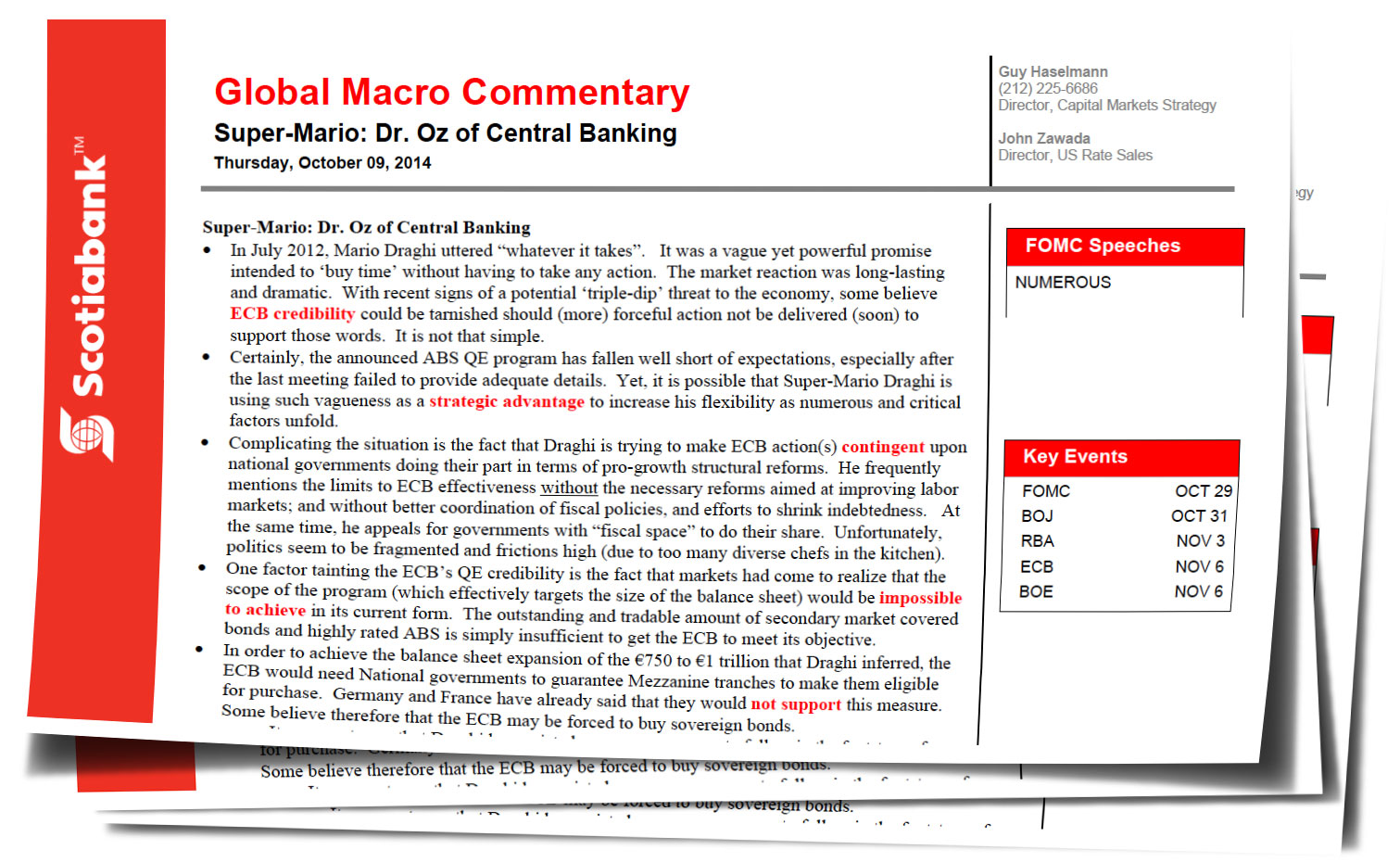

Super-Mario: Dr. Oz of Central Banking

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

· In July 2012, Mario Draghi uttered “whatever it takes”. It was a vague yet powerful promise intended to ‘buy time’ without having to take any action. The market reaction was long-lasting and dramatic. With recent signs of a potential ‘triple-dip’ threat to the economy, some believe ECB credibility could be tarnished should (more) forceful action not be delivered (soon) to support those words. It is not that simple.

