by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday November 18th

U.S. equity index futures were mixed this morning. S&P 500 futures were down 1 point in pre-opening trade.

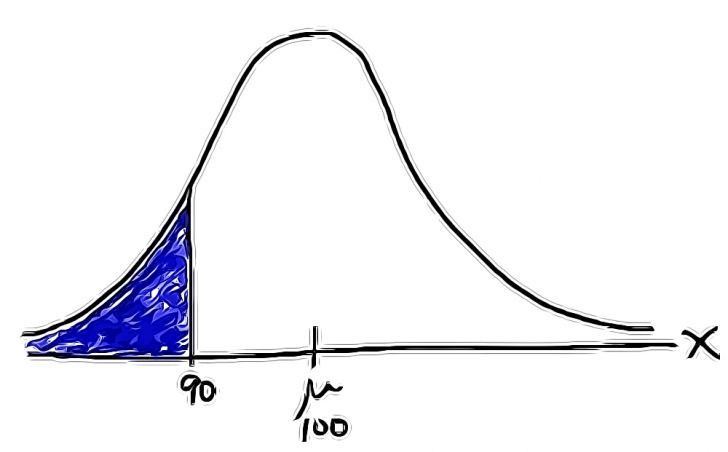

Index futures were virtually unchanged following release of the October Producer Prices Index. Consensus for October PPI was a decline of 0.1%. Actual was a gain of 0.2%. Excluding food and energy, consensus for October PPI was a gain of 0.1%. Actual was an increase of 0.4%.

CBS (CBS $52.88) is expected to open lower after Atlantic Equities downgraded the stock from Overweight to Neutral.

Macy’s slipped $0.74 to $60.87 after Bank of America/Merrill downgraded the stock from Buy to Neutral.

Urban Outfitters lost $1.29 to $29.54 after Atlantic Equities downgraded the stock from Overweight to Neutral.

Wells Fargo eased $0.26 to $53.18 after BMO Capital downgraded the stock from Outperform to Market Perform. Target is $54.

EquityClock’s Daily market comment

Following is a link:

http://www.equityclock.com/2014/11/17/stock-market-outlook-for-november-18-2014/

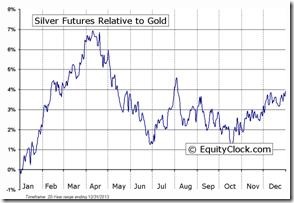

Note comments on performance of gold, silver and copper equities relative to gold, silver and copper.

Celebration Time

The Horizons Seasonal Rotation ETF (HAC on the TSX) is celebrating its 5th anniversary today. Since launch on November 18th 2009, the fund has outperformed the TSX Composite Index and underperformed the S&P 500 Index. Volatility in the fund has been significantly less than volatility in both markets.

Interesting Charts

Lumber prices have resumed an intermediate downtrend. Note that West Fraser and Canfor were deleted from our Monitored list at the close on Friday. Both lumber and lumber stocks have a history of stalling briefly during the next month followed by a second momentum spurt near the end of the year.

StockTwits Released Yesterday @equityclock

Quiet bullish action by S&P 500 stocks to 10:30 AM. Breakouts: $VIAB, $TSN, $KMI, $RHT. Breakdown: $HP

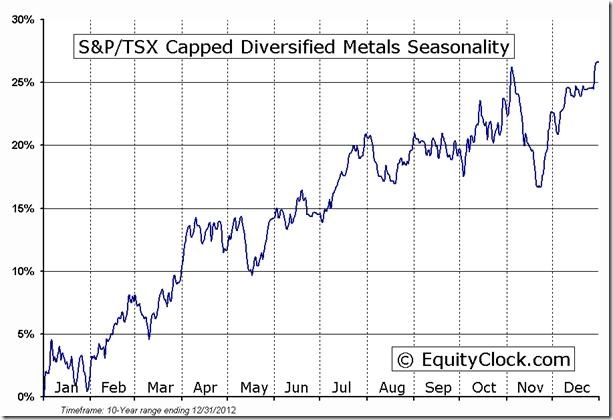

The period of seasonal strength by base metal stocks has started. Nice breakout by $HBM.CA above a base.

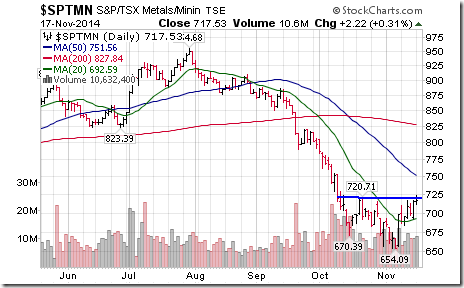

Nice breakout by the TSX Metals & Mining Index above 720.71. ‘Tis the season for base metal strength!

Technical Action by Individual Equities Yesterday

Five more S&P 500 stocks broke above intermediate resistance levels after 10:30 AM EST: Aetna, Newell Rubbermaid, Republic Services, Time Warner and Kellogg.

Two TSX 60 stocks broke above resistance levels: Silver Wheaton and Valeant Pharma.

Tech Talk/Globe Investor ETF Column

Headline reads, “An ETF to capture Black Friday gains”. Following is a link:

Tech Talk/Horizons Weekly Market/Sector Technical Scorecard

Released yesterday morning. Following is a link:

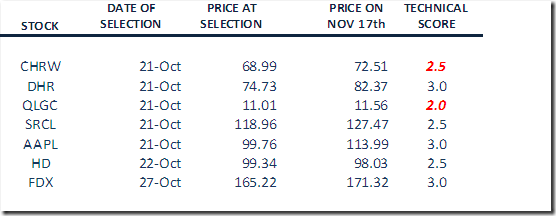

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Special Free Services available through www.equityclock.com

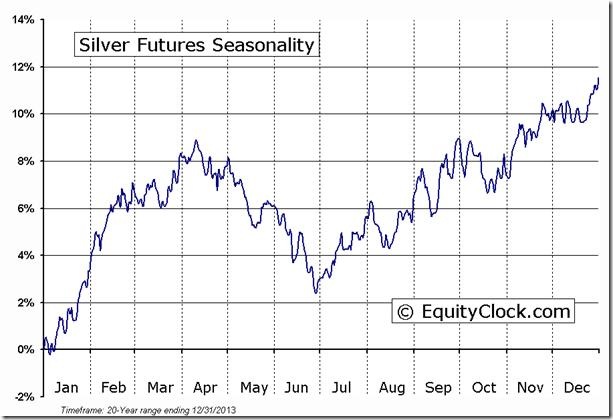

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

| FUTURE_SI1 | FUTURE_SI1 Relative to Gold |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

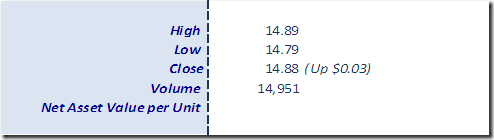

Horizons Seasonal Rotation ETF HAC November 17th 2014

Copyright © Don Vialoux, EquityClock.com