2015 Fixed Income Outlook: Handle with Care

by Anthony Valeri, Investment Strategist, LPL Financial

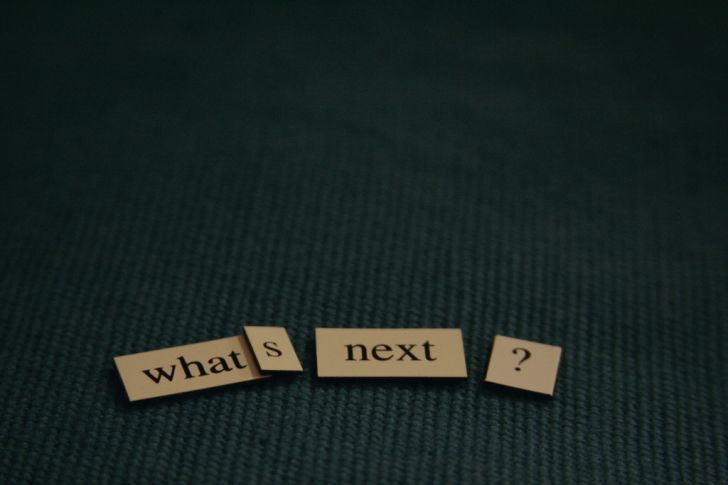

Bond markets are likely to transition to a flat-return environment in 2015 after a volatile, but surprisingly positive return environment in 2014. We expect returns to be roughly flat or in the low-single digits for 2015. The journey to the Federal Reserve’s (Fed) first interest rate hike has not been derailed and will continue in 2015. Short and intermediate Treasury yields were marginally higher through the first 10 months of 2014 in preparation for this transit, despite the more widely publicized decline in longer-term 10- and 30-year Treasury yields. A reduced weight to bonds may be the right ticket as bond investors face improving economic growth, slowly rising inflation, and the approach of the Fed’s first interest rate hike, likely in late 2015 or early 2016, all of which would likely contribute to pushing bond prices broadly lower in 2015 [Figure 1].

Delivery Delays

Even if the Fed postpones the first interest rate hike to early 2016 or beyond, the opportunity for fixed income investors remains limited. Lower yields provide a small buffer against the prospects of future price declines associated with rising interest rates; in addition, they augur for low returns—even if the Fed decides to push back the timing of a first interest rate hike.

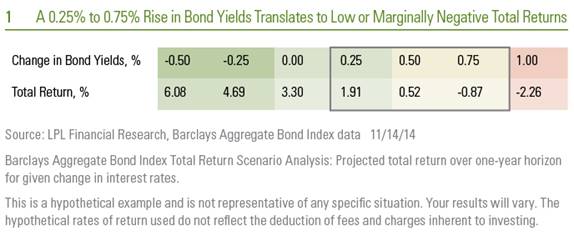

Valuations also remain expensive across the bond market, providing limited opportunities for investors. Inflation-adjusted yields remain well below historical norms and perhaps best illustrate how expensive bonds remain [Figure 2]. A modest rise in interest rates or inflation will mean bond investors are facing flat or possibly negative total returns, after accounting for the impact of inflation.

High-yield bonds and bank loans stand out within the bond market. Good corporate fundamentals and a low-default environment indicate lower-rated bonds can help investors manage a challenging bond market. Bouts of weakness in high-yield bonds during 2014 were based on non-fundamental factors, such as global social unrest, geopolitics, and general profit-taking. But high-single-digit earnings growth through the first three quarters of 2014 and low defaults suggest the ability of corporations to repay debt obligations can remain strong in 2015.

Continued economic expansion and higher yields give corporate bonds a slight edge as investors seek to maximize bond returns. The probability of a recession remains low, and steady economic growth should continue to reinforce corporate credit quality. Corporate fundamentals are likely to remain quite healthy and higher yields could potentially be an important source of return. In a rising-rate environment, yield provides not only a source of return, but also a cushion against price declines associated with rising interest rates.

High-Quality Focal Points

Among high-quality fixed income sectors, investment-grade corporate bonds and municipal bonds provide rays of light in an otherwise dark landscape. Corporate fundamentals are likely to remain firm and the average yield advantage of 1.1% stands out in a low-yield world, despite being below the 20-year average of 1.3% (as of October 31, 2014).* Yield will be an important source of return, as additional contraction in yield spreads (which may lift prices) is unlikely.

Municipal bonds could likely benefit from another year of limited supply. State and local government revenue has improved over the past few years but expenses have grown as well, which will keep state budgets under pressure. The capacity to take on new debt-funded infrastructure projects is therefore limited, and tax-free issuance should remain low by historical standards. The municipal bond market could likely experience another year of limited net growth, which should provide a tailwind for relative returns.

At the same time, the demand for tax-exempt income remains elevated, creating a favorable supply-demand balance for municipal bonds. Like investment-grade corporate bonds, additional valuation improvement is likely to be limited after the 2014 rebound; but on a longer-term basis, municipal bond valuations remain attractive.

International Restrictions

High-quality foreign bonds remain more expensive compared with domestic counterparts. Inflation-adjusted yields on high-quality European bonds are lower, compared with U.S. bonds, which have already priced in more robust action from the European Central Bank (ECB), as well as a pessimistic economic backdrop for 2015 and beyond. Low yields, including negative yields on top-rated, short-term government bonds, suggest recessionary conditions are fully priced in.

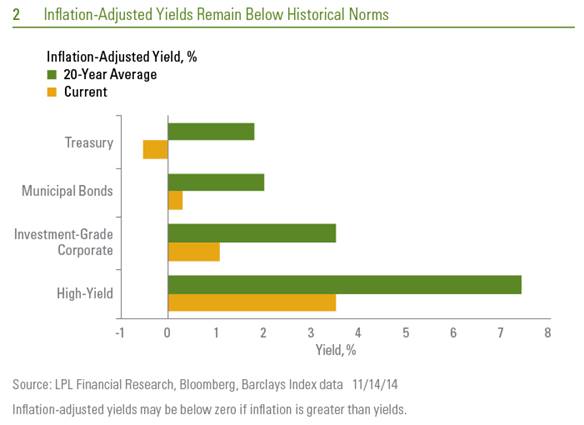

The 10-year U.S. Treasury is a beacon of yield relative to most other developed nations. The gap between the yield of the 10-year U.S. Treasury and the 10-year German bund, for example, recently reached record levels with the additional yield being greater than 1.5% [Figure 3]. Since the creation of the European Union, this gap in yield represents a peak and highlights the relative and absolute success of the U.S. economic recovery. On a positive note, the strength of overseas demand is another reason why we expect the rise in domestic bond yields to be gradual.

Bond investors are limited by the imminent first interest rate hike, expensive valuations, and the potential for even a modest rise in inflation. High-yield bonds and bank loans can help investors manage a challenging bond market. Among high-quality bonds, municipal bonds and investment-grade corporate bonds offer modest value.

Please see our Outlook 2015: In Transit publication for insights on the economy, stock and bond markets, and investments for the year ahead.

*According to Barclays Index data.

*******

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

This week’s commentary features content from LPL Financial Research’s Outlook 2015: In Transit.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Copyright © LPL Financial