OPEC Declares War on US Producers

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• The decline in oil prices and energy shares has been shockingly quick and deep, with West Texas Intermediate (WTI) declining 37% in just six months. The key problem in the oil markets is the current oversupply, stemming from a dramatic increase in US oil production.

• In response to US production increases, OPEC has made a major policy change with respect to oil prices. Historically, OPEC has cut production in response to excess supply and weak oil prices. With OPEC deciding not to cut production in the face of a market clearly oversupplied, it signals to us, that OPEC is more concerned about its declining market share than supporting prices.

• As a result of this new strategy from OPEC, we believe WTI oil prices are set to trade in a new lower range of roughly US$60/bbl to US$80/bbl in the coming months. Given this view, our outlook for oil prices and the energy sector is less constructive than just a few months ago.

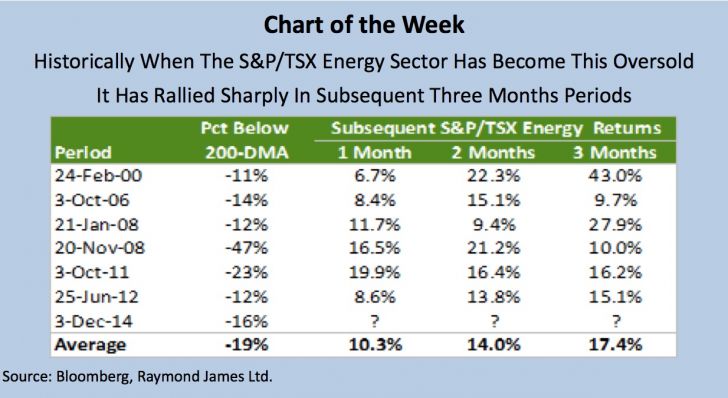

• For now, we are maintaining our overweight recommendation for the energy sector. However, the sector is currently on downgrade watch and we may look to downgrade the sector on short-term strength, which we believe may be coming. In the near-term, we see the potential for the energy sector to bounce in the coming months (see Chart of the Week).

Read/download Ryan Lewenza's complete report below: