by David Merkel, Aleph Blog

No one knows their financial “risk tolerance” outside of the context of losing money. Part of the trouble is that risk and return are often described in the same breath as if they are inseparable, when they are more weakly related than most think, and certainly not linear.

Surveys, no matter how well-intentioned or -designed do not typically grasp the asymmetry of gain and loss. People feel losses much more acutely than gains, and are far more likely to change their behavior after losses. Can’t tell you how many times I have had people say to me, “I’m never buying stock again,” after 2000-2 and 2008-9.

Nothing can prepare you for the event of loss except prior losses. Those who have made it through losing money have coping strategies ranging from diversification to rebalancing to benign neglect, etc. The best look at it as a cost of doing business, and try to view it together with all other investment decisions made — there will always be losses, but were there gains as well, and more of them over the long haul?

Risk is best faced in prospect, and not retrospect: ask yourself if the current assets that you hold offer fair compensation for the risks that they have. Are they building value even if the market is not reflecting it yet?

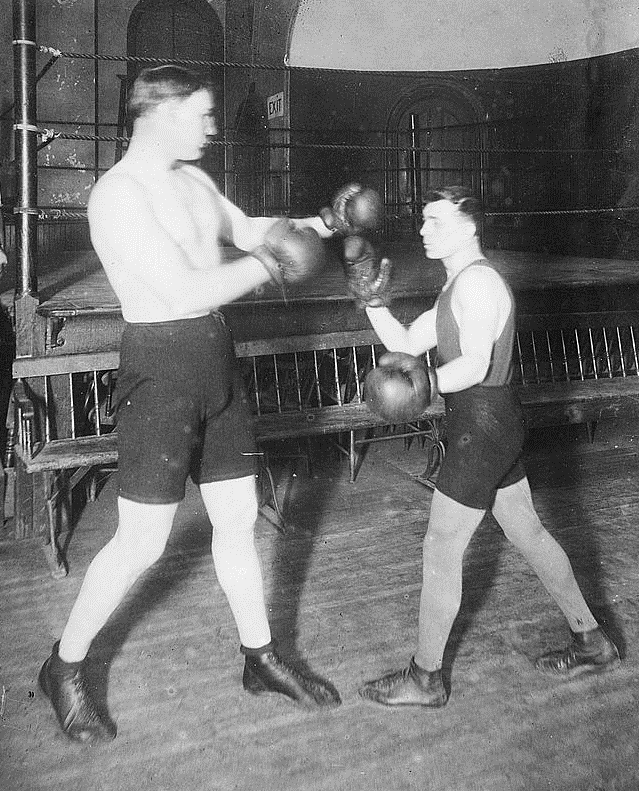

I’m going to be starting a new irregular series at Aleph Blog, where I go through my past tax returns and pull out all of the blunders over the past 25 years. I hope it will be instructive to my readers in many ways, but perhaps the most important of those ways is that you have to get up and fight again if you have been knocked down. Don’t give up! If you leave the game, it is typically at the time prior to gains. Rather, ask whether what you are doing now is the right thing to do on a looking forward basis. The past is gone, and the only time to affect the future is now.

So look for the new series, and appreciate my packrat tendencies that I still have the records for these matters. Hopefully it will be fun, and particularly instructive for younger readers because I was young once too, and I started in this game as an amateur. I made a lot of mistakes, but I did not compound my mistakes by leaving the game.

Copyright © Aleph Blog