by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

The Case for Dividends

• Bond yields have been in a secular decline since the early 1980s. For example, the US 10-year Treasury yield peaked at roughly 16% in 1981 versus 2.3% today. With bond yields so low, investors have increasingly looked to equities to meet their income and cash flow needs. We believe there are a number of long-term supportive trends for dividend-paying stocks and therefore continue to view them as the cornerstone of any investor portfolio.

• History shows that dividends account for a significant portion of total stock returns. Since 1988, the S&P/TSX Composite Index (S&P/TSX) has returned a cumulative 370% on a price basis. However, on a total return basis (including reinvested dividends) the S&P/TSX has returned 823%. This equates to dividends accounting for roughly 50% of total returns over this period.

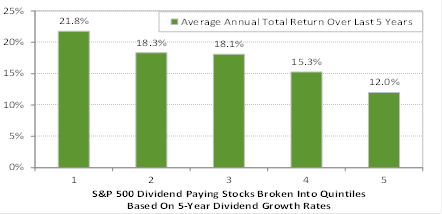

• We have a clear preference for dividend growers, as our research shows they typically deliver the best returns with lower volatility. For example, the top quintile of dividend growers in the S&P 500 Index (S&P 500) returned on average 21.8% annually over the last year five years, well above returns of lower dividend growth stocks (see Chart of the Week). On the volatility front, we note that the annual standard deviation of the S&P 500 Dividend Aristocrats Index is 15.4% versus 16.6% for the S&P 500.

• On the last page of this report we provide a list of high-dividend-growth stock ideas that fit this investment theme.

Download/Read Ryan Lewenza's complete report below:

Copyright © Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James