on February 21st of 2011:

Gundlach rarely is shy about offering his opinion on markets. Like most bond honchos, including Gross, a member of the Barron’s Roundtable, he seldom likes stocks, which are, after all, bonds’ primary rival for investment dollars. “Though I rarely go public with specifics on stocks, I think the Standard & Poor’s 500, which is now over 1300, will hit 500 in the next couple of years,” he says. “I usually couch my belief by saying merely that 2011 will be a tough year for equities.”

I became aware of Bill Gross in the aftermath of the 1987 stock market crash. My recollection is that he predicted a very dire future for the U.S. economy and stock market at that time. The stodgy Dow Jones Industrial average has risen from around 1,800 then to near 18,000 now. A 27-year 10-fold increase in price, not counting dividends, is not too shabby and something you would not have wanted to miss. His scare tactics have been consistent in this secular bull. Here is an excerpt from an interview with Peter Cohan on February 26th of 2009:

Stocks are dead for the rest of your life. That’s the gist of my exclusive interview with the head of PIMCO Total Return — the biggest bond fund you’ve never heard of. But you should know PIMCO because its chief, Bill Gross, is one of the world’s most powerful bond investors.

As Gross told me, “things will never be the same. Risk taking has been destroyed and any animal spirits must come from Washington. Global growth rates — low, low, low — asset classes will be readjusted for that outlook. That is — stocks will be more of a subordinated income vehicle as opposed to a ‘stocks for the long run’ growth vehicle.”

Not only were the macro-economists of this opinion, but the media, blogosphere and twitterverse were happy to pile on. Optimism associated with American consumers, during a meaningful period of household debt reduction the last five years, was a winning investment in contentious consumer-discretionary stocks. Much of the “new normal” argument was correct and got priced into securities very quickly thanks to the respect market participants have for these very successful macro thinkers. It also scared folks away from the big banks like Wells Fargo (WFC), Bank of America (BAC) and JP Morgan (JPM). In Mr. Gross’s eyes, if there are very low levels of economic activity, why would investors want to own a lender?”

Gundlach has a very dour view of the very favorable demographics in the U.S., which should mathematically overwhelm GDP growth the next five years. As 86 million echo-boomers marry, have kids and form households, it should stimulate housing in the U.S. and create a demand for money which hasn’t existed since 2006. Doubleline’s view is that Millennials will not marry in the same historical numbers or have kids like previous generations. And he argues that if they do, they will live in urban areas, severely limiting housing’s ability to positively impact the GDP computations.

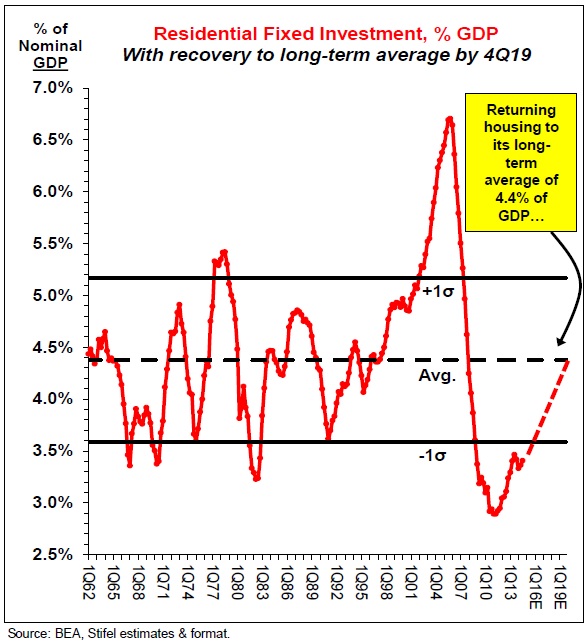

A look at the chart below helps us refute this attitude which is prevalent among some of the wisest macro economists:

Besides the 2004-06 housing bubble, the prior peak in residential fixed investment as a percentage of GDP was 1978 at close to 5.4%. What was going on back then? The largest population group, baby boomers, was getting married, having babies and buying houses. They were doing this at some of the highest interest rates in U.S. history and doing it at 50-year lows in housing affordability. John Templeton said, “The most dangerous words in the investment world are that it is different this time.”

We believe it is not different this time. Once folks have a screaming six-month old baby, we suspect they’ll want out of urban living and once they get toddlers, they’ll want a fenced yard. To get the fenced yard they will move to the suburbs and lower gasoline prices are a huge stimulus to making that choice.

As a firm, we believe this bull market will die on over-enthusiastic positives not on regurgitated negatives. Therefore, we want as much exposure to a housing boom as we can get. We get that through stocks like Berkshire Hathaway (BRK.B) and NVR (NVR), the nation’s fifth-largest homebuilder.

A booming economy and housing market in a few years could force the Federal Reserve Board to normalize interest rates and slow down the boom. When Main Street demands credit, business people could sell stocks to buy property, build warehouses and hire employees. Banks will sell Treasury bonds to make home and auto loans. This would cause bonds to go into a bear market and interest rates to rise. This is not the argument at the heart of the wall of worry today or at any time in the last six years. From a historical standpoint, these talented and respected macro-economic strategists might have unknowingly reestablished the proverbial wall of worry in the U.S. stock market.

Warm Regards,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management