Leading Indicators

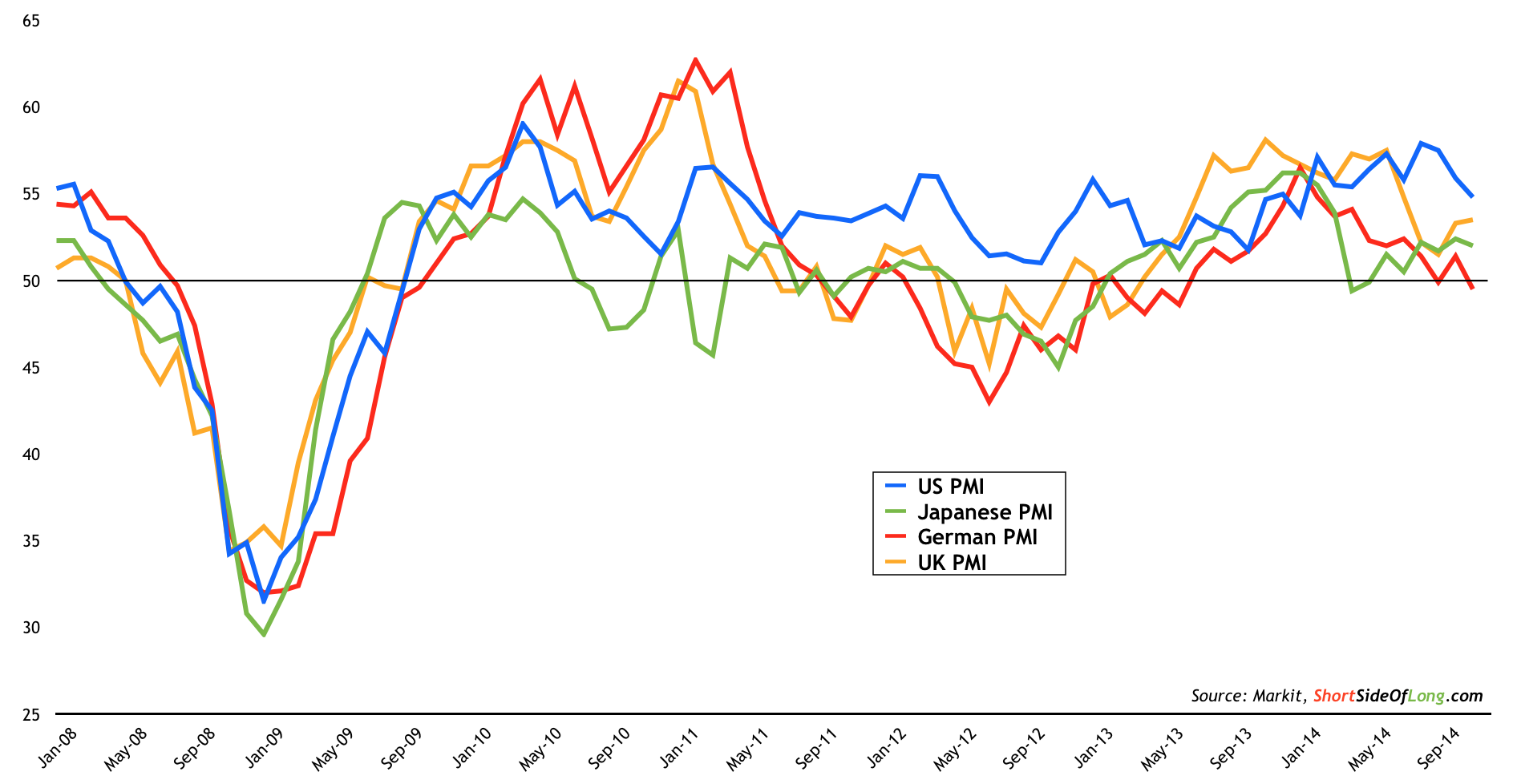

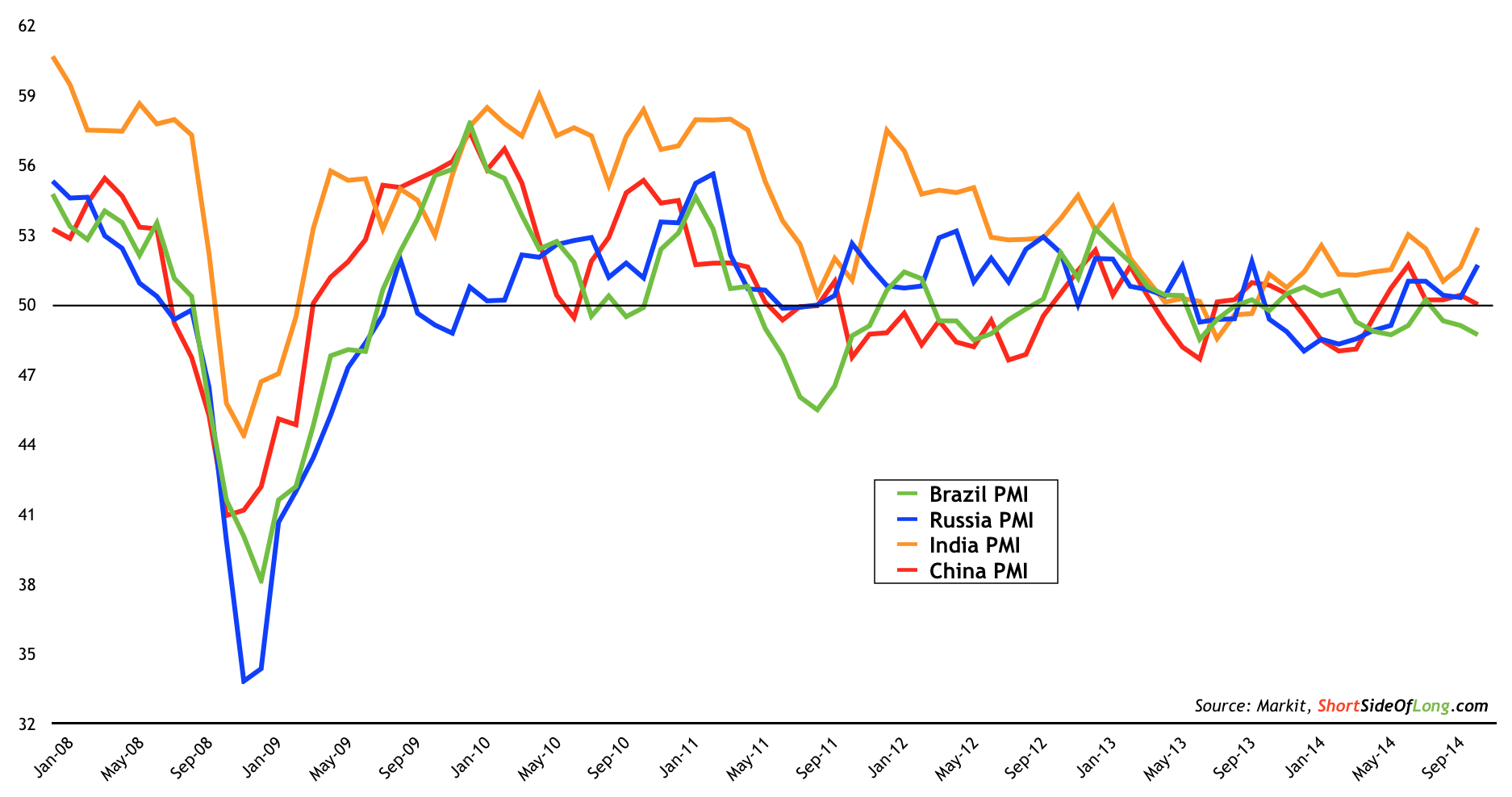

Chart 1 & 2: Global manufacturing still expanding… but at slower pace!

Source: Short Side of Long

- Recent Global Markit Manufacturing PMI data for the month of November showed some of the slowest global expansion in over a year, but nevertheless growth remains intact for now. Eurozone continues to be disappointment within the developed markets, while Brazil and China remain in stagnation within the emerging markets. Surprisingly, Russian manufacturing is showing slight signs of recovery at present. Current developed economies PMI readings stand as following: US at 54.8, Japan at 52.5, Germany at 49.5 and UK at 53.5; while emerging economies PMI readings stand as following: China at 50.0, India at 53.3, Russia at 51.7 and Brazil at 48.7. Observing all of the charts above, Markit analysts highlight the following summary:

Global manufacturing production expanded at the slowest pace for 15 months in November, as growth of new orders hit a 16-month low and the trend in international trade volumes stagnated. The forward- looking orders-to-inventory ratio also edged down to its weakest level since the end of 2012. At a 14-month low of 51.8 in November, the J.P.Morgan Global Manufacturing PMI nonetheless signalled a further expansion of the sector.

