by Cullen Roche, Pragmatic Capitalism

Early last year I wrote a post describing the illusion of “passive investing”. In essence, there is no such thing because not a single one of us can replicate a totally passive index without making timed contributions, distributions, rebalancing, etc. I think the idea of “passive” investing is largely a marketing pitch sold by firms who do something that is generally a less “active” form of investing and this alternative perspective is constructed in order to draw a line in the sand thereby creating the illusion that less active forms of investing are something totally different from anything more active.

The whole idea of “passive” investing is obviously flawed though. It’s just marketing jargon. As Rick Ferri, one of the undisputed kings of indexing, recently noted, we are all active to some degree. But more importantly, anyone constructing an index based approach is essentially engaging in a form of a smart beta strategy. That is, they’re taking a global aggregate index and reconstructing it to suit their personal needs in the smartest manner possible. Let me explain in more detail.

If you wanted to engage in the most passive indexing style of all you’d buy an index that comprised all of the world’s financial assets and you’d let it ride forever without touching it. Of course, that index doesn’t exist so you can’t implement a pure indexing strategy in the first place. But you can get somewhat close. For instance, you can buy the Total Stock Market Index, the Total Bond Aggregate and various other asset classes that would get you pretty close to a global financial asset portfolio. But we should be clear – there is no such thing as a passive indexing purist. There is active management and inactive management.

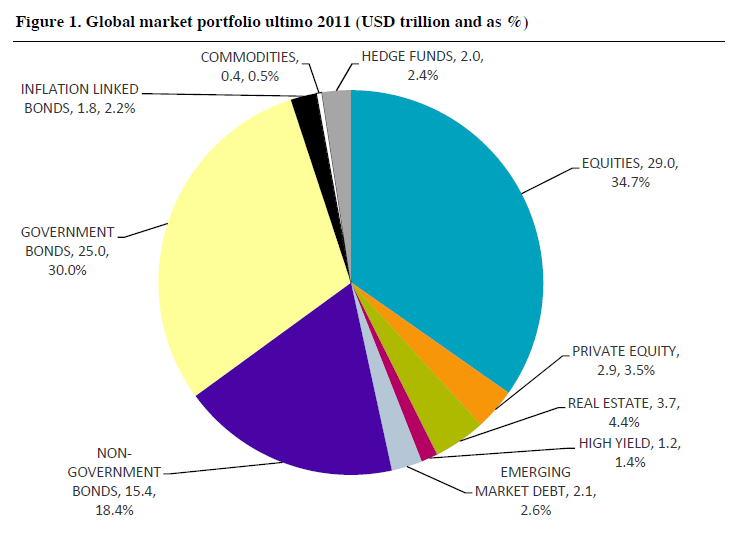

I was talking to James Osborne about this the other day and elaborated on this “passive” investing contradiction. Earlier this year researchers published a paper providing a general benchmark portfolio for what a global asset portfolio might look like:

One thing that you’ll probably notice is that this portfolio probably doesn’t look anything like your personal portfolio. In fact, the low equity allocation and high bond allocation is almost certainly different from the way most of us have been positioned for the last 20-30 years if you go by some of the mantras touted by people utilizing a “stocks for the long-run” mentality. The reason why is simple – most people promoting “passive investing” are using theoretical academic methodologies to construct what is nothing more than an alternative version of smart beta portfolios. It’s clever marketing based on highly theoretical underlying assumptions.

When most of us construct portfolios these days we adhere to the concepts taught by academics according to Modern Portfolio Theory (MPT) utilizing theories like the Efficient Frontier. And so you construct a portfolio using a vague idea of “risk”, “return” and the “long-run”. The Efficient Frontier boils risk down to standard deviation (which is not correct) and then concludes that most investors should be overweight stocks because variance in stocks is reduced over time. In essence, you get the “stocks for the long-run” conclusion.

This thinking is also used by people promoting the Efficient Market Hypothesis (EMH) promoting the purchase of low fee index funds “for the long run”. But these theories rely on the false assumption that an investor perceives “investment risk” as being synonymous with standard deviation. This is obviously not true. If it were then a fund that goes up 2% & 3% in consecutive years would be perceived as more risky than a fund that goes up and down 1% in consecutive years. Clearly, no investor would perceive minor upside variance as being worse than a fund that generates no return with both upside AND downside changes. Concepts like MPT, EMH and the Efficient Frontier rely on theoretical underpinnings that don’t actually translate to reality in a realistic manner.

In addition, this thinking results in something that claims the global asset financial portfolio above is not the most efficient way for you to allocate assets. Instead, most of these approaches argue that being overweight stocks is the ideal approach. So it takes the global aggregate and changes it in what is nothing more than a theoretical justification for betting on stocks relative to bonds (ie, active forecasting and active asset allocating). Therefore, most EMH amd MPT academics actually conclude that the market isn’t an efficient allocator of assets which creates obvious problems for the theoretical underpinnings of the concepts! Instead, they recommend an active reallocation of the global index using highly theoretical thinking based on a necessarily bullish long-term forecast.

The concern here is that there are lots of fund companies and managers selling this concept of “passive investing” for something it isn’t and constructing portfolios based on what could very well be a flawed understanding of the underlying macro foundations of the financial world. The problem here is multi-faceted. In utilizing this nice sounding theoretical framework the investor is likely to:

- Misunderstand risk and therefore perform a flawed risk profiling.

- Misunderstand the portfolio construction process and its relationship to risk.

- Allocate assets in a manner that likely creates much more risk in your portfolio than actually exists.

I should be clear – the “passive” investing movement is constructed with good intentions for portfolio construction. You should reduce fees, frictions, tax inefficiencies and establish the most efficient portfolio you possibly can. But be wary of people selling the idea of “passive investing” who don’t also describe this fine print. Your “passive” strategy definitely involves an implicit forecast about the future and is probably more active than you think. While promoters of “passive” investing probably have good intentions it’s very likely that they’re utilizing an underlying framework that is internally inconsistent and not based on a sound macro set of understandings.

Copyright © Pragmatic Capitalism