by Don Vialoux, EquityClock.com

Pre-opening Comments for Tuesday October 28th

On average over the long term, today is the optimal day to enter U.S. and Canadian equity markets for a seasonal trade lasting until next spring.

U.S. equity index futures were higher this morning. S&P 500 futures were up 7 points in pre-opening trade.

Index futures slipped following release of the September Durable Goods Order report. Consensus was an increase of 0.7% versus a decline of 18.4% in August. Actual was a decline of 1.3%. Excluding transportation, September Durable Goods Orders were expected to increase 0.5% versus a gain of 0.4% in August. Actual was a decline of 0.2%.

Third quarter reports continue to pour in. Companies that reported after yesterday’s close included Aetna, Amgen, AutoNation, Coach, Consolidated Energy, Corning, Dupont, HCA, Marsh & McLennan, Parker Hannifin, Pfizer, Sherwin-Williams, Starwood Hotels, Twitter and Whirlpool.

Twitter fell $6.45 to $42.11 after the company lowered guidance. In addition, Normura and Stifel Nicolaus downgraded the stock.

Madison Square Gardens gained $6.73 to $72.51 after announcing plans to split the company into two public entities. The stock also was upgraded from Hold to Buy by ISI Group.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/27/stock-market-outlook-for-october-28-2014/

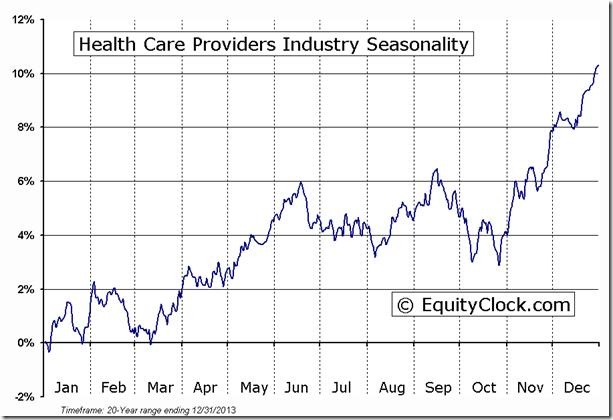

Note the stocks and sectors that are entering their period of seasonal strength today.

Interesting Charts

iShares Brazil responded to news that incumbent President Dilma Rousseff won re-election.

Nickel prices have virtually collapsed since the beginning of September.

Brooke Thackray on BNN Television

Brooke is appearing on BNN’s Market Call Tonight at 6:00 PM this evening

Tech Talk/Horizons ETFs Market Sector Technical Scorecard

Following is a link to the weekly report:

http://www.horizonsetfs.com/campaigns/TechnicalReport/index.html

StockTwits released yesterday @equityclock

Surprisingly bullish action by S&P stocks to 10:15 despite early weakness. 8 stocks broke resistance: $KMX, $STZ, $CME, $ABC, $CAH, $ROP, $YHOO.

Stocks entering period of seasonal strength today: http://stks.co/a1AKk $SLW.CA $SNC.CA $IHF $WEN $LOW $TR $GXP $MBT.TO $PAA.TO $ABX $UPS

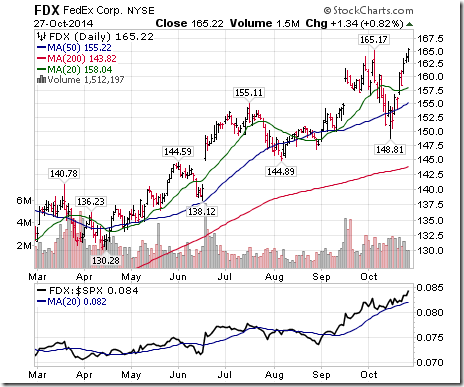

$FDX broke resistance to reach an all-time high. Encouraging sign for Christmas season!

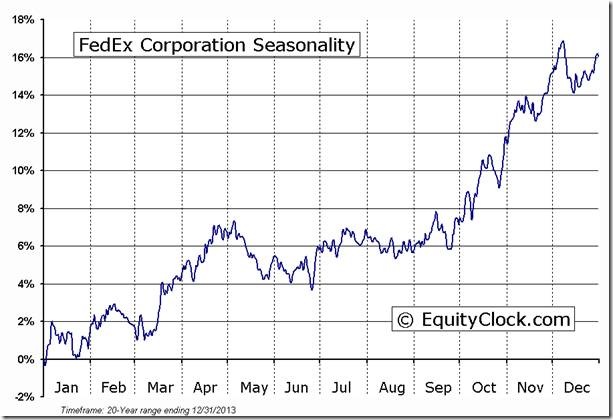

Seasonal influences for $FDX are also positive.

Technical action by individual equities yesterday

By the close, 14 S&P 500 stocks broke resistance and one stock broke support (Peabody Energy).

Among TSX 60 stocks, BCE and Loblaw broke resistance. Loblaw touched an all-time high.

CSTA Event on November 8th 2014: Show Me the Money

A cross Canada event will be held simultaneously in Toronto, Winnipeg, Calgary, Vancouver and Victoria.

Mr. Vialoux is a presenter in Winnipeg.

More information is available at www.csta.org

Monitored List of Technical/Seasonal Ideas

FedEx was added to the list at the close yesterday.

Green: Increased score

Red: Decreased score

All securities must maintain a technical score of 1.5 or higher to remain on the list

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 27th 2014

Copyright © EquityClock.com

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/a282483b8c5a1d7ed3e9c7def60c7ba2.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/HLIC/784c6e9fab91f2be71516449b336e90a.png)