by Don Vialoux, Timing the Market

Pre-opening Comments for Wednesday October 8th

U.S. equity index futures were higher this morning. S&P 500 futures were up 3 points in pre-opening trade.

The Canadian Dollar was virtually unchanged following release of Canadian September Housing Starts. Consensus was an increase to 197,500 from 192,400 in August. Actual was 197,800.

Monsanto (MON $108.50) is expected to open lower after reporting lower than consensus fourth quarter earnings.

Symantec jumped $1.10 to $24.29 after the company announced plans to split into two public companies.

Costco gained $3.33 to $128.60 after reporting higher than consensus fourth quarter revenues and earnings.

Cummins added $0.63 to $130.20 after Stifel Nicolaus initiated coverage with a Buy rating. Target is $160.

GoPro fell $2.42 to $91.43 after Piper Jaffray downgraded the stock from Overweight to Neutral. Target is $90.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/10/07/stock-market-outlook-for-october-8-2014/

Note the list of individual equities that are entering their period of seasonal strength (e.g. AAPL)

Interesting Charts

European equities and their related ETFs led weakness in U.S. equities yesterday.

The VIX Index spiked again. ‘Tis the season!

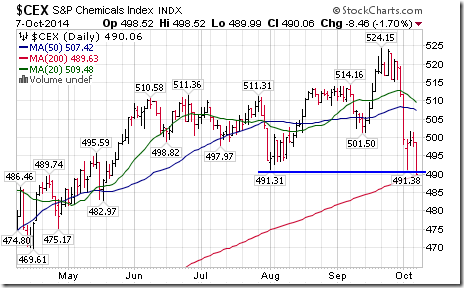

Economic sensitive sectors, indices and related ETFs were hit the hardest.

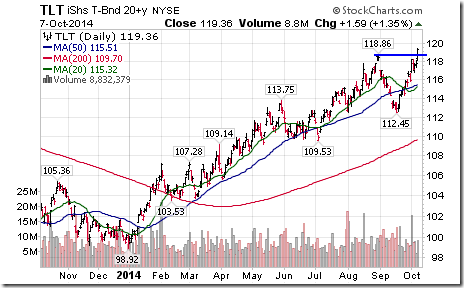

Treasury bond prices moved higher in anticipation of a slowdown in U.S. economic growth.

Momentum indicators show that the Euro is deeply oversold and finally is showing early signs of trying to bottoming.

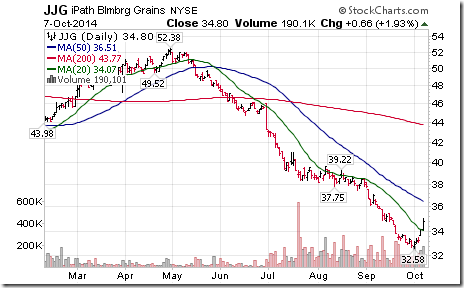

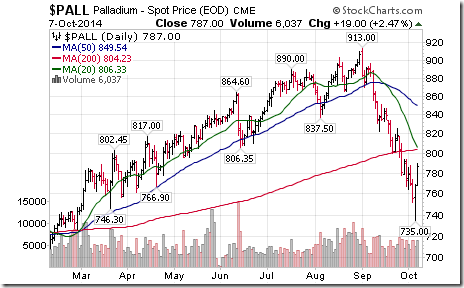

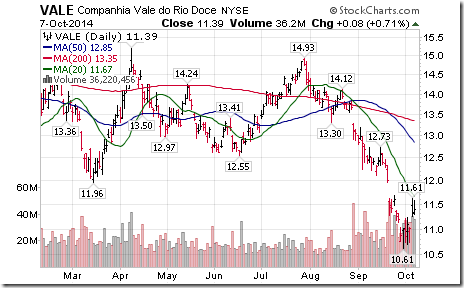

Nickel, aluminum, gold, platinum, palladium, copper and grain prices continue to show signs of trying to bottom.

