by James Picerno, Capital Spectator

Most markets around the globe bounced back in August after July’s drubbing. Although there’s still plenty of risk percolating around the world, there were few signs that investors were becoming cautious last month.

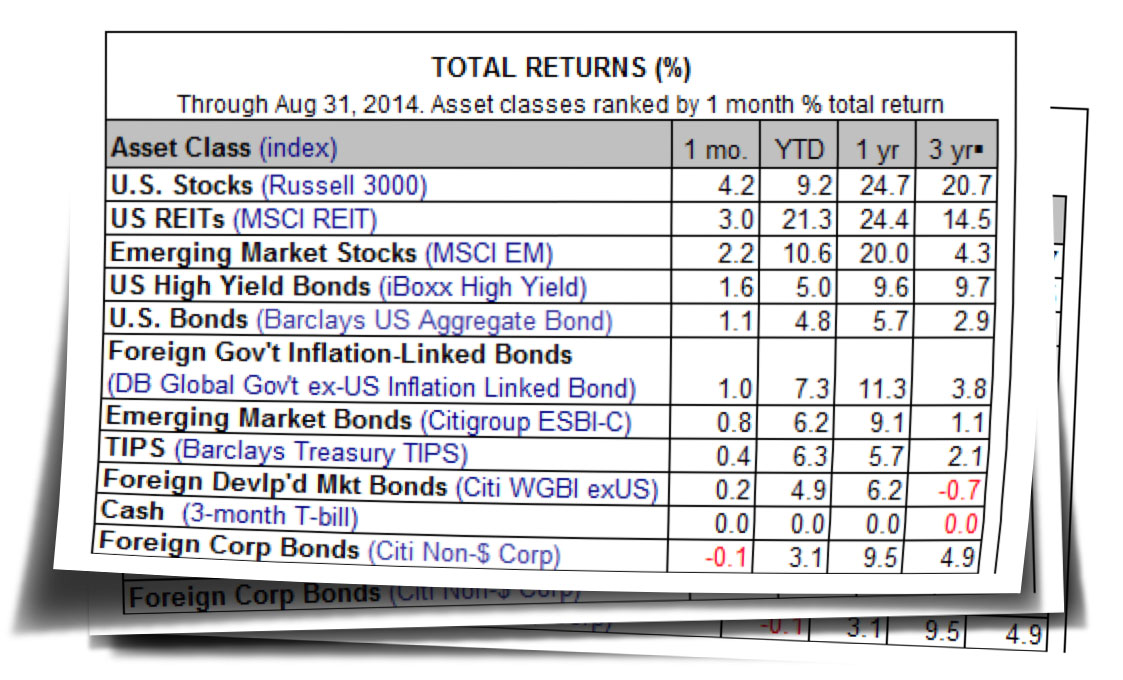

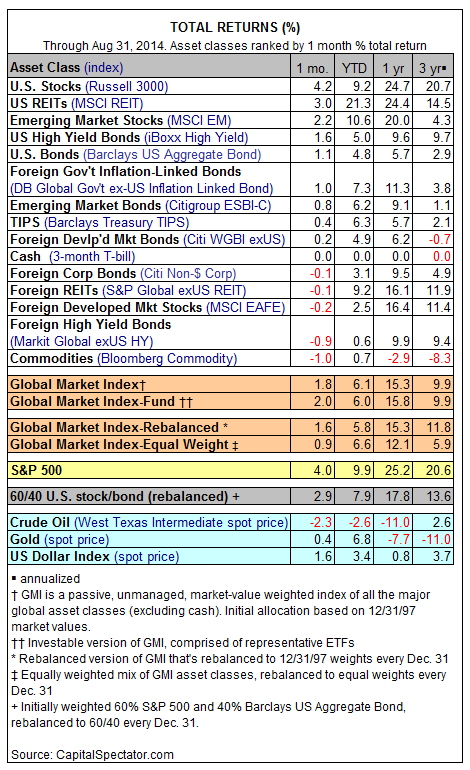

US equities led the rally in August: the Russell 3000 Index added 4.2% last month, the best monthly gain since this past February. Meantime, commodities broadly defined (the worst performer last month) tumbled once again. The Bloomberg Commodity Index (formerly the Dow Jones-UBS Commodity Index) slid for the second month in a row, with a 1.0% drop in August. Commodities overall have shed ground in three of the past four months, based on this benchmark.

There was no sign of weakness in August for the Global Market Index, an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI’s 1.8% advance last month stacks up as the best monthly rally since February. For the year so far through August, GMI is ahead by a robust 6.1%, or comfortably ahead of the year-to-date return at this point in 2013, when GMI was up by 4.9%.

Note, too, that red ink has been banished from all the major asset classes so far in 2014. The general upswing in prices has been accompanied by an increase in geopolitical risk in hot spots around the world, notably in Ukraine and the Middle East. Meanwhile, Europe seems to be flirting with a new recession (or the continuation of the last downturn that never really ended?). All of which inspires the question: Will markets continue to climb a wall of worry?

Copyright © Capital Spectator