by Don Vialoux, EquityClock.com

Pre-opening Comments for Thursday November 13th

U.S. equity index futures were mixed this morning. S&P 500 futures were up 1 point in pre-opening trade.

Index futures were virtually unchanged following release of the Weekly Jobless Claims report. Consensus was an increase to 281,000 from 278,000 last week. Actual was an increase to 290,000.

Third quarter reports continue to flow in. Companies reporting after the close included Cisco, Wal-Mart, Viacom, Tyco and Kohl’s.

Hasbro fell $1.20 to $56.27 after announcing negotiations to purchase DreamWorks.

Procter & Gamble (PG $88.40) moved lower after announcing a share exchange with Berkshire Hathaway where Berkshire will purchase Procter & Gamble’s Duracell division in exchange for Procter & Gamble shares owned by Berkshire Hathaway.

Bristol-Myers slipped $0.31 to $58.30 after Morgan Stanley downgraded the stock from Overweight to Equal Weight. Target is $60.

Jabil (JBL $21.35) is expected to open lower after Goldman Sachs downgraded the stock from Buy to Neutral. Target is $22.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/12/stock-market-outlook-for-november-13-2014/

Note comments on the Nikkei Average.

Interesting Charts

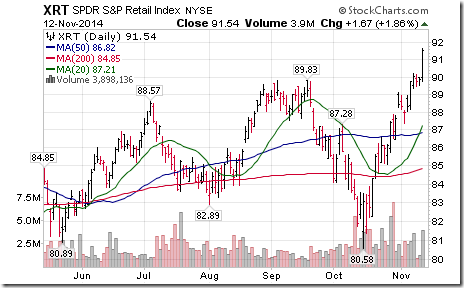

Impressive break to an all-time high! Tis the season! Here comes Santa Claus!

The TSX Composite Index is showing earlier than usual outperformance relative to the S&P 500 Index. Normally, the TSX does not start to outperform the S&P 500 Index until the end of November.

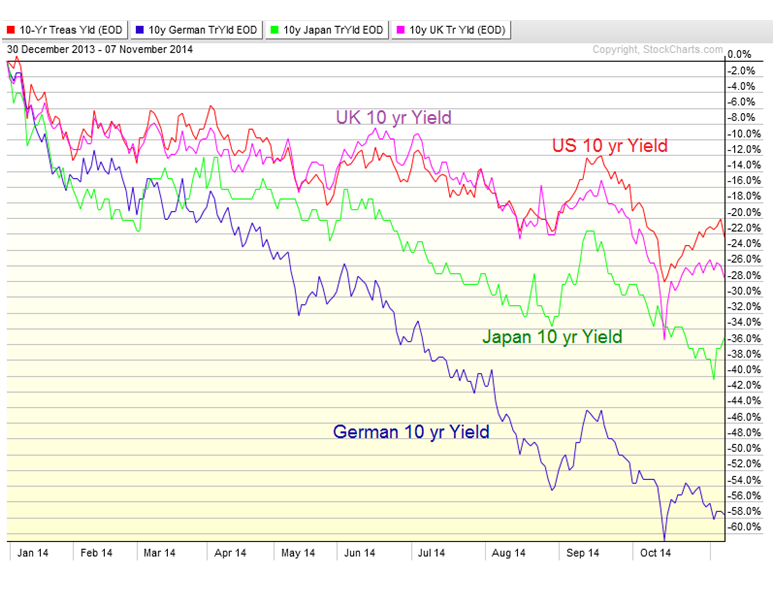

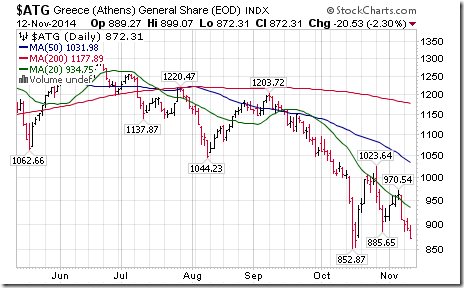

Early warning signs for Greek and possibly European equities!

StockTwits Released Yesterday @equityclock

Nice breakout by $DOW above resistance at $50.19. ‘Tis the season for strength!

Bullish technical action by S&P 500 stocks to 10:30. Breakouts: $FOSL, $ADT, $DOW. No breakdowns.

More good news for Agriculture stocks! Grain prices through $JJG broke to a 3 month high.

Technical Action by Individual Equities

No additional S&P 500 equities broke intermediate support or resistance after 10:30 AM.

No TSX 60 stocks broke intermediate support or resistance.

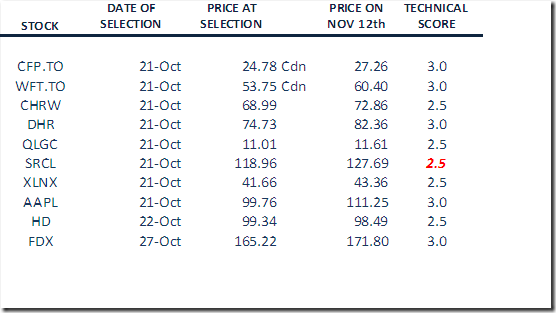

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Tech Talk/Horizons Seasonal/Technical Alert on the Canadian Financial Sector

Following is a link:

Special Free Services available through www.equityclock.com

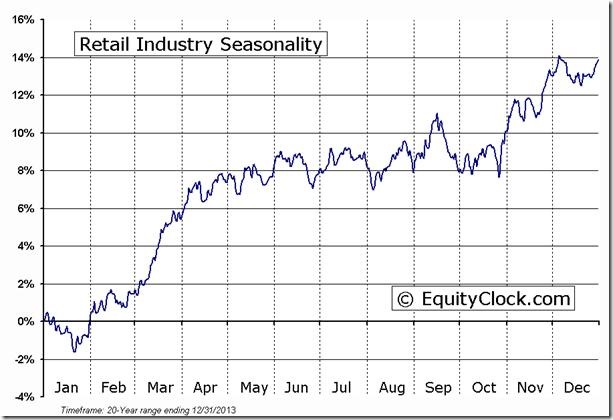

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC November 12th 2014

Copyright © Don Vialoux, EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/41760a0555d9a4375d2ecf631c42d8a3.png)