by Cullen Roche, Pragmatic Capitalism

In a great piece over the weekend Josh Brown goes into some detail on the situation with Bill Gross leaving PIMCO. He asks the important question – what does an owner of the Total Return Fund do now that Gross is gone? I’m not going to answer that question, but I did think there was an important lesson in Josh’s post.

In 2011 Bill Gross, who had crushed the aggregate bond market by almost 2% per year before fees for 30 years, made one of the most vocal bets on interest rates that we’ve seen since the crisis. He was very worried about rising rates when QE ended. He asked “who will buy the bonds” in his March 2011 monthly letter and his bearish stance on T-bonds led him to reduce his allocation to T-bonds to zero.

I was very vocal about this view at the time because I believed Gross was misunderstanding the impact of QE. In fact, I thought a large portion of the field of finance and economics was misunderstanding the risks of QE, the “money printing”, etc because they weren’t properly understanding its operational reality. In essence, Gross was saying that interest rates would rise because QE was ending and the decline in rates due to QE would have to reverse. That is, of course, unless you don’t think QE had much of an impact on rates to begin with. If that was your belief and you thought that inflation would remain low (as I did) then there was really no rational reason to expect interest rates to surge following the end of QE2.

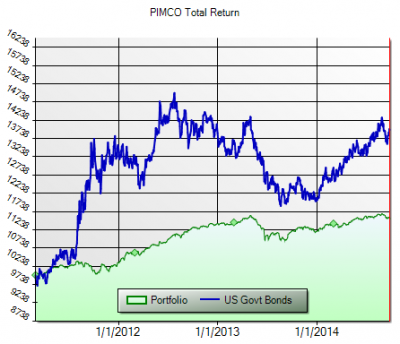

Of course, Gross ended up being wrong as rates actually fell after QE2 ended. The Total Return Fund went on to underperform the long bond by a huge margin  over the next 2 years and the very public call came under harsh scrutiny. Investors began to ask if Gross had lost his touch. And the fund flows reversed out of the fund began as quickly as they’d flooded in after 2008. As the years went by Gross appeared to never recover from the call and last week we learned that Gross was leaving the firm he founded.

over the next 2 years and the very public call came under harsh scrutiny. Investors began to ask if Gross had lost his touch. And the fund flows reversed out of the fund began as quickly as they’d flooded in after 2008. As the years went by Gross appeared to never recover from the call and last week we learned that Gross was leaving the firm he founded.

The interesting thing is not that Gross was a victim of bond market ignorance – he’s obviously a bond market genius, far more savvy than a chump like myself. but he was a victim of macro ignorance. The implementation of QE by the Fed had forced all market participants to take on a whole new set of understandings. And those who had a sound understanding of macroeconomics were better prepared to deal with the aftermath.

In my new book I outline 8 rules for picking an asset manager (see here). Rule 8 is ensuring that a fund manager has a sound understanding of the macro world. Misunderstanding the big picture creates tail risks in a portfolio because it means that fund manager exposes investors to the risk that he/she could dramatically misunderstand important macro events. And in a world where everything is becoming increasingly macro oriented (whether it’s Fed policy, dependence on global events, etc) you can’t afford to invest with asset allocators who don’t have a sound understanding of the macro environment.

Of course, understanding the world isn’t a guarantee of future performance. But I am a big believer in the idea that those with a superior understanding of macro dynamics will be better prepared to manage the risks that threaten investment performance. In other words, by having a superior understanding we can better understand what we know in addition to what we don’t know. And this ultimately helps you avoid the pitfalls that befell the PIMCO Total Return Fund.

Copyright © Pragmatic Capitalism