by Sober Look

The latest US payrolls report presents a challenge for the Fed. As discussed back in April (see post), US labor markets are continuing to heal, suggesting that the rate "normalization" should be a serious consideration for the central bank. However the recent deterioration in commodities, especially energy, is "importing" global disinflation to the US (see post). In particular, the Saudi commitment to retake lost market share has sent shock waves through the oil markets (see post).

|

| GCC is a diversified commodity index (source: barchart) |

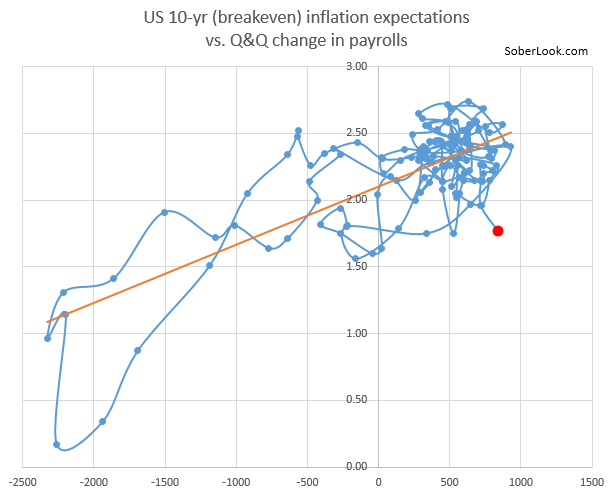

As a result, longer-term market-implied inflation expectations have fallen substantially.

The latest declines in expectations came after the recent FOMC minutes already showed increasing concerns at the central bank:

FOMC: - “Many participants observed the committee should remain attentive to evidence of a possible downward shift in longer-term inflation expectations.”

At the same time payrolls in the US are growing at a rate approaching the pre-recession peak (though still materially below what we saw in the 90s).

In fact the divergence between payrolls growth and inflation expectations is currently unusually high. Payrolls are driven by stronger US domestic economy, while inflation expectations are impacted by external factors, which creates this disconnect.

|

| Red dot represents the current situation |

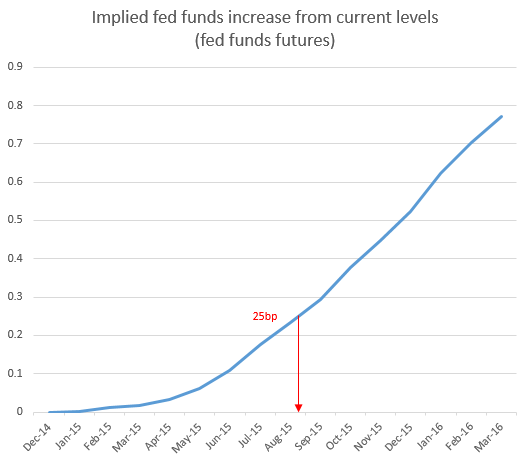

This mismatch is causing a dissonance for policymakers and market participants, adding to the disagreement on the timing of liftoff. Current market expectations for the first hike now point to Q3 of 2015.

|

| Source: CME |

However if inflation expectations persist at these levels or worsen, it will be nearly impossible for the Fed to move on rates - irrespective of how much labor markets improve. The bet represented in the chart above is that energy prices will stabilize and/or growth in wages improves substantially by next summer - pushing breakeven expectations higher. But such an outcome, driven to some extent by factors external to the US, is far from certain.

What makes the timing of liftoff particularly difficult to estimate is the value of the US dollar.

|

| Source: barchart |

With a number of major central banks either easing or expected to begin easing monetary policy (diverging from the Fed), the rise in the relative value of the dollar will continue. That will bring inflation expectations even lower by weakening US import prices and pressuring commodities. If the strong dollar can make goods and to some extent services from abroad cheaper, there is less incentive for US-based firms to raise wages. Tapping cheaper markets abroad becomes more profitable.

And as the expectations of liftoff draw closer, the dollar will strengthen further, making it more difficult for the Fed to pull the trigger (what some refer to as a "self-correcting" mechanism). It's hard to envision the Fed acting unilaterally in the sea of looser monetary policy worldwide. The policy trajectory of the US central bank is therefore tied to a large extent to the global recovery, which remains elusive for now.

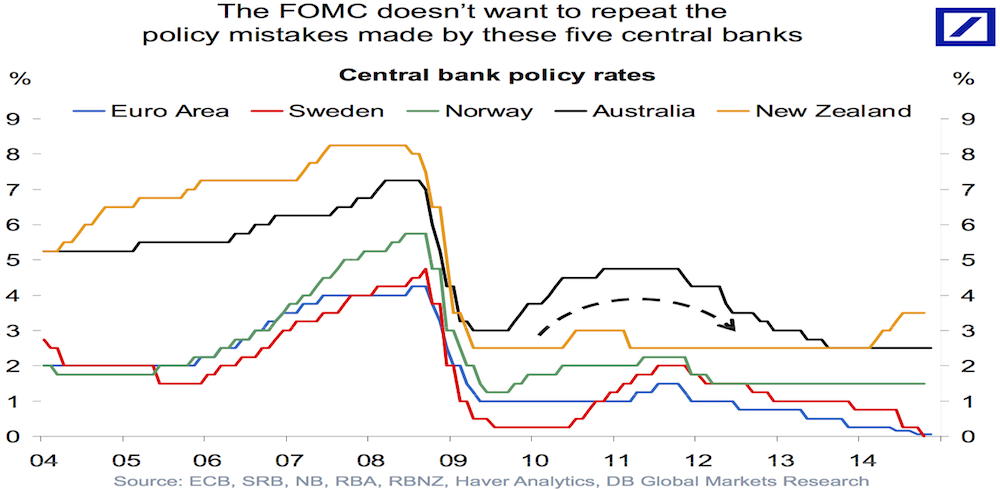

The Fed officials are keenly aware of premature policy tightening by a number of central banks, who were forced to reverse their decisions later.

|

| Source: @themoneygame (Business Insider), Deutsche Bank |

What some of these central banks didn't count on was the global nature of disinflation, over which they had little or no control (see chart). In the Fed's case, such a reversal would severely undermine the FOMC's credibility, sending policymakers back to the drawing board.

Copyright © SoberLook.com