· Certainly, the announced ABS QE program has fallen well short of expectations, especially after the last meeting failed to provide adequate details. Yet, it is possible that Super-Mario Draghi is using such vagueness as a strategic advantage to increase his flexibility as numerous and critical factors unfold.

· Complicating the situation is the fact that Draghi is trying to make ECB action(s) contingent upon national governments doing their part in terms of pro-growth structural reforms. He frequently mentions the limits to ECB effectiveness without the necessary reforms aimed at improving labor markets; and without better coordination of fiscal policies, and efforts to shrink indebtedness. At the same time, he appeals for governments with “fiscal space” to do their share. Unfortunately, politics seem to be fragmented and frictions high (due to too many diverse chefs in the kitchen).

· One factor tainting the ECB’s QE credibility is the fact that markets had come to realize that the scope of the program (which effectively targets the size of the balance sheet) would be impossible to achieve in its current form. The outstanding and tradable amount of secondary market covered bonds and highly rated ABS is simply insufficient to get the ECB to meet its objective.

· In order to achieve the balance sheet expansion of the €750 to €1 trillion that Draghi inferred, the ECB would need National governments to guarantee Mezzanine tranches to make them eligible for purchase. Germany and France have already said that they would not support this measure. Some believe therefore that the ECB may be forced to buy sovereign bonds.

o It appears to me that Draghi has resisted enormous pressure to follow in the footsteps of other central banks who have implemented sovereign QE. I am perplexed why it has become conventional wisdom to presuppose that QE is inflationary, since the inflation sought has been so elusive - aside from asset price inflation (i.e. bubbles). Maybe conventional wisdom is simply wrong.

o Maybe Draghi actually believes sovereign bond QE is counterproductive or ineffective. I admit it is counterfactual to know the level of inflation had the Fed not have undertaken QE 3. However, printing money is like spilling water; it is easy to do, but it’s hard to control where it goes.

o The measures adopted by the ECB recently are likely attempts to weaken the Euro which helps the ECB more directly achieve its mandate. A Fed rate hike would help in this regard.

· In regard to the balance sheet, the initial allowance of TLTRO has a full-allotment of €400 billion. In September, a much worse than expected €86 billion was allotted. Even if an optimistic €350 billion is allotted before the spring, the original LTRO program will return approximately €350 billion of outstanding loans. Thus, old loan repayment would completely offset new loans, leaving the balance sheet at the same level.

· ECB members have said that the council never explicitly voted on “whatever it takes” or on tying ABS QE to a “balance sheet target”. Is it possible that Draghi unilaterally devised these tactics to cheaply ‘buy’ as much time as possible, while also cunningly coaxing the committee toward a future direction? After all, Draghi must have known that the numbers embedded in the current program simply do not add up.

· Over the years, Draghi has earned my respect. He has shown incredible foresight and shrewdness in navigating through the turbulent waters of EU politics (and a few crises), while also trying to best use the ECB’s limited tools to achieve its legal mandate. His biggest challenges have probably yet to come. Luckily, no one is more capable.

· I suspect markets can expect more creativity from him, but it is unwise to expect sovereign QE. There is little to be gained, while the risks are enormous. He is clearly aware that structural reforms are urgently needed. Unfortunately political compromise and actions often only happen when a crisis forces a reactionary response. Maybe the lesson the ECB can learn from the Fed is that along with all the risks to financial stability, QE enables fiscal stalemate. His threats of making ECB policy ‘contingent’ on governmental actions may backfire or fail, but it is brilliant.

· I maintain my prediction that the 30-year Treasury will trade sub-3% by Thanksgiving and toward 2.5% in 2015. Additionally and despite the rally, Eurodollar futures are still pricing in too many hikes too soon. The market’s reaction today from Fischer’s comments was a clear example of the difficulties that the Fed will encounter as they attempt ‘lift-off’. Tick tock.

· “The medicine should never be worse than the disease” - Me

Regards,

Guy Haselmann | Director, Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann[at]scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia

Read/Download Guy Haselmann's report below:

Global Macro Commentary October 9

Copyright © Scotiabank GBM