What do the pros REALLY think about the market?

by Cam Hui, Humble Student of the Markets

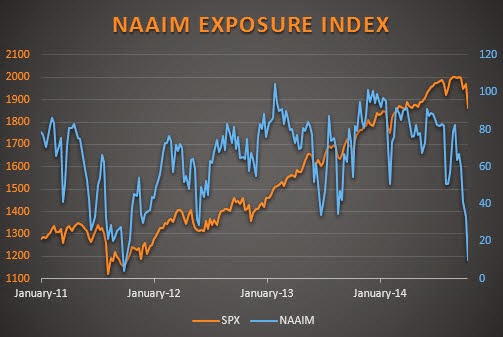

I was reviewing a few "institutional" manager polls and found a number of glaring discrepancies. On one hand, Ryan Detrick highlighted the level of panic among NAAIM managers in their equity exposure:

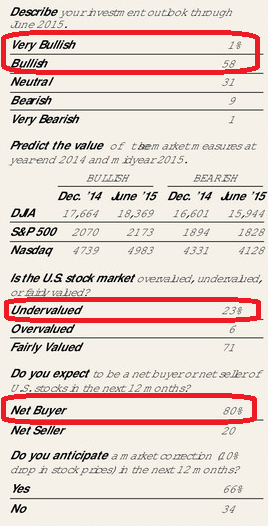

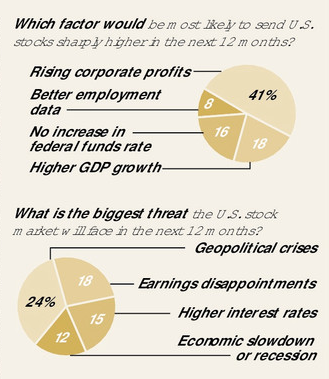

On the other hand, the newly published Barron’s Big Money Poll of money managers showed them to be super-bullish on equities. The table from the poll shows the pros to be tilted bullishly towards stocks, far more believe equities are undervalued than overvalued and, most importantly, 80% expect to be net buyer of equities in the next 12 months:

It’s going to take a lot more than the past month’s 5%-plus selloff in stocks for America’s money managers to change their upbeat tune. That’s what they’ve been telling Barron’s in the past two weeks, ever since 59% of participants in our latest Big Money poll said they were bullish or very bullish about the outlook for U.S. stocks through the middle of 2015. That’s up from 56% in our spring survey, but below last fall’s bullish reading of 68%.

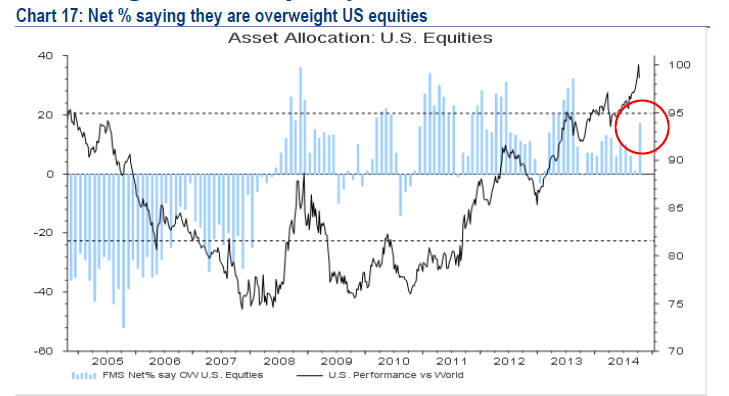

The BoAML Fund Manager Survey (FMS) shows US equity exposure to be slightly above average and rising, but not excessively high:

WTF? How can managers be both bearish (NAAIM), mildly bullish (FMS) and extremely bullish (BM) on US equities all at the same time?

In addition, the NAAIM survey readings seem highly unusual to me. The swings in asset allocation in NAAIM sample do not correspond to the behavior of any institutional manager that I am familiar with. Most institutional managers have individual mandates, e.g. US large cap equities, HY bonds, etc., which require them to stay fully invested. A cash level of more than 5% is unusual under most circumstances (imagine how you would react if you bought SPY and its NAV underperformed in a market rally because the manager decided to hold 20% cash).

