by Don Vialoux, Timing the Market

Pre-opening Comments for Thursday September 4th

U.S. equity index futures were higher this morning. S&P 500 futures were up 6 points in pre-opening trade.

Index futures moved higher following release of economic news. The Bank of England maintained its overnight lending rate at 0.50%. The European Central Bank lowered its overnight lending rate. It also announced the Bank intends to purchase asset backed securities beginning of November. Consensus for Weekly Jobless Claims was an increase to 300,000 from 298,000 last week. Actual was 302,000. Consensus for the U.S. July Trade Deficit was $42.0 billion. Actual was a deficit of $40.5 billion. Consensus for the August ADP Employment report was an increase to 220,000 versus 218,000 in July. Actual was 204,000. Consensus for revised Second Quarter Productivity was an increase of 2.6% versus an initially reported 2.5% gain. Actual was an increase of 2.3%.

The Euro dropped sharply following news of the European Central Bank’s moves.

Bank of Montreal has launched coverage on the U.S. forest product sector. Domtar, Weyerhaeuser, Boise Cascade and Louisiana Pacific were initiated with an Outperform rating.

EquityClock.com’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/09/03/stock-market-outlook-for-september-4-2014/

Interesting Charts

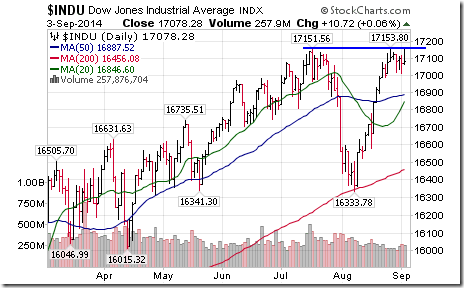

U.S. equity indices remain stalled near all-time highs.

Defensive sectors such as Health Care continue to show positive real and relative strength. Market Vectors Pharmaceutical ETF reached an all-time high.

Economic sectors have a history of underperformance on a real and relative basis in the month of September. They have been showing positive real returns and negative relative returns during the past two weeks.

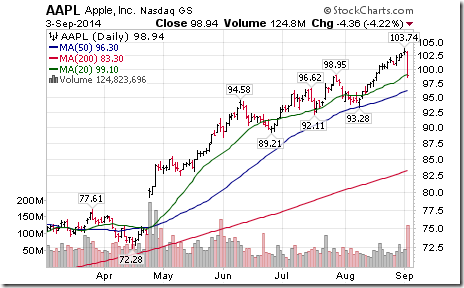

Weakness in the NASDAQ Composite can be attributed mainly to the drop in Apple following an analyst downgrade. The stock had been moving higher in anticipation of new product announcements scheduled to be released on September 9th. Positive seasonal influences on average end next week. Preferred strategy is to take seasonal profits on strength between now and next Tuesday.

Grain prices reached new lows following news that the crop production this year will exceed expectations

FP Trading Desk Headline

FP Trading Desk headline reads “Bull market wants to go higher”. Following is a link:

http://business.financialpost.com/2014/09/03/bull-market-wants-to-go-higher/

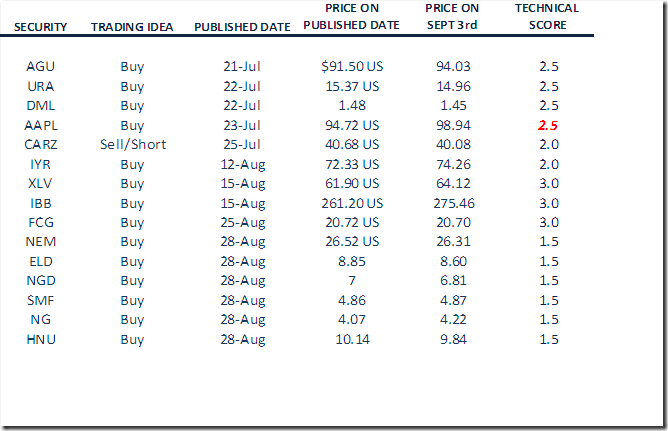

Monitored Technical/Seasonal Trade Ideas

UNG was deleted for a loss of 3.23% and K.TO was deleted for a loss of 2.35% after their technical score fell below 1.5.

