by David Merkel, Aleph Blog

October 15, 2014

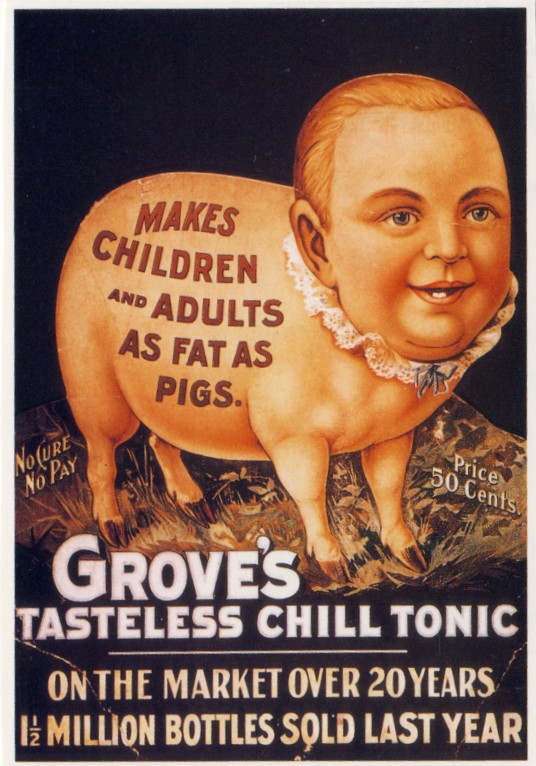

Photo Credit: Dan Century

I use factors in my investing. What *are* factors, you ask? Factors are quantitative variables that have been associated with potential outperformance. What are some of these factors?

- Valuation (including yield)

- Price Momentum (and its opposite in some cases)

- Insider Trading

- Industry factors

- Neglect

- Low Volatility

- Quality (gross margins as a fraction of assets)

- Asset shrinkage

- Share count shrinkage

- Measures of accounting quality

- and more…

This is a large portion of what I use for screening in my eighth portfolio rule. I’m not throwing this idea out of the window, but I am beginning to call it into question. Why?

I feel that the use of the most important factors are getting institutionalized, such that many major investors are giving their portfolios a value tilt, sometimes momentum tilts, and other sorts of tilts. I also see this in ETFs, where many funds embrace value, yield, momentum, accounting, or other tilts.

Now, we have been through this before. In 2007, momentum with value hedge funds became overinvested in the same names, with many of the funds using leverage to goose returns. There was quite a washout in August of that year as many investors exited that crowded trade.

I’m not saying we will see something like that immediately, but I am wary to the point that when I do my November reshaping, I’m going to leave out the valuation, yield and momentum factors, and spend more time analyzing the industry and idiosyncratic company risks. If after that, I find cheap stocks, great, but if not, I will own companies that are hopefully not owned by a lot of people just because of a few quantitative statistics.

I may be a mathematician, but I try to think in broader paradigms — when too many people are looking at raw numbers and making decisions off of them solely, it is time to become more qualitative, and focus on strong business concepts at reasonable prices.

Copyright © Aleph Blog