by Cullen Roche, Pragmatic Capitalism

The smartest investors know that they’re actually not that smart. That is, they recognize the fact that they’re going to be wrong a lot. But in realizing this they also acknowledge a more important fact – they don’t have to be right all the time to succeed. They just have to be right about the right stuff when it matters. Warren Buffett once described this idea at the Berkshire Shareholder meeting:

“Take the probability of loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we’re trying to do. It’s imperfect but that’s what it’s all about.”

That sounds like a mouthful, but it’s actually a very simple concept. In essence, you don’t have to be right a lot, you just have to be right about your big bets at the right time. Michael Maubboussin has described this concept as expected value:

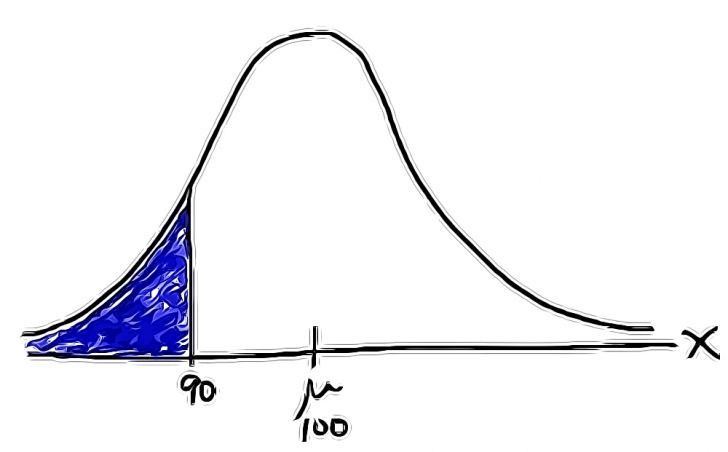

“Expected value, in turn, is the weighted-average value for a distribution of possible outcomes. You calculate it by multiplying the payoff (i.e., stock price ) for a

given outcome by the probability that the outcome materializes.”

This concept is very well known to good gamblers who understand that they’re playing a negative sum game against the house. But in knowing when to bet big they can increase the odds that they will beat the house. That is, they can increase the expected value of their overall outcomes by knowing when to place the right bets. This isn’t only due to the fact that they make big bets when the odds favor them, but also because they don’t make the catastrophic mistakes that result from betting on things you can’t understand. They not only win big, but they avoid losing big.

While investing is not necessarily synonymous with gambling this idea is crucial to understanding how to implement a successful investment approach. Whether it’s buy and hold investing and understanding that stocks tend to rise over long periods of time or understanding the value of specific firms relative to other firms. Smart investors think in terms of probabilities and not certainties.

Copyright © Pragmatic Capitalism