There used to be a belief on Wall Street that copper had a Ph.D. in economics since it was often used as a barometer for the economy and often the market. Traders would look for divergences between the copper and the equity markets for signs of potential danger. If Dr. Copper began to weaken it was believed that the stock market would soon follow. While this may have been the case at one point I would argue it no longer is today or has been for a few years now.

Dr. Copper in my opinion has been replaced by technology, specifically semiconductors. The market seems to be much more focused on the happenings of Silicon Valley rather than Milwaukee or Detroit. While the industrial sector still remains a large piece of our economy it no longer is the driver of growth. At least that’s what price action has been telling us.

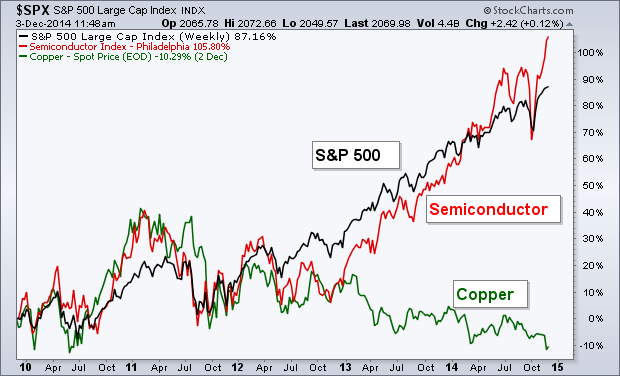

The chart below shows the performance of the S&P 500 (black line), the Semiconductor Index (red line), and the spot price of Copper (green line). You can clearly see that copper has not been enjoying the bull market party while semi’s have been moving right along with the market. It’s a little hard to see, but in 2011 we saw semiconductors break away from the S&P 500 as the industry made a lower low, a divergence that the equity market eventually fixed by falling in price by nearly 20%. Ever since then we’ve gotten confirmation by the semi’s of the new highs in the S&P.

It seems Copper has been expelled while the semiconductors step to the front of the class.

Photo courtesy of Cristian

Disclaimer: Do not construe anything written here as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the article.

Copyright © Andrew Thrasher