Comparing survey samples

It all became more clear to me when I read the survey sample discussions of each of the polls. My former Merrill colleague Walter Murphy indicated to me that the NAAIM sample consists of RIAs investing money on behalf of their clients. In other words, these are individual mom and pop investment advisors with discretionary authority over client funds.

By contrast, both the Barron`s and BoAML survey sample are more institutional in character. Barron`s describes their survey respondents this way:

THE BIG MONEY POLL is conducted twice a year, in the spring and fall, with the help of Beta Research in Syosset, N.Y. The latest survey drew responses from 145 portfolio managers from across the country, representing some of the largest investment companies in America and many smaller firms. Barron’s has been conducting Big Money for more than 20 years to get professional investors’ read on the financial markets and the economy.

By contrast, the BoAML sample is more global in nature as they conduct both global and regional surveys:

An overall total of 220 panellists with $640bn AUM participated in the survey. 176 participants with $508bn AUM responded to the Global FMS questions and 103 participants with $264bn AUM responded to the Regional FMS questions.

Highlights of macro risk

Now that the sample question are resolved, my conclusion is that the RIAs panicked during the recent risk-off period, while the US institutional managers turned more bullish on US equities and global and non-US managers drew back their risk profile a bit to benchmark.

The responses also highlighted the kind of macro risks involved in the forecasts. Consider that, according to Barron`s, manager expect 10-year Treasury yields to rise to between 3.0-3.5% next year.

Wow! That represents a rise of roughly 1% in the 10 year yield in the context of a rising stock market. That would suggest a very robust earnings and economic growth scenario, which is shown below. Here is the key risk: Either growth expectations be unrealistically high or the bond yield forecast wrong.

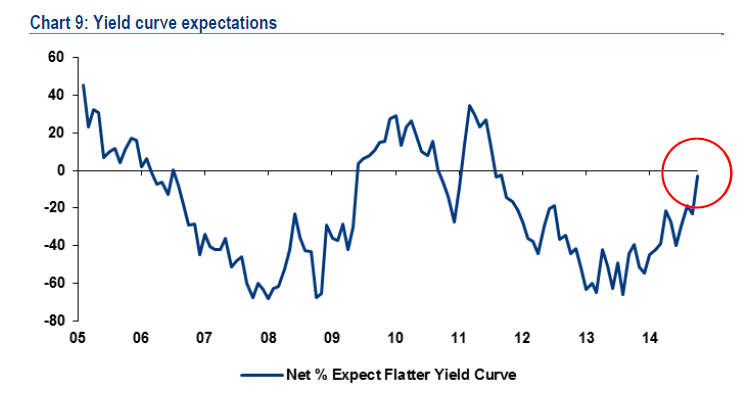

In addition, the BoAML survey shows a majority of managers expect a flattening yield curve. If both the Barron`s sample and the BoAML samples are correct, then that will imply 10-year yields will rise to 3.0-3.5% while the yield curve flattens - meaning an unexpected spurt in the short end indicating that the Fed will tighten far more aggressively than the market expects.

Somebody is very wrong, but there are undoubtedly opportunities in betting against the consensus here.

To be sure, the BoAML survey is far more global in nature and those survey results reflect the angst that managers feel over the non-US economies. Macro risk is rising in the eurozone and China in the form of growth slowdowns. The cautiousness shown in that sample stands in stark contrast to the bullishness to the US money manager sample of the Barron`s survey. That`s why it`s important to understand the differences in respondent populations before interpreting the data and jumping to conclusions.

Watch what they do

In the end, professional money managers are not that different than you or me. There are tall ones and short ones, white ones and brown ones, male and female and they come in all shapes and sizes. That`s why I do tend to tread carefully when I read these survey results. I prefer to watch either market based indicators, e.g. option premiums and skews, or focus on questions about what they`re doing with their money, e.g. AAII asset allocation survey, rather than what they think, AAII bull-bear survey.

Watch what they do, not what they say.

`

Copyright © Humble Student of the Markets