by Eddy Elfenbein, Crossing Wall Street

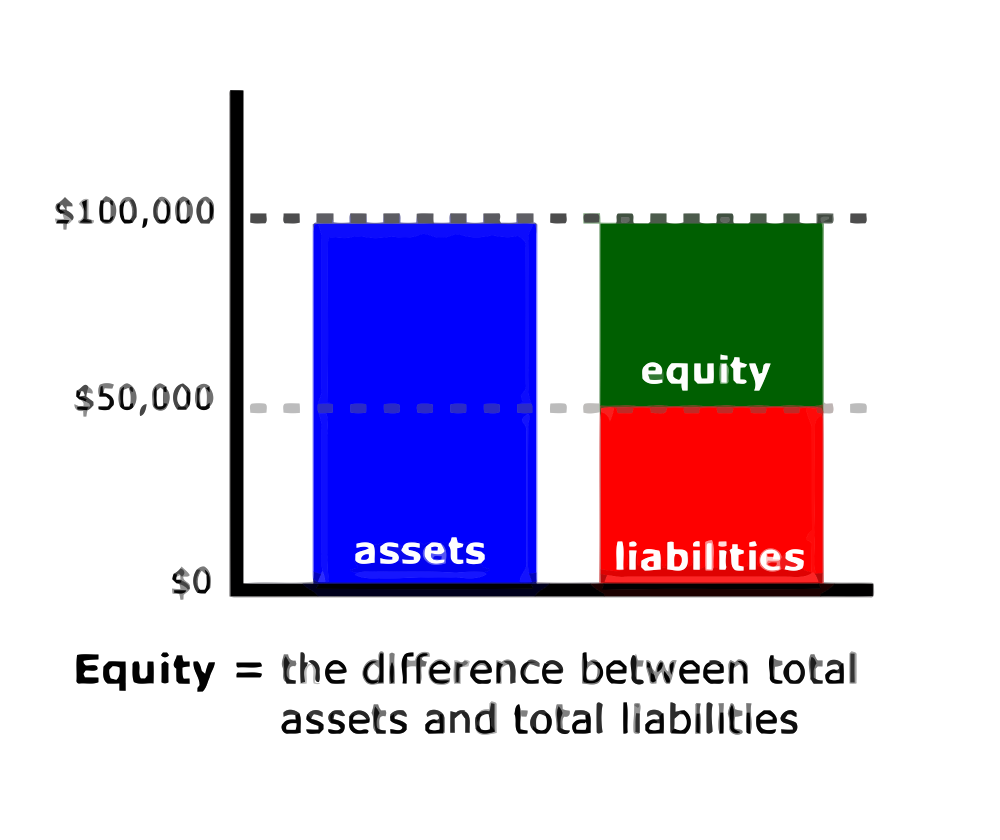

I wanted to discuss an important topic that’s often misunderstood by investors, and that’s the difference between equity and assets.

When new investors look at the list of things to invest in, they tend to see it as a giant list of similar options; stocks, bonds, commodities, forex, real estate and so on. But this blurs an important point which is that stocks are unique. There’s no other class quite like them.

All other assets are things. They just sit there. If you buy some gold and leave it alone, in 50 years it will still be there, just sitting there. There are income-producing assets like bonds and real estate, which makes them a little better than commodities. But still, they’re just things. They can neither think nor create.

Equity, on the other hand, is wholly different. It’s a legal entity by which people can come together and employ said assets to make goods and services for people. It’s almost analogous to looking at the difference between a pile of car parts and a fully assembled car. The business works to make a profit, and it keeps investing those profits in the business to make still more profits.

Some trader right now is investing in, say, copper. I wish them well. But remember that copper has no independent value. By itself, it’s just an element. Not to get too philosophical, but copper’s entire value is based on what it can do for us. What are the goods and services it can enhance? For that to happen, copper needs to pass though the hands of a business.

This is why long-term studies of what’s been the best investment usually have stocks at the top, followed by bonds and real estate followed by commodities. When you’re investing in a company, you’re really investing in human ingenuity—the way that people can come together and figure out how to make something useful from those assets.

Real estate, for example, is a nice investment. I hope everyone owns their own home. But in the long run, real estate will never, ever, ever, ever outpace stocks. Never. This isn’t just my opinion, it’s reality. It won’t happen because it can’t happen.

A house is simply an asset. No matter how hard it tries, it will never be anything more than an asset. A house does its job by just sitting there. But a stock is different. A stock is part ownership in a corporation. A corporation is people using assets to create wealth. This ain’t just a matter of definitions.

You can buy a share of stock of a company that can buy a house. A house can’t invest in a corporation. You can form a corporation and issue stock. With the proceeds, you can do cool things, like…buy a house and rent it for profit. After a while, you’ll have enough money to buy another house. Then another and another. Soon, you’ll have a nice stable of houses. That’s what businesses do—they grow. If they don’t grow, they’re replaced by businesses that do. It’s that simple, and a house can never do that.

Posted by Eddy Elfenbein