by James O'Shaughnessy, O'Shaughnessy Asset Management

Sometimes, a really simple approach to investing works remarkably well. Shareholder yield unites a stock’s dividend yield with its buyback yield to show what percentage of total cash the company is paying out to shareholders, either in the form of a cash dividend or expended cash to repurchase its shares in the open market. Thus, if a company is paying a five percent dividend yield and has a buyback yield of ten percent, its shareholder yield would be 15 percent. You calculate buyback yield by contrasting shares outstanding today with those outstanding one year earlier. If a stock has 90 shares outstanding today and had 100 outstanding a year earlier, it would have a buyback yield of 10 percent, which you derive by dividing the 10 fewer shares by the 100 from a year earlier. Conversely, if a stock has 100 shares outstanding today while it had 90 shares outstanding one year earlier, it has a buyback yield of -11 percent, indicating that the company has issued additional shares.

Between January 1st, 1927 and November 30th, 2013 (sorry for the stub period, we’re still updated the long-term data from What Works on Wall Street) an investor starting with $10,000 who simply bought the ten percent of stocks from our All Stocks Universe (All stocks with an inflation-adjusted market capitalization greater than $200 million) with the highest shareholder yield would have a portfolio worth $33,028, 684! That’s an after inflation return of 9.77 percent over nearly 87 years. Compared with someone who simply bought the All Stocks Universe, where the final portfolio value was $5,476,926, or a 7.52 percent real average annual return. See what the miracle of compounding 2.25 percent more than the index can do over long spans of time?

What about the unfortunate investor who was excited by the ten percent of stocks from All Stocks with the lowest shareholder yield? His $10,000 grew to just $160,500, a pathetic 3.25 percent real average annual return over nearly 87 years! Apparently stocks issuing a lot of shares make lousy investments. Yet, it shows that even an investor who bought horrible stocks still did better than an investor who sat in U.S. T-bills over the same period, where the original $10,000 grew to just $15,099, a puny 0.48 percent real average annual return.

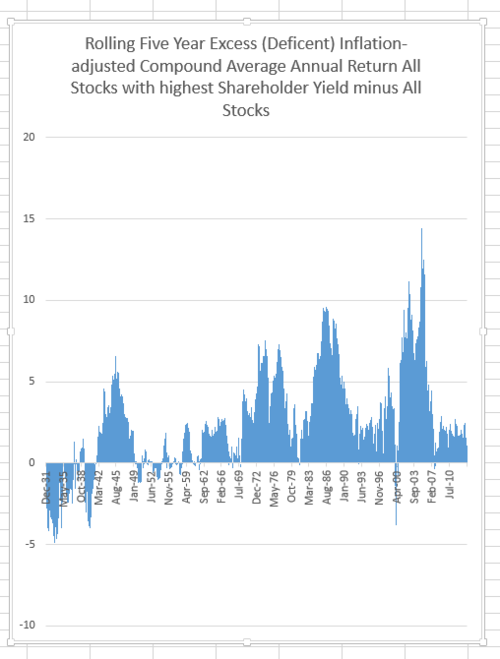

Of course, as with any strategy, nothing works all the time. If you glance at the chart below you will see that investors in the early 1930s through the early 1940s would have underperformed an investment in the All Stocks Universe. Yet, for all 984 rolling five-year periods, the strategy underperformed in just 186 of them, or 19 percent of the time. And the underperformance was not large: the average annual loss to All stocks over all losing five-year periods was just -1.38 percent. For the 798 rolling five-year periods where the strategy did beat All Stocks, it did so by an average of 3.28 percent real average annual return, a significant pick-up over All Stocks returns.

What about the skeptical investor who says “who cares how something has done over the long run because in the long run we’re all dead.” Fair enough, let’s look how the stocks with the highest shareholder yield faired more recently. We’ll start on January 1st, 2000 through November 30th, 2013. Keeping in mind that the 2000s were the worst decade for stocks in 110 years, the high shareholder yield investor would have looked at the last 13 years as a cakewalk. $10,000 invested on January 1st, 2000 would grow to $40,523, a real average annual return of 10.58 percent and nearly double $10,000 invested in All Stocks, which grew to $20,583, or a real average annual return of 5.32 percent.

With all this evidence, why aren’t investors flocking to stocks with the highest shareholder yield? I discuss part of the reason in my post Why Models Beat Humans, but part of it can also be blamed on our inability to look past the names the factor serves up. Ever heard of Teekay Tanks Ltd? Me neither. It’s a small-cap stock with a shareholder yield of 17.8 percent. How about Montpelier RE Holdings? Not ringing any bells? Not for me either. Oh, and it was recently downgraded by Deutsche Bank. But it’s got a shareholder yield of 13.2 percent. Finally, here’s a name I bet you know as it was recently made famous by a hedge fund manager—Herbalife Ltd. I know it’s a controversial name, but it nevertheless has a shareholder yield of 10.9 percent.

Now, I have no idea how these three names will fare, and that is why I recommend buying a broad basket of stocks with high shareholder yield. I highlight these three because they are either little known or controversial or both. It’s very difficult for non-rules based investors to willingly pony up to the bar and buy names that can be scary, yet all of the evidence shows that it is an extremely profitable way to invest.

Copyright © James O'Shaughnessy, O'Shaughnessy Asset Management