by Cam Hui, Humble Student of the Markets

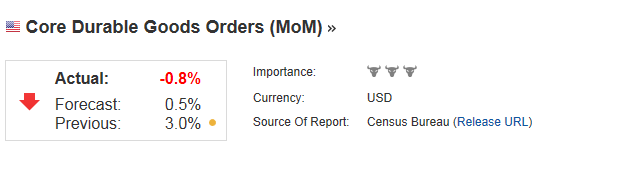

Ho hum! Another month, another miss on core capital goods orders release.

I have been writing about this topic for several months (see What equity bulls need for the next phase, CapEx: Still waiting for Godot and Financial engineering as a CapEx substitute). In the current mid-cycle phase of the economic expansion, companies typically ramp up their capital expenditures, which seems to have gone MIA this time.

Healthy borrowing, but not for CapEx

So where is the CapEx? Credit conditions are easy and capacity utilization is creeping up, so this is a perfect time for a CapEx revival. A WSJ article recently blared a headline indicating that US bond issuance was nearing $1 trillion on a YTD basis. Where did all that borrowing go?

Investors and analysts say companies are raising funds partly with an eye to investing in fresh projects as the U.S. economy gains pace, a move that can further help along economic growth. Acquisitions have about doubled in the U.S. from last year to a recent $1.1 trillion, and U.S. bond sales earmarked for capital spending—purchases or upgrades of long-lived assets such as plant and equipment—have risen 90% from a year earlier to $40 billion, Dealogic said.

The article reveals much of the borrowing occurred because rates are low:

Much of the cash is being used to refinance existing debt, being sent back to shareholders as dividend payments and share buybacks, or banked in the corporate treasury as executives consider how to potentially deploy funds as the economy expands.

The previously cited capital spending figure being up 90% from a year ago sounds encouraging. Digging further:

About $315 billion of corporate bonds have been sold in the U.S. to repay or refinance existing debt, an approximately 35% increase over last year, according to Dealogic...

According to Dealogic, about $109 billion in bonds has been sold globally this year that identified mergers as a use of proceeds, up from $84 billion at this time last year...

Share buybacks have been another popular use of bond proceeds. SP 500 companies bought back about $158.4 billion in the first quarter, the third-largest quarterly amount since 2005, according to FactSet...

In that context, $40 billion for capital expenditures pales in comparison.

A Jim Chanos warning

Jim Chanos recently voiced his worries about the current trend of substituting financial engineering for actual physical capital investment (via Business Insider):

Add Jim Chanos' to the number of voices worried that American companies are running out of gas and in need of real consumer demand to create revenue.

In an interview with Bloomberg's Masters in Business, hosted by Barry Ritholtz, Chanos explained how corporate buybacks were less a sign of strength and more a cry for help from American companies.

He said: "What worries me is that corporate America in aggregate, has pre-tax returns on capital in the mid to high teens. The long-term expected rate of the equity markets, is roughly half that. And when corporations embarked on massive buybacks across all industries and all companies, in effect these CEOs are buying the stock market. So what they’re telling you then, is unequivocally that they think that either they’re happy to earn the stock market rate of return or maybe something hopefully better. Or their rate of return on the margin of any new capital project is much much lower, in fact half or less of what is stated. And that does not bode well for the future of profits, or for the quality of earnings reported as current profits."

He concluded:

Chanos says that corporate balance sheets are looking healthier because analysts aren't deducting acquisitions from a company's cash flow as they should.

“Increasingly we’re seeing acquisitions, which are not taken out of most analysts for cash flow numbers, acquisition are replacing CapEx or R+D," Chanos said. "So companies are buying their R+D or their capital, and that should [be] properly deducted from cash flow, because in aggregate corporate America is not growing. So by buying each other and buying divisions of each other, in effect, they’re capitalizing their R+D … and that particularly applies for big tech, which are perceived as very cheap companies. If you actually look at them, the only reason their revenues aren't declining at a reasonable rate is because they’re buying other companies.”

Is Chanos right? Is Corporate America substituting financial engineering for actual capital spending, which should be occurring during this phase of the economic expansion? Are there insufficient number of capital projects that beat their WACC (weighted average cost of capital) to warrant investment?

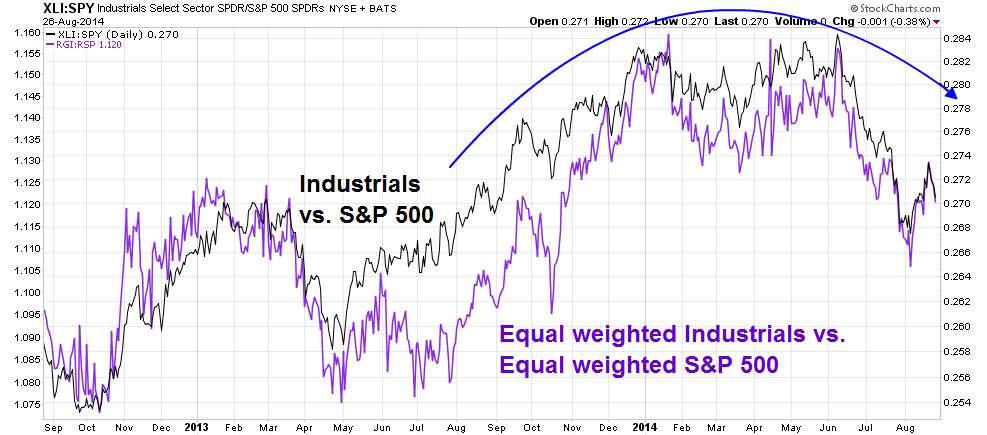

I have no idea. What I do know is that Mr. Market is reacting to these developments. The chart below of the performances of the capital goods intensive Industrial sector, cap weighted or equal weighted (which reduces the effects of heavyweight GE), is rolling over relative to the SPX.

Should this trend in listless capital spending continue, it will hollow out Corporate America and stunt its long-term competitiveness.

Copyright © Humble Student of the Markets