by Scott Krisiloff, Avondale Asset Management

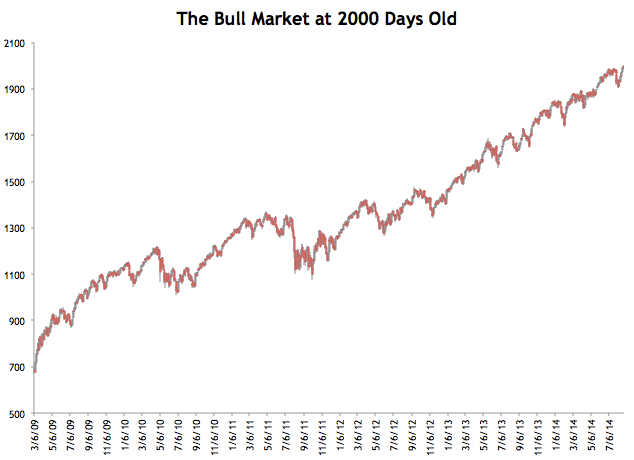

If you count March 6, 2009, when we rallied from an intraday low of 666, as the first day of the bull market, yesterday marked the 2000th calendar day of our current bull. How fitting then that yesterday was the day that the S&P 500 closed above 2000 for the first time.

At 2000 days old our current bull market is now the fourth longest bull market since 1928. Since then, the only bull markets that have lasted longer were in 1974-1980 (2,248 days), 1949-1956 (2,607 days) and 1987-2000 (4,494 days). Adding those bull markets together, the market has existed in a more extended bull market than this one on 3,349 calendar days–a little more than 10% of the time.

We’ve come a long way since March 6, 2009. Back then we were talking about nationalizing the banking system. Nobody on that day would have dreamed that we’d be here 2000 days later.

For a stroll down memory lane, here are some of my favorite financial catchphrases that encapsulate what we’ve been through in the last 5.5 years: “Too big to fail”, “green shoots”, “quantitative easing”, “V-shaped recovery”, “next shoe to drop”, “the new normal”, “flash crash”, “PIIGS”, “double dip”, “QE2″, “arab spring”, “debt ceiling”, “operation twist”, “sequestration”, “QE3″, “fiscal cliff”, “taper”, “government shutdown”, “polar vortex”, “geopolitical tensions”, and of course “great recession”.

Copyright © Avondale Asset Management