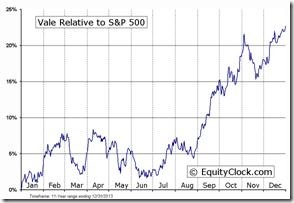

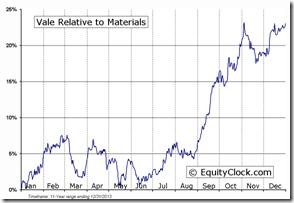

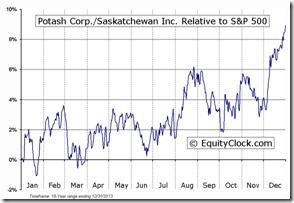

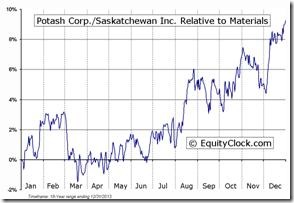

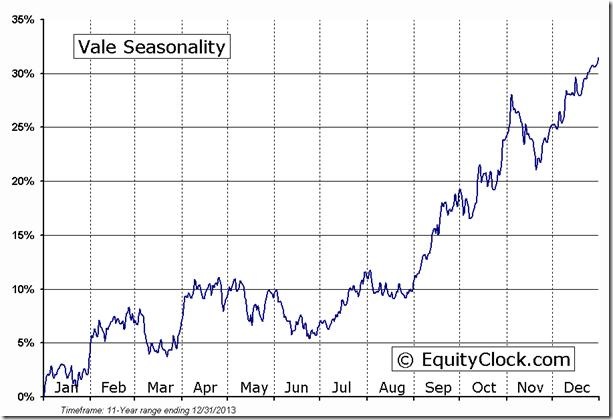

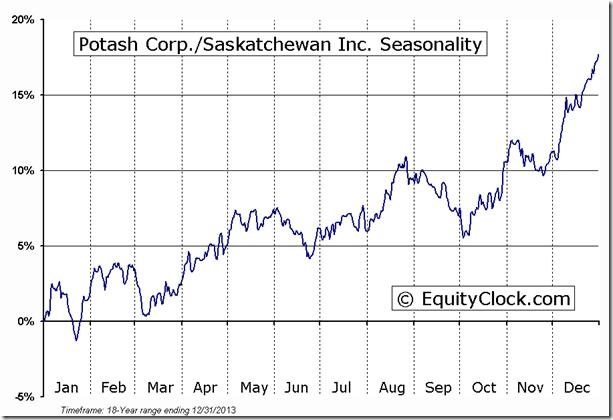

Equities such as VALE (nickel and aluminum prices) and POT (grain prices), that have just entered their period of seasonal strength, are starting to respond to higher commodity prices despite “difficult” equity market conditions. Best to put on the radar screen for possible purchase when more technical evidence becomes available.

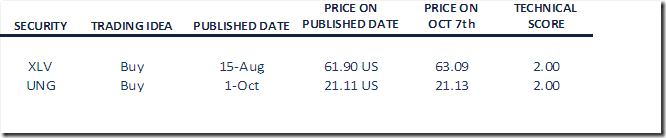

Monitored Technical/Seasonal Trade Ideas

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following are examples:

VALE Relative to the S&P 500 |

VALE Relative to the Sector |

POT.TO Relative to the S&P 500 |

POT.TO Relative to the Sector |

FP Trading Desk Headline

FP Trading Desk headline reads, “Why you should buy the dip in U.S. stocks”. Following is a link:

http://business.financialpost.com/2014/10/07/why-you-should-buy-the-dip-in-u-s-stocks/

StockTwits released yesterday

Quietly bearish action by S&P 500 stocks to 11:00 AM. Breaks above resistance: $GMCR, $CAG. Breaks below support: $HCBK, $PBCT, $TYC, $AMAT, $FTR, $AIG.

Technical Action by Individual Equities

By the end of the trading day, another 5 S&P 500 stocks broke support: SWK, GME, PETM, LH and HON. No more broke resistance.

No TSX 60 stocks broke support or resistance.

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC October 7th 2014

Copyright © Timing the Market

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/HLIC/afd8588d7ec20818c8e764bcc05ccf8f.png)