North America was a key growth engine. Canada was in joint-third place of the Output PMI growth rankings, a position it shared with the Netherlands, while Mexico and the US were in fifth and sixth places respectively. This was despite the US seeing a sharp growth slowdown. The UK and Japan also reported solid expansions.

Apart from the slower US expansion, the weakness in the global manufacturing sector also mainly reflected stagnation in China and further subdued growth in the eurozone. The lacklustre performance of the euro area came despite it having three of the top-ranked nations (Ireland, Spain and the Netherlands), whose solid expansions were offset by weaker growth in Germany and contractions in Austria, France and Italy. Elsewhere, Brazil, Indonesia and South Korea also reported lower output.

Chart 3: Chinese equities & OECD LEI showing a possible improvement

Source: Short Side of Long

- Recent OECD Leading Indicators for the month of November showed a modest expansion in the US, while Eurozone and Japan continued to show slight deterioration. Interestingly, after many quarters of below trend growth, China seems to be showing signs of a potential recovery. Could the Chinese stock market, seen in Chart 3, know something we don’t? It is attempting to break out to there year highs. Summarising the overall report, OECD states that:

Composite leading indicators point to continued weak growth in Europe but stable growth in most other major economies and in the OECD as a whole. Amongst major economies stable growth momentum is anticipated for Canada, the United States, Brazil, China and Russia. The CLI points to growth losing traction in Japan though this may be related to one-off factors.

Within the Euro Area, the CLI continues to point to a loss of growth momentum, with stronger signals of a slowdown in the case of Germany and Italy. In France however the outlook continues to suggest stable growth momentum. The CLI for the United Kingdom indicates that growth may ease, albeit from relatively high levels. India is the only major economy where the CLI points to a pick-up in growth momentum.

