Economic growth is strengthening in some parts of the world, while it’s slipping in others. What does the uneven nature of the recovery mean for investors? Russ weighs in with implications for currency, bond and equity markets.

As last week’s non-farm payroll report illustrated, the recovery – both in and outside the United States – remains a grudging, disappointing one. That said, it’s still a recovery, albeit an uneven one.

Economic growth is strengthening in some parts of the world, while it’s slipping in others. In other words, as I mentioned in a post earlier this week, the major trend in the global economy is one of increasing divergence, rather than slower growth, and the uneven nature of the recovery is an important development for investors.

It’s already influencing currency and bond markets. And depending upon the future path of monetary policy in Europe and Japan, it could significantly impact equities as well. Here’s a closer look at the three investing implications of diverging growth.

A stronger dollar. With U.S. growth on the rise while Europe is stalling and Japan is struggling with the negative effects of its recent hike in the consumption tax, it should come as no surprise that the dollar is trading at its best levels since last summer. While the exact timing of a Federal Reserve (Fed) hike is still an open question–with the Fed set to end quantitative easing next month and raise rates sometime in 2015–the U.S. central bank is on a very different path than the European Central Bank (ECB) and the Bank of Japan (BOJ). Both the ECB and the BOJ are likely to maintain ultra-loose monetary policies through 2015. The combination of faster growth and some normalization in monetary policy suggest that the dollar will continue to enjoy a tailwind into 2015.

Global rates pushing down U.S. rates. While the Fed is likely to start raising short-term rates next year, you would not know it from the long-end of the Treasury curve. Ten-year yields have remained stubbornly low and rate volatility is close to historic lows. There are several reasons for this, including institutional buying, a lack of supply and demographic changes. But low yields in Japan and Europe are also contributing, helping to pull down U.S. rates. German bunds and Japanese government bonds both yield less than 1%, while even peripheral European debt, such as Spanish debt, yields little more than 2% (if anyone is wondering where to find a +4% yield, highly rated sovereign bond, you’d need to try New Zealand). The lack of competition for yield is one factor contributing to persistently low yields in the United States.

Bad news may be good news for international stocks. Europe is struggling with deflationary headwinds and Japan is suffering under the burden of last April’s hike in the consumption tax. Yet, over the past month, both markets are performing on par with the U.S. market. The reason: optimism that weak economies will force the ECB and BOJ to expand monetary easing. Should this happen, both equity markets are likely to benefit. In other words, bad news might be good for Japanese and European stocks.

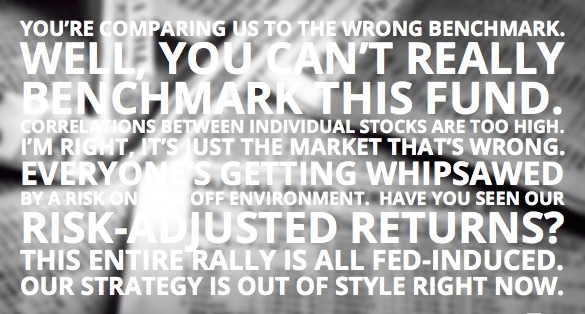

In short, most of the past five years has been dominated by manic swings in investor behavior: fears of another recession followed by euphoria over central bank action to counteract that danger. To some extent this dynamic is still in play. What has changed is that the cycle is no longer the same in each country.

Sources: BlackRock, Bloomberg

Russ Koesterich, CFA, is the Chief Investment Strategist for BlackRock and iShares Chief Global Investment Strategist. He is a regular contributor to The Blog and you can find more of his posts here.

Copyright © Blackrock

iS-13478