by Don Vialoux, EquityClock.com

StockTwits Released Yesterday @equityclock

Technical action by S&P stocks to 10:30: Bullish. Breakouts: $OMC, $WYN, $BEN, $BA, $CSCO, $ T. No intermediate breakdowns

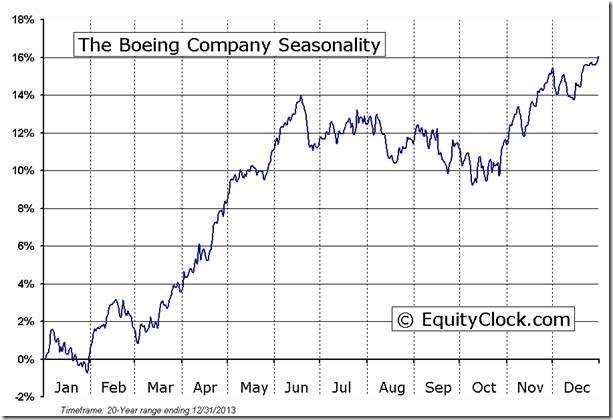

Notable on the list of breakout was $BA. ‘Tis the season for strength! Also helping $XLI

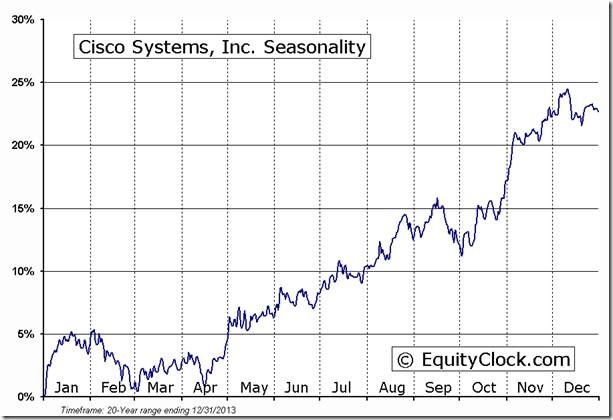

Also notable was the breakout by $CSCO. ‘Tis the season for strength til January.

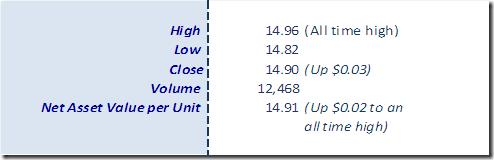

Nice breakout by $HAC.CA to an all-time high!

Technical Action by Individual Equities

Two more stocks broke intermediate resistance after 10:30 AM: Starbucks and Airgas. Two stocks broke support: Nabors Drilling and WPX Energy

One TSX 60 stocks broke support: Encana.

Adrienne Toghraie’s “Trader’s Coach” Column

|

The Future Does Not Have to Equal the Past

By Adrienne Toghraie, Trader’s Coach

From the time we are born, most of us learn that we must be accountable for our actions. First it is to our families and then later to our teachers, preachers, coaches, and society. Since traders are already conditioned to be accountable, they should make use of this tool in reaching for trading mastery.

Sweeping it under the carpet

Traders like to think that they only need to be accountable to themselves in order to get the best out of their trading. But it has been my experience that most traders fail miserably at this task. So why are traders not able to do this?

They do not want to:

· Be wrong

· Admit that they are changing their rules

· Face up to the fact that they do not have good rules

· Realize that they need psychological help

· Realize that they do not have what it takes

If you are committed to doing whatever it takes to follow your rules to reach a higher level of profit, you should consider asking someone to help you with this task if you are not doing a good job of it yourself.

Who could take on the role of a trader’s accountability?

· A significant other

· A friend

· A trading buddy

· A teacher

· A coach

What would a person need to help you be more accountable?

· A clearly defined set of rules from you

· Your commitment to telling the truth to them

· An accounting of the trades you took

· Why you think the trades you took were good opportunities

· The risk/reward ratios before the trade

· The money management procedure you followed

· Whether or not you followed your rules

· The lessons you learned

· And at the four month periodical review, the changes you would make and why

Reward or punishment

There should be a clearly defined predetermined punishment or reward that both of you agree upon for not following your rules. Here are some examples of punishments or rewards to consider.

Punishment

· No trading the rest of the day

· Walk around the block before taking the next trade

· Twenty push ups

· Limit the size of your trades for the rest of the week

Rewards

· Ten percent of every good trade will go into a rewards account for you

· A food or entertainment treat

· Time with a special friend

· Any – my favorite, a massage

Conclusion

When you make yourself accountable in trading to someone else, you activate that part of you that has already been programmed for accountability. In doing this you will be more accountable to yourself.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Next one is Tuesday, November 25th at 4:30 pm ET

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

FP Trading Desk Headline

FP Trading Desk headline reads, “Debunking a US Dollar myth”. Following is a link:

http://business.financialpost.com/2014/11/13/debunking-a-u-s-dollar-myth/?__lsa=067e-7282

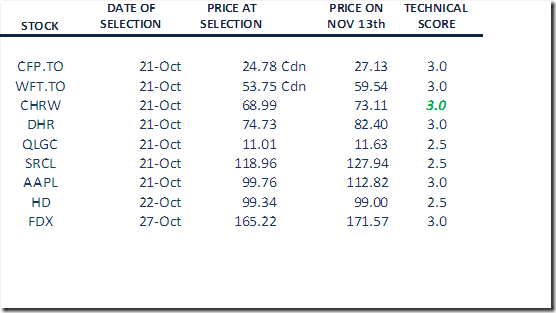

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Xilinx was deleted with a profit of 2.8% after its technical score fell below 1.5

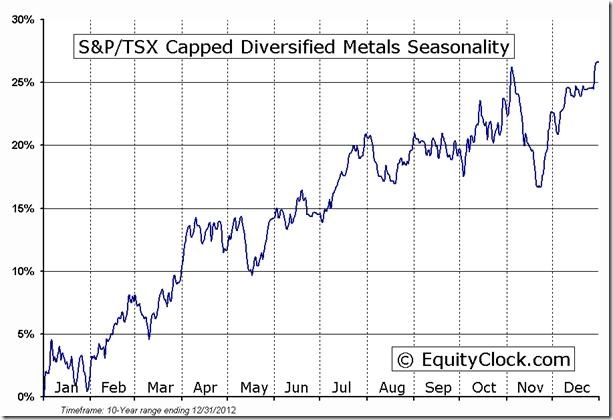

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

|

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC November 13th 2014

Copyright © Don Vialoux, EquityClock.com