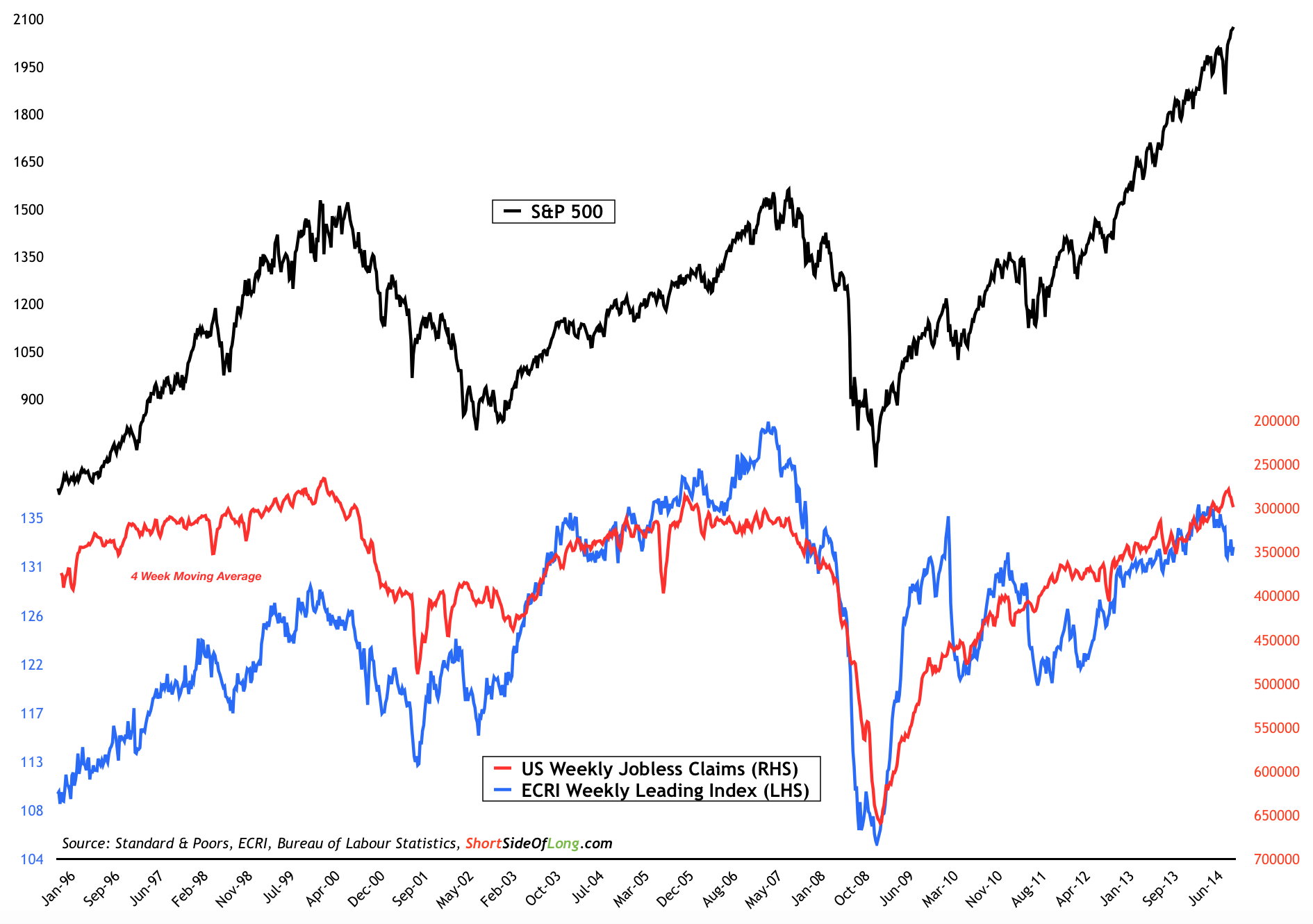

Chart 4: US leading economic indicators are giving us a mixed picture

Source: Short Side of Long

- United States is still by far the largest and most important global economy. That is why following US domestic leading indicators should be very influential in decision making for all global investors. The high positive correlation between S&P 500 equity index, ECRI’s Weekly Leading Indicator and the Weekly Jobless Claims data has broken down in recent weeks. The stock market has gone vertical since middle of October, towards record highs. At the same time, ECRI’s Weekly Leading Index has been falling rather sharply. Majority of this weakness is coming from the recent increase in volatility and credit spreads. So far this has not had much impact on the stock market, however it is important to monitor coming developments closely. After all, let us not forget that the ECRI’s WLI turned down before the stock market peak in 2000 and 2007.

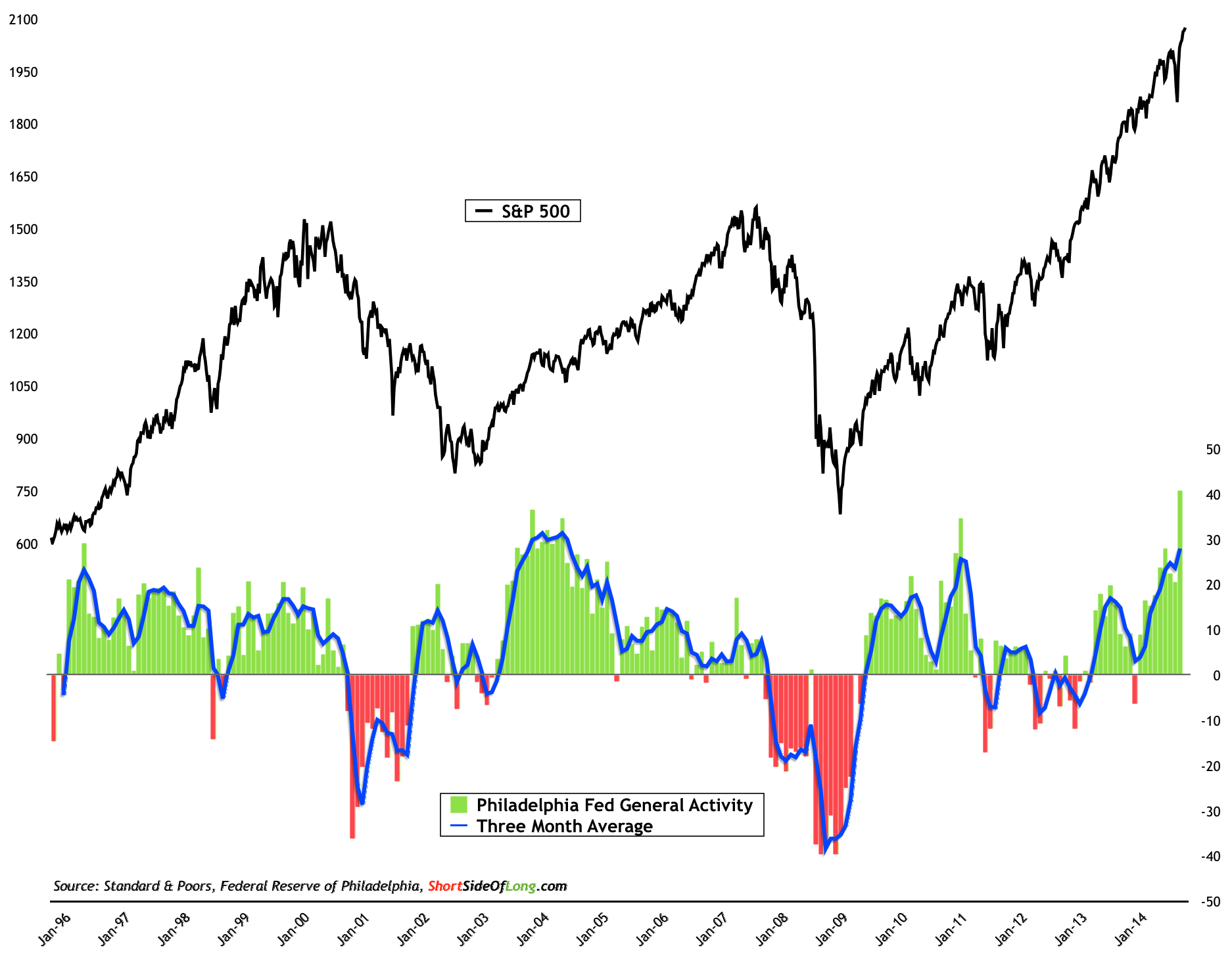

Business Confidence

Chart 5: United States business confidence is booming similar to 2011

Source: Short Side of Long

- United States Philadelphia Fed Business Activity is currently in “boom town” territory, similar to what we saw during early parts of 2011 . The current reading of 40.8 is one of the highest in surveys history, and definitely the highest reading in the last two decades (refer to Chart 5). The recessionary fears, created by Eurozone Debt Crisis and China slowdown during 2011/12, is now clearly behind us. With stock market so elevated and business confidence so high, I wonder if anything could surprise us on the down? Note: Just like consumer sentiment data, business confidence is one of the better contrary indicators to time long term equity purchases and sales. Philly Fed Index has averaged 8 over the last few decades, with a very high reading of 40.8 in November 2014 and very low reading of -39.6 in February 2009 (days before a generational low in the stock market).

