Recent stock market losses have engendered a good deal of investor angst about technology stocks, but Russ believes anxiety over the technology sector is premature. In fact, it remains one of his favorite sectors. Here’s why

by Russ Koesterich, Portfolio Manager, Blackrock

As stock market volatility has returned lately, market watchers are predictably trying to explain the reasons behind every mini sell-off.

Many commentators have blamed at least some stock market losses on the technology sector, and particularly on Apple Inc.’s supply chain issues. Such sell-off post mortems seem to have engendered a good deal of investor angst about technology stocks.

My read, however, is that anxiety over technology is premature. In fact, information technology is still one of my favorite sectors. Here are three reasons why.

Momentum. Even after recent selling, technology stocks still stand out as top relative performers year-to-date. Large cap U.S. technology companies, as measured by the S&P 500 Information Technology Index, were up roughly 12% as of late September, easily outperforming the broader U.S. market, as measured by the S&P 500 Index. Even during the late September sell-off that some market watchers attributed to Apple news, tech stocks fared no worse than the broader market.

Despite its outperformance this year, the technology sector is not particularly expensive. Tech valuations are reasonable, although not cheap. For the sector, price-to-book (P/B) and price-to-earnings (P/E) valuations are both below their long-term average. On a relative basis, as measured by P/E, the technology sector trades at a modest 13% premium to the U.S. market. In contrast, at the market peak in 2000, technology stocks were trading at around a 140% premium to the S&P 500.

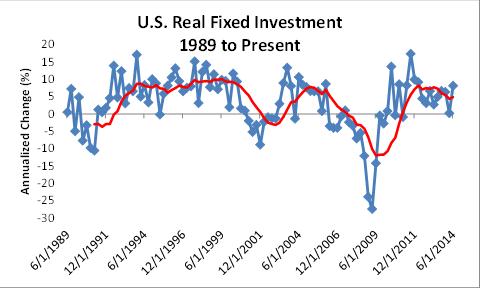

Perhaps most importantly, looking forward I can see a catalyst for further gains: increased capital spending. Fixed investment has been weak for well over a decade. Since 2000, U.S. real fixed investment has averaged around 1.5% annualized growth. Prior to the bursting of the tech bubble, real investment averaged approximately 5% annualized growth.

Part of the drop reflects a post-financial crisis collapse in residential investment, but much of the decline can be traced to a dearth of capital spending. This may be starting to change.

An aging capital stock appears to be driving some rebound in corporate spending. Real fixed investment grew at a healthy 8.1% annualized rate in the second quarter and has averaged more than 6% during the past three years, as the figure below shows.

A return to a more robust capex environment would benefit technology companies, particularly those geared to corporate spending.

Finally, while another repeat of the 1990s is unlikely, it’s worth highlighting that the long tech rally of that decade coincided with the last period of strong investment. Between the start of 1993 and the bursting of the technology bubble, real fixed investment increased at an average annualized rate of more than 8%. During that same period, the S&P 500 technology sector advanced more than 1,200% versus gains of roughly 250% for the broader U.S. market.

While I don’t expect a repeat of that rally – for one thing, back in late 1992 technology stocks were trading at roughly half their current valuations – a long overdue capital spending cycle will likely add another tailwind for tech stocks. For more on why I like the technology sector, be sure to check out my latest Investment Directions monthly market outlook.

Sources: Bloomberg, BlackRock research

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here.

Index returns are for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

©2014 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owners.

iS-13681

Copyright © Blackrock