A security must have a Technical Score of 1.5 – 3.0 to be on this list.

Green: Increased Technical Score

Red: Reduced Technical Score

= = = = = = = = = = = = = = = = = = = = = = =

Adrienne Toghraie’s “Trader’s Coach” Column

|

A New Perspective

By Adrienne Toghraie, Trader’s Success Coach

“Nothing is working,” a perspective client told me as he frustratingly recounted his present situation. “Everything I know about making money in trading is no longer available. It’s like I’m cursed. I enter perfectly and as soon as I do, the market goes against me. Not only that, my whole life seems to be in an upheaval at this moment in time.”

Some of you may relate to what this trader is saying and others might say that he is over the top with self-pity. So before we come to judgment on this man, let me give you some more information about this trader’s life as an outside observer. First of all Jeff lives in the heart of New York City, has a degree in finance, is in his mid 40s, healthy, has a devoted girl friend and is worth a few million dollars. Jeff’s father is a wealthy man and Jeff is the only beneficiary in his will. In the past, Jeff has earned money from his trading and has the ability of continuing to earn money as a professional trader if and when he makes some adjustments.

Advice to change perspective

I do empathize with Jeff’s feelings, which are very real and very deep. However, sometimes you do need to look at the bigger picture before you can get back on the right track. My first advice to Jeff was to go to the Hayden Planetarium and get more of a perspective on how insignificant his issues were in comparison to the cosmos. I also told him to think about what it would be like if he was like so many people who in these challenging times have been kicked out of the only profession they know and have a family of four to support. Jeff grumbled at my suggestions at first.

We all know that literally millions of people’s lives are more difficult than Jeff’s in our country alone, let alone the rest of the world. And while there is nothing wrong with striving for a better life, if Jeff wants to make this happen he needs to change his perspective.

The second bit of advice I gave Jeff was to revisit the choices he made over the last year and find the commonalities from the trades that were successful and the trades that were not successful and notice the differences. Jeff was not going to follow my lead from the start without resistance. At first he wanted to reel me in with more stories about how he was cursed. I told him that he had great stories that I’m sure many people would be fascinated to hear. Then I said, “Are your stories and the reactions you get from them more important than overcoming your issues?” Jeff finally gave into my advice that weekend – even the planetarium. After following up on my advice about back-tracking his trades, I instructed him to go back to the drawing board of his business plan and make some adjustments. He did not have a business plan. I asked, “How can you ever be accountable to yourself without a trading business plan?”

Emotions will keep you from seeing opportunity

When you wallow in the emotions that result from the looped stories you keep playing back in your head, even when they are justified, you will either see a distorted view of opportunities or you will not see the opportunities that are available to you. In this loop your brain will search for situations where you will attract more negative scenarios. To change course you need to change your thinking. One of the best ways to do this is by looking at your life from various other perspectives.

Conclusion

There is always going to be someone who is richer, smarter, a better father, a better husband and a better trader. And from the opposite side of the coin, the same is true in reverse. The fact is that you can only do the best you can with what you have. That best will have more fertile ground to grow when you are in a positive state of mind. The only choice you have to create a better situation is to change your direction of focus to what you can do rather than what you cannot do. Then enjoy the process and reap the rewards of the good feelings. Good feelings are free to everyone who chooses to have them and the only real wealth we have control over.

Free Monthly Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

= = = = = = = = = = = = = = = = = = = = = = =

StockTwits Yesterday

Quiet technical action to 11:00 AM! Six S&P stocks broke resistance: $SLM, $WFC, $MCK, $TMO, $NSC, $NVDA

Editor’s Note: By the close, two more S&P stocks broke resistance: UNH and FOXA

One TSX 60 stock broke support: ERF.

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

Horizons Seasonal Rotation ETF HAC September 3rd 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray