by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday November 4th

U.S. equity index futures were lower this morning. S&P 500 Index futures were down 5 points in pre-opening trade.

Index futures dipped further following release of the September U.S. Trade Deficit report. Consensus was a deficit of $40.1 billion. Actual was a deficit of $43.0 billion.

The Canadian Dollar was virtually unchanged following release of Canada’s September Merchandise Trade Balance report. Consensus was a deficit of $300 million versus a deficit of $600 million. Actual was a surplus of $710 million.

Third quarter reports continue to pour in. Companies that reported since the close yesterday included Alibaba, Agrium, Archer Daniel, Becton Dickenson, Burger King, CVS, International Paper, Michael Kors, Office Depot and Priceline.com.

Eastman Chemical added $0.30 to $82.33 after Sun Trust upgraded the stock from Neutral to Buy. Target is $95.

Anadarko Petroleum (APC 89.40) is expected to open higher after Bernstein upgraded the stock from Market Perform to Outperform. Target is $115.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/03/stock-market-outlook-for-november-4-2014/

GlobeInvestor Report Released Yesterday

Headline reads, “Why Mid-term elections season is a great time to buy the market”. Authors are Don and Jon Vialoux. The article examines performance of the U.S. equity market following the Mid-term U.S. election. Following is a link:

Horizons ETFs Market/Sector Technical Scorecard

Weekly Tech Talk/Horizons report. Following is a link:

Interesting Charts

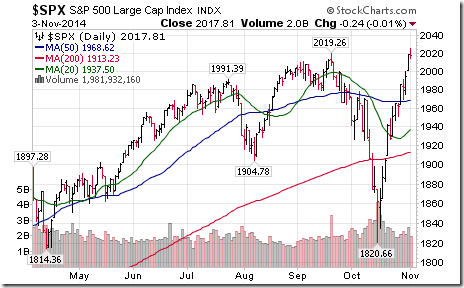

The S&P 500 Index moved above 2019.26 to touch an all-time inter-day high.

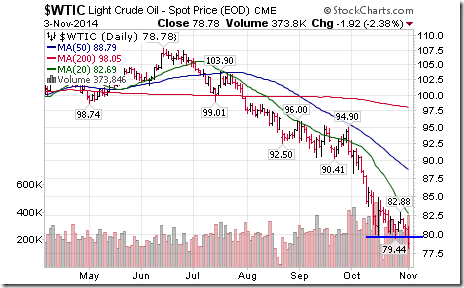

The U.S. Dollar continues to stream higher.

Strength in the U.S. Dollar had a negative impact on commodity prices, particularly crude oil.

StockTwits Released Yesterday

Quiet bullish technical action by S&P 500 stocks to 11:00 AM. 6 stocks broke above resistance: $OMC, $CAG, $RHT, $STX, $D.

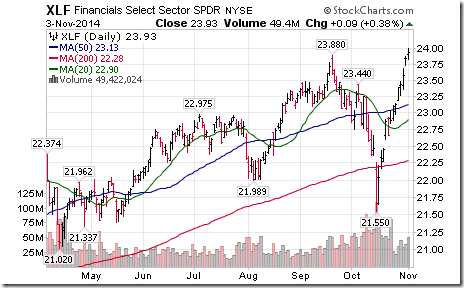

$XLF breaks to a six year high.

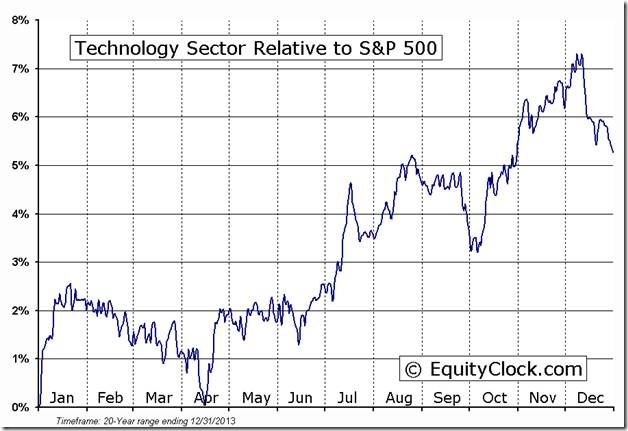

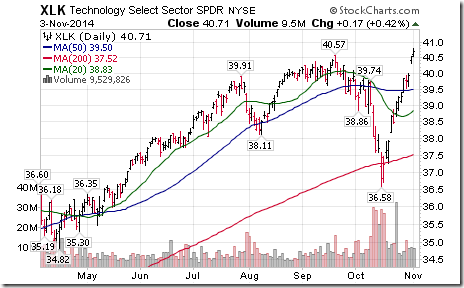

$XLK breaks to a 14 year high. ‘Tis the season to move higher on a real and relative basis!

Technical action by individual equities yesterday

By the close, 10 S&P 500 stocks broke intermediate resistance (added WAG, AGN, CNP and WY) and none broke support.

No TSX 60 stocks broke intermediate support or resistance

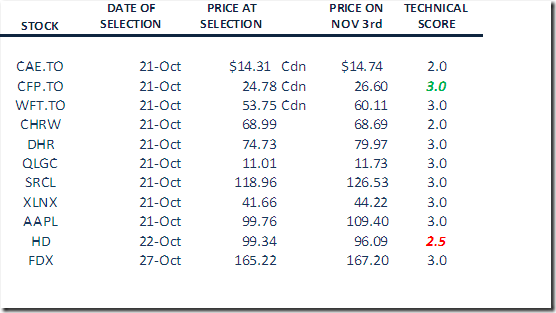

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Special Free Services available through www.equityclock.com

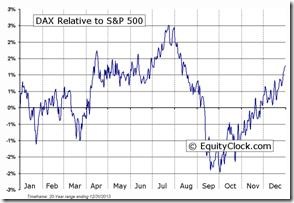

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

^GDAXI Relative to the S&P 500 |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC November 3rd 2014

Copyright © EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/ba600e5f1b8232e770f0d9a2d33cb6d4.png)