by Ben Carlson, A Wealth of Common Sense

The U.S. stock market is once again trouncing the broader international markets this year. Through the end of September, the total U.S. stock market, as measured by the Vanguard Total Stock Market Fund, is up nearly 7% while the Vanguard Total International Fund is basically flat on the year.

Since the beginning of 2013, the U.S. market it up almost 43% against a 15% gain for foreign markets. It’s tempting to look at these numbers and assume you’ll be fine just holding U.S. stocks and forgetting about the rest of the globe.

Investors have a short memory at times, so it’s easy to forget that everyone hated U.S. stocks in the middle part of the last decade as foreign stocks, led by emerging markets, were up almost three times as much on a total return basis:

Over the entire 2002 to 2014 period the total returns are fairly close, with the U.S. market up 139% against a gain of 133% for international stocks. These numbers show how mean reversion works over time.

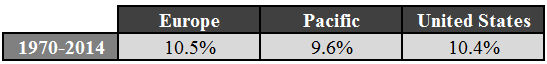

It’s also instructive to break out the international markets by different regions to show how certain geographies have performed over time. MSCI data goes all the way back to 1970 and they have an index for both Europe and the Pacific region (made up of Japan, Australia, Hong Kong and Singapore).

Looking at the performance of these two markets along with the S&P 500 over forty plus years, we find that the annual returns are fairly similar:

Any long-term investor would have done great in these markets had they been invested over the entire time frame. But breaking the numbers down by different periods shows how cyclical the annual returns have been over time:

Until the latest period, European stocks have actually been the most consistent performers while the U.S. and Pacific markets have taken turns going from top to bottom.

These numbers are a good reminder of why it makes sense to diversify globally and avoid a home country bias. There could be long stretches of severe underperformance if you invest in a single geography at the wrong time.

No one can predict if U.S. returns on stocks will be as high as they’ve been historically or if another country or region will outperform in the coming decades. There are far too many factors that are unknown.

It’s impossible to know ahead of time if the down periods in one market will coincide with your spending needs when you need to start drawing down your portfolio. Selling in a down or underperforming market only compounds your problems when a market runs into a bad stretch.

Not only are there long stretches of underperformance for some regions, but there is Japan-style underperformance which is in a league of it’s own. Japan currently makes up about 60% of the MSCI Pacific Index so it makes for a pretty good proxy. Here are the annual returns for the Pacific Index and S&P 500 broken out by pre- and post-Japanese bubble:

Anytime you bring up the benefits of being a long-term stock investor, someone will play devil’s advocate by pointing out that Japan has been a terrible long-term investment for some time now. But it really depends on your definition of long-term because the returns are so close over the entire data-set.

Sometimes it comes down to luck and what period you happen to be saving and investing your money in. You have no control over this whatsoever. Pacific shares were an amazing investment for two decades, but have been working off those excesses ever since.

It would be great if we were all guaranteed a smooth ride with no variation in performance, but markets don’t function that way. They’re extremely cyclical and can go from worst to first and back again over any month, quarter, year, decade, etc.

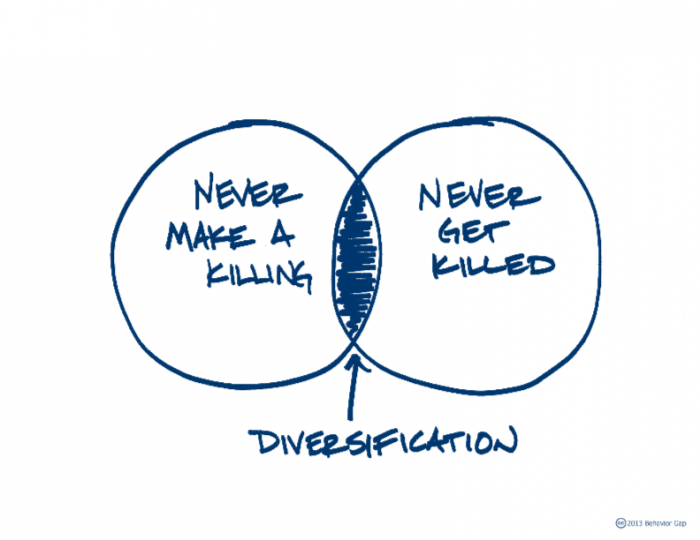

It’s intelligent to utilize diversification so you don’t get stuck with a portfolio that only earns the Pacific returns since 1990. You have to give up the chance for exclusively earning the returns from 1970-1989, but that’s the trade-off.

Diversification is about accepting good enough while missing out on great but avoiding terrible.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense