Reduce Staples into Strength

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

Report Highlights

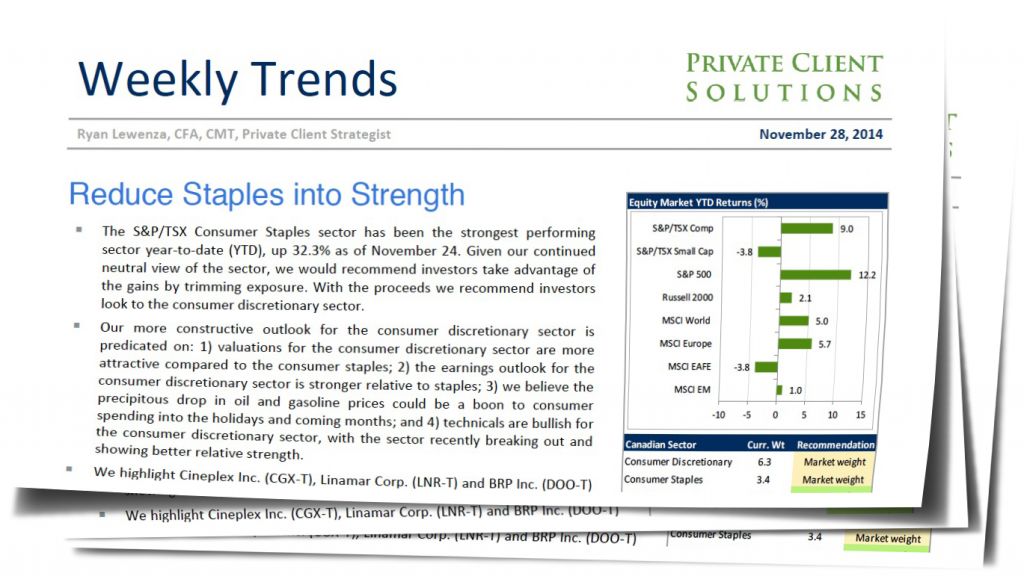

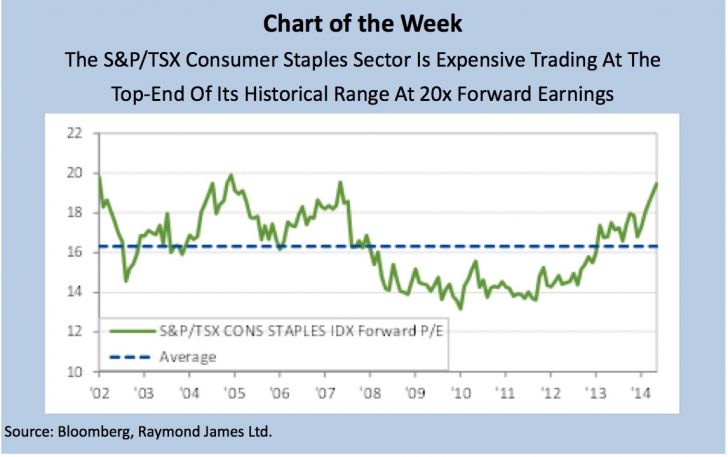

• The S&P/TSX Consumer Staples sector has been the strongest performing sector year-to-date (YTD), up 32.3% as of November 24. Given our continued neutral view of the sector, we would recommend investors take advantage of the gains by trimming exposure. With the proceeds we recommend investors look to the consumer discretionary sector.

• Our more constructive outlook for the consumer discretionary sector is predicated on: 1) valuations for the consumer discretionary sector are more attractive compared to the consumer staples; 2) the earnings outlook for the consumer discretionary sector is stronger relative to staples; 3) we believe the precipitous drop in oil and gasoline prices could be a boon to consumer spending into the holidays and coming months; and 4) technicals are bullish for the consumer discretionary sector, with the sector recently breaking out and showing better relative strength.

• We highlight Cineplex Inc. (CGX-T), Linamar Corp. (LNR-T) and BRP Inc. (DOO-T) as attractive equity ideas in the consumer discretionary space.

Read/Download Ryan Lewenza's report below:

Copyright © Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James