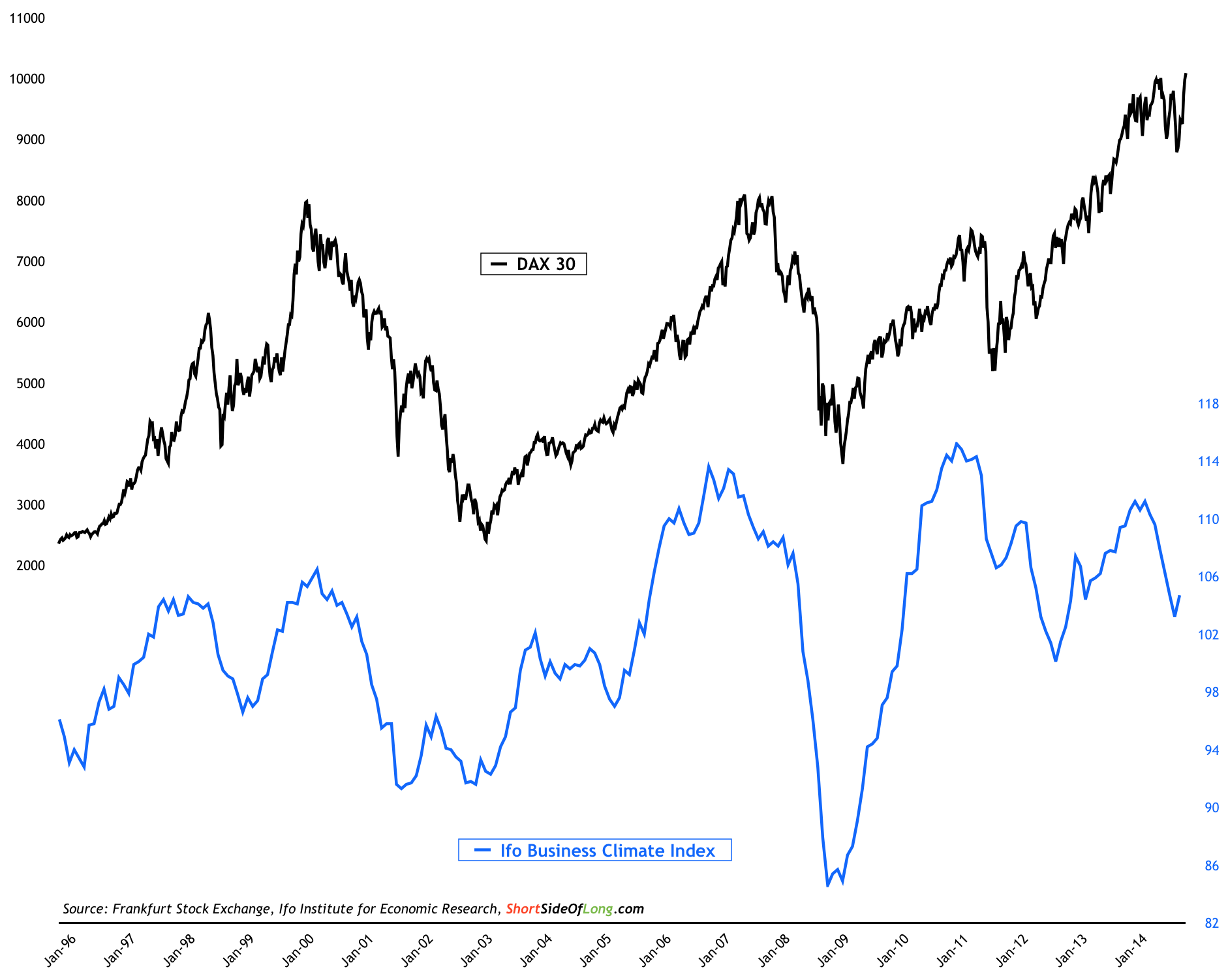

Chart 6: German business confidence recently fell due to Russia issues

Source: Short Side of Long

- German lfo Business Climate Index has been deteriorating since April of this year. The current survey readings for the month of November sit at 104.7, which is the first uptick in eight months. While business confidence did fall due to an economic slowdown as Ukraine & Russia Crisis, the DAX 30 seems to have gone through a necessary correction and has now returned towards record highs. I would listen to the stock market here and view the recent confidence drop as a contrary indicator. Note: Just like consumer sentiment data, business confidence is one of the better contrary indicators to time long term equity purchases and sales. lfo business condition readings have averaged 102 over the last two decades, with a very high reading of 115 in February 2011 (just prior to a EU Crisis and DAX 30 crash) and a very low reading of 84.6 in December 2008 (during the GFC and two months away from the generational stock market low).

Chart 7: Weakening the Yen has created optimism in Japanese economy

Source: Short Side of Long

- Japanese Tankan Manufacturing Conditions has been steadily improving since Abenomics took over in late 2012. With a recent vertical move by the Nikkei, I would assume that coming survey data will show business confidence at even higher levels, mimicking that of the US. However, I would like to remind my readers of two important points here: 1) business confidence is usually a good contrary indicator; and 2) Nikkei is now reaching a major resistance zone from 2007. It reminds to be seen whether or not the stock market will keep rising at such a fast velocity. Personally, I am not betting on it right now. Note: Just like consumer sentiment data, business confidence is one of the better contrary indicators to time long term equity purchases and sales. Tankan conditions has averaged -3 over the last two decades, with a very high reading of 26 in July 2004 and a very low reading of -58 in March 2009 (right around the time the Nikkei 225 put in a 30 year low).

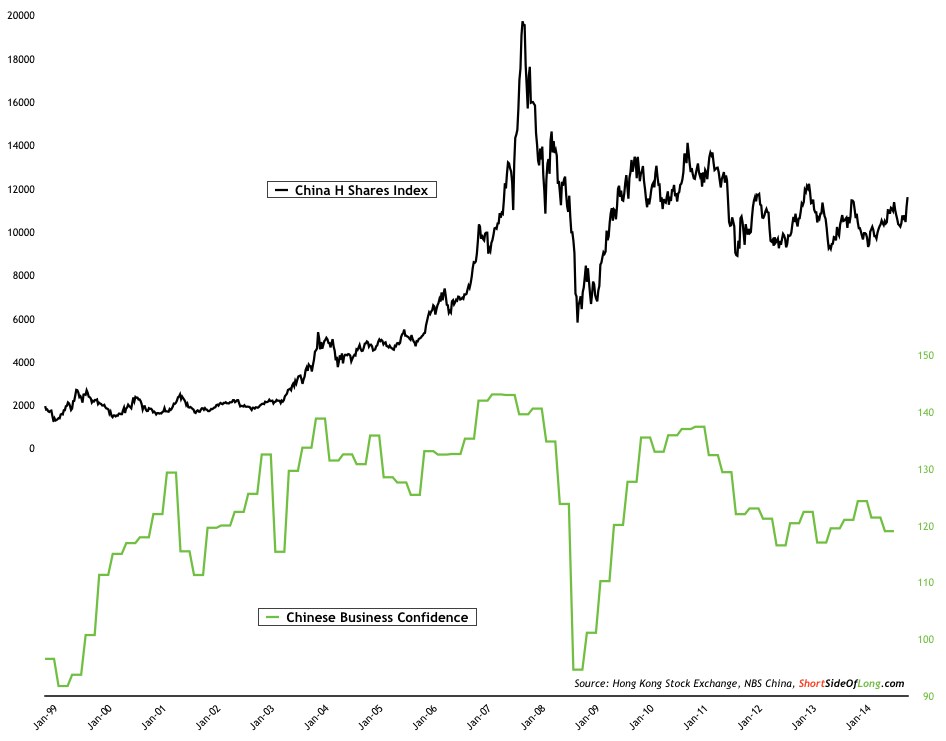

Chart 8: Chinese business confidence has been deteriorating since 2010

Source: Short Side of Long

- Chinese Business Confidence has been struggling since late 2010 and continues to show no signs of improvement just yet. Current quarterly reading is at 119.0, relative to readings of 137.0 in October 2010 (prior to the Chinese slowdown) and 94.6 in October 2008 (depths of the Lehman saga). Out of all the major economies we have had a look at today (US, Germany, Japan), Chinese business confidence has been suffering the most since the global slowdown started in 2011. However, after such a prolonged downturn, we should entertain the idea that just maybe the recent breakout attempt in the stock market could be an early sign of an improvement in economic activity. Note: Just like consumer sentiment data, business confidence is one of the better contrary indicators to time long term equity purchases and sales. Chinese Business conditions has averaged 123 over the last 15 years, with a very high reading of 143.1 in June 2007 (just prior to the start of Global Financial Crisis) and a very low reading of 91.7 in June 1999 (in the aftermath of Asian Financial Crisis).

