by Don Vialoux, EquityClock.com

(Editor’s Note: No pre-opening comments today)

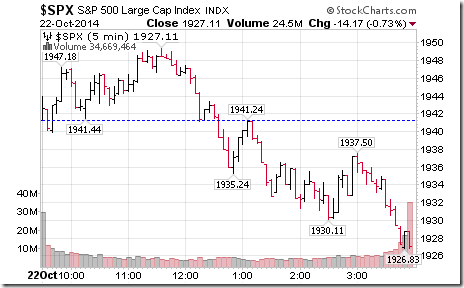

Market Reaction to Terrorist Action in Canada Yesterday

North American equity indices moved higher in early trading yesterday. Surprisingly, initial reaction to the news released near 10:00 AM was muted. A wide variety of S&P 500 stocks broke resistance in early trading. However, North American equity markets are more susceptible than usual to negative surprises. Weakness followed.

Although disturbing, the terrorist act apparently was done by a “lone wolf” activist. Accordingly, impact on equity markets is expected to be temporary. Short term and intermediate technical indicators continue to suggest that North American equity indices bottomed last Wednesday/Thursday.

StockTwits Released Yesterday

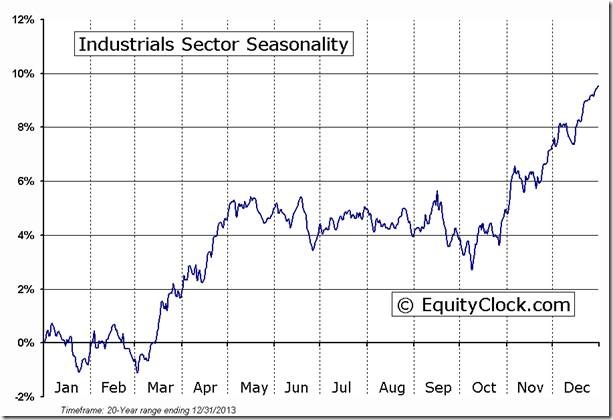

Another 16 S&P stocks broke resistance to 10:30 AM: $GRMN, $HD, $LOW, $WHR, $GIS, $ACE, $HCN, $MAC, $SPG, $TRV, $BSX, $CTAS, $IRM, $RHI, $ADP, $YHOO.

Consumer Discretionary and Industrial stocks dominated the list of breakout. ‘Tis the season!

Technical Action by Individual Equities Yesterday

By the close, 23 S&P 500 stocks broke intermediate resistance and none broke support. No TSX 60 stocks broke intermediate support or resistance.

Canadian Society of Technical Analysts Event

Show me the money!

Don Vialoux is a presenter at the event in Winnipeg

The CSTA 2014 National Conference, a webinar presented for the first time in multiple locations across Canada simultaneously

Date: November 8 2014

The event has various start times across the country. The event agenda and registration is available at www.csta.org Sessions are offered in Toronto, Winnipeg, Calgary, Vancouver and Victoria

Adrienne Toghraie’s “Trader’s Coach Column

|

ReAdjusting for Traders

By Adrienne Toghraie, Trader’s Success Coach

Sometimes all it takes is a tweak in the right direction or a simple understanding that can make all the difference in performance. When you cannot find the right model in trading to give you what you need to make the kind of adjustment necessary to stop losing money, make a profit or make more of a profit, you might look to another area of performance to find a good model.

A good trader off his game

Joe has been trading for over twenty years successfully except for the last two years. When I worked with him as a client, the first thing I considered was if there were any past or current events that would account for his losing money in the markets. It took a while to get to the bottom of what was causing his problem. In a word, Joe had reached an age where his body and mind were not responding in the same way that they did when he was younger. This caused him to be off on his timing. I proceeded to develop a model based on other areas of performance.

I knew Joe was a golfer, and we talked about the importance of focusing on one ball going in one hole in golf. Then he explained to me that he had his best game when he imagined that he was the ball. This prompted me ask him to transfer his experience in golf to trading, but this time he would become the trade.

The next part of the model came from my experience of being a professional singer. I told him that singers go flat when they do not have the support they need from their breath. We translated this to trading by having him do what was necessary with food and exercise to build his energy so his body and mind would support clear thinking.

The last part of the model came from talking about the importance of a stress free environment in his mind. Most self-talk translates to stress and conflicted thinking. I told him to take a walk and think of everything he needed to say to himself. Anything that became a looped story he was to write.

Now Joe had a model for a good foundation of energy that would support a stress free environment. With this he would now become the markets.

Analysis

Take stock of yourself and your trading in your periodical review looking for what you can tweak to earn more profits. Here are some of the questions that you can ask yourself:

· Do I believe I could be more profitable?

· Is there something that I could improve about my strategy?

· If I changed something in myself, could it be advantageous for my trading results?

· What could I improve in my environment that could benefit my focus?

· If significant others supported me more, would I get better results?

· Who could assist me in improving my strategy or myself?

· What am I willing to do to improve my trading and myself?

After you complete your analysis

· Did you improve since the last time you took stock of your trading results and yourself?

· What specific changes did you make?

· What changes did you want to make, but failed to make?

· What new changes do you want to make?

· What will you do differently this time to make sure you succeed in what you have planned to change?

Conclusion

When you readjust yourself and your trading, you renew, revitalize and reinvigorate yourself and your results. This will result in igniting the passion that will bring you to your next level of success.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

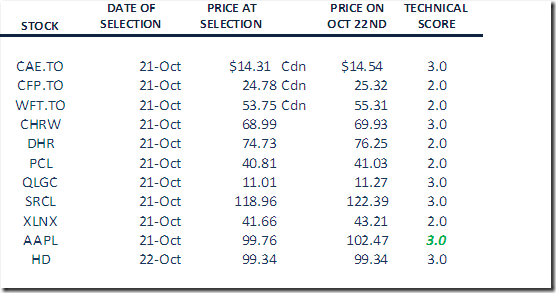

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

All securities must maintain a technical score of 1.5 or higher to remain on the list

Yesterday, Apple briefly touched an all-time high.

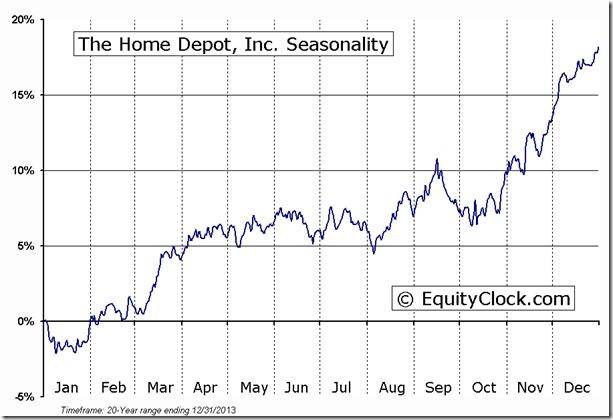

Special Free Services available through www.equityclock.com

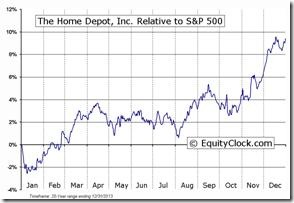

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

HD Relative to the S&P 500 |

HD Relative to the Sector |

Editor’s Note: Home Depot was added to the “Monitored List” at the close yesterday

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

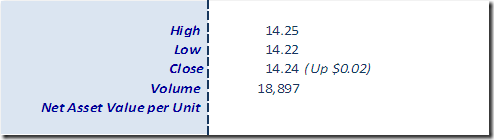

Horizons Seasonal Rotation ETF HAC October 22nd 2014

Copyright © EquityClock.com