From Jeremy Grantham's GMO:

We have been writing quite a bit about why asset allocation today is in one of the toughest investing environments we’ve ever encountered. And it’s not just because we think equity markets are overvalued. No, we’ve seen that plenty of times before over the past decade or so. Remember the technology bubble of the late ’90s? That was challenging, sure, but what got lost in the shuffle was that while U.S. large-cap stocks were outrageously overpriced, it turned out that real estate investment trusts, emerging equities, and international small caps were deliciously priced. And it was perfectly clear to us what we had to do: avoid technology and own the cheap stuff, even though it might have looked a bit unconventional. Then we entered the 2007–2008 credit bubble, and while, yes, virtually all equity markets were overpriced, it was perfectly clear to us what we had to do: hide and wait. And that was not a bad proposition because there were plenty of safe places to hide—Treasury Inflation-Protected Securities, U.S. Treasuries, and a strategy we had developed called Alpha Only—and earn a decent, if not spectacular, return.

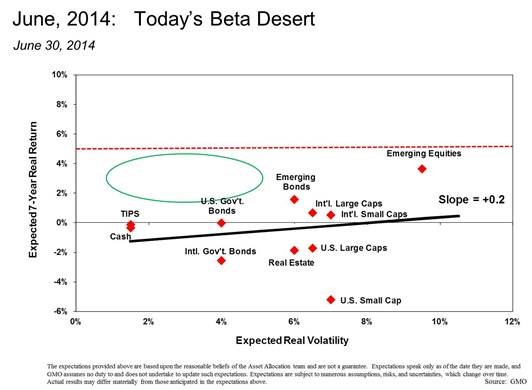

Today’s environment, however, is quite distinct, as seen in the chart below, where we lay out the GMO seven-year forecasts in a volatility (an imperfect shorthand for risk) versus return format for the traditional asset classes, or betas. This beta desert is so challenging because not only are there no asset classes that we believe are priced to deliver 5% real return (the red line), there is also no safe place to hide and wait (the green circle).