Monthly Commentary

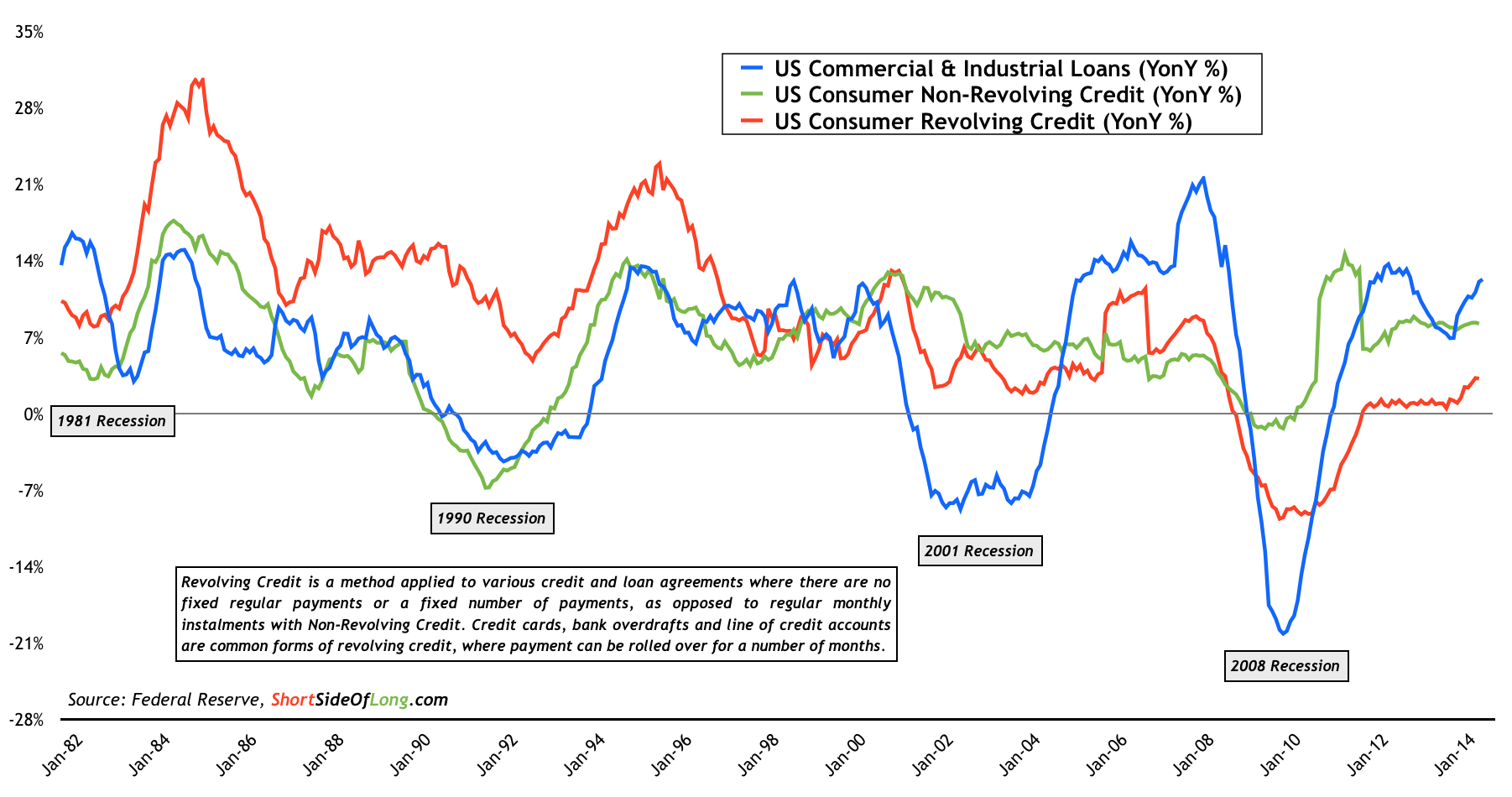

Today we focus on a lagging economic indicator in the form of US credit growth. I want to make it crystal clear that indicators like this shouldn’t be used on their own for investment purposes and timing of markets. We have to remember that markets are a discount mechanism and anticipate the future by at least 6 months (if not more), so looking at lagging economic data is like driving a car by looking at only the rear view mirror. For example, this is why 60 out of 67 economists who predicted rising rates in 2014 were complete wrong. All year long, interest rates just fell lower and lower… and lower. Their models and lagging data failed to anticipate any of that.

Chart 9: United States annual credit growth remains robust for now…

Source: Short Side of Long

Nevertheless, looking at such data from time to time can be useful, because we can see longer term underlaying trends. After a huge credit contraction in 2008, the worst since the The Great Depression, at present we notice a decently robust annual credit growth. In particular, US consumer revolving credit (red line in Chart 9) is showing that credit cards, bank overdrafts and line of credit accounts are being used more. In other words, debt is being run up to higher levels. While this development might not be healthy in the long run, it boosts demand at present and therefore will most likely increase company earnings. Having said that, the two most important questions you should be asking yourself are: 1) how much of this is already discounted by evaluated US equity markets; and 2) will this credit growth trend continue into 2015?

Copyright © Short Side of Long