by Ben Carlson, A Wealth of Common Sense

“If you can get good at destroying your own wrong ideas, that is a great gift.” – Charlie Munger

Warren Buffett famously ran a partnership for a small group of investors before turning Berkshire Hathaway into his investment vehicle of choice. He produced extraordinary results for himself and his investors.

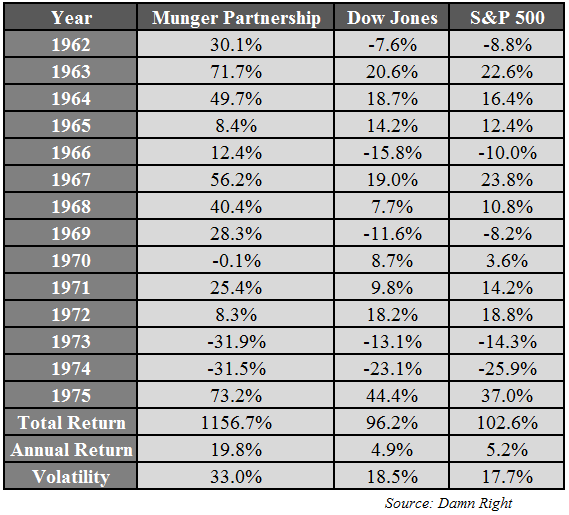

Many don’t realize this but his business partner Charlie Munger actually ran his own investment partnership as well. Here are Munger’s annual returns measured against the Dow and S&P 500 from inception until the fund was closed down:

The fund’s performance was stellar but you’ll notice it ran into some trouble in the 1973-74 bear market when the partnership was down over 53% while the Dow fell around 33%. Here’s Munger’s take on losses from the Janet Lowe’s book Damn Right: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger:

I’ve been through a number of down periods. If you live a long time, you’re going to be out of investment fashion some of the time.

The volatility in the fund, as measured by the standard deviation of returns, was roughly double that of the market. Should that matter as long as the results were superior? Munger doesn’t think so:

This great emphasis on volatility in corporate finance we regard as nonsense. Let me put it this way; as long as the odds are in our favor and we’re not risking the whole company on one throw of the dice or anything close to it, we don’t mind volatility in results. What we want are favorable odds.

My take on volatility is that it’s only a risk if it causes an investor to forgo their process in favor of investing based on an emotional state of fear or greed. Otherwise volatility creates opportunities for patient investors.

Many in the investment industry tout their strategy as the only way to invest successfully. Munger would be on the short list of investors that could legitimately make this claim based on his track record. Instead he has a more nuanced take for finding a process that suits each individual’s unique tolerance for risk and their own personality:

Each person has to play the game given his own marginal utility considerations and in a way that takes into account his own psychology. If losses are going to make you miserable – and some losses are inevitable – you might be wise to utilize a very conservative patterns of investment and saving all your life. So you have to adapt your strategy to your own nature and your own talents. I don’t think there’s a one-size-fits-all investment strategy that I can give you.

There are no easy answers in the financial markets. There will never be a single technique that suits every individual. You must be willing and able to follow any specific approach.

Investing can be hard work. This is especially true for those that try to beat the market. It’s not impossible, but it’s not easy. Munger shared his thoughts on whether that means most investors should simply use index funds:

Does that mean you should be in an index fund? Well, that depends on whether or not you can invest money way better than average or you can find someone who almost surely will invest money way better than average. And those are the questions that make life interesting.

Regardless of your strategy, Munger makes it clear that having a long-term orientation with minimal activity can be a huge advantage:

There are huge advantages for an individual to get into position where you make a few great investments and just sit back. You’re paying less to brokers. You’re listening to less nonsense…If it works, the governmental tax system gives you an extra one, two, or three percentage points per annum with compound effects.

A relentless reader, Munger believes that any good investor should spend the bulk of their time in the pursuit of knowledge and understanding:

I don’t think you can get to be a really good investor over a broad range without doing a massive amount of reading.

Finally, Munger is a fan of putting long-term systems and processes in place at Berkshire Hathaway that don’t require constant oversight by himself or Buffett:

Berkshire’s assets have been lovingly put together so as not to require continuing intelligence at headquarters.

It’s simple, but never easy.

Source:

Damn Right: Behind the scenes with Berkshire billionaire Charlie Munger

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense