by Don Vialoux, Timing the Market

Tech Talk Interview on Michael Campbell’s MoneyTalks Radio

(Completed on Saturday July 20th)

Following is a link:

http://moneytalks.net/upcoming-shows.html

Economic News This Week

June Consumer Prices to be released at 8:30 AM EDT on Tuesday are expected to increase 0.3% versus a gain of 0.4% in May. Excluding food and energy, June CPI is expected to increase 0.2% versus a gain of 0.3% in May.

June Existing Home Sales to be released at 10:00 AM EDT on Tuesday are expected to increase to 4.97 million from 4.89 million in May.

Canadian May Retail Sales to be released at 8:30 AM EDT on Wednesday are expected to increase 0.5% versus a gain of 1.1% in April.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday to increase to 310,000 from 302,000 last week.

June New Home Sales to be released at 10:00 AM EDT on Thursday are expected to slip to 480,000 from 504,000 in May.

U.S. June Durable Goods Orders to be released at 8:30 AM EDT on Friday are expected to increase 0.5% versus a decline of 0.9% in May. Excluding transportation, June Orders are expected to increase 0.5% versus no change in May.

Earnings News This Week

Equity Trends

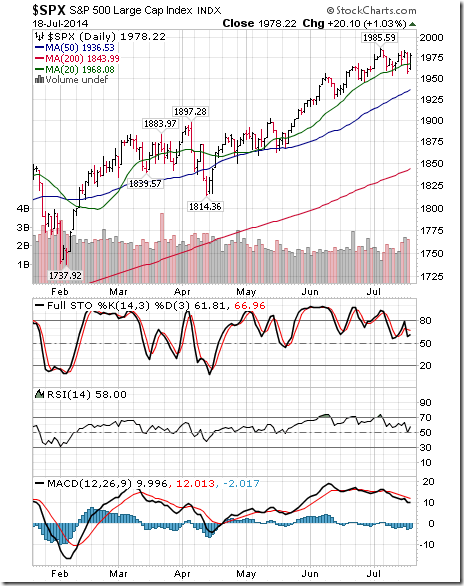

The S&P 500 Index gained 10.65 points (0.54%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day moving average fell last week to 71.00% from 76.80%. Percent remains intermediate overbought and trending down.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 85.60% from 84.80%. Percent remains intermediate overbought and trending down.

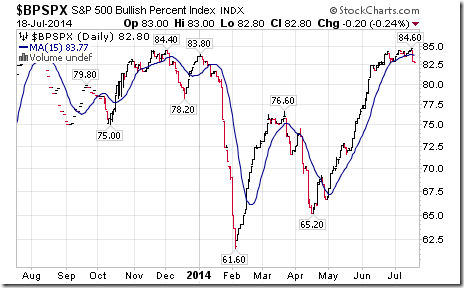

Bullish Percent Index for S&P 500 stocks fell last week to 82.80% from 84.00% and fell below its 15 day moving average. The Index remains intermediate overbought and starting to roll over.

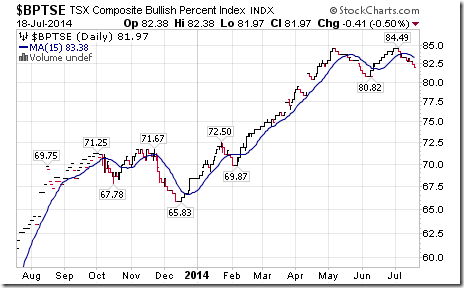

Bullish Percent Index for TSX Composite stocks fell last week to 81.97% from 82.86% and remains below its 15 day moving average. The Index remain intermediate overbought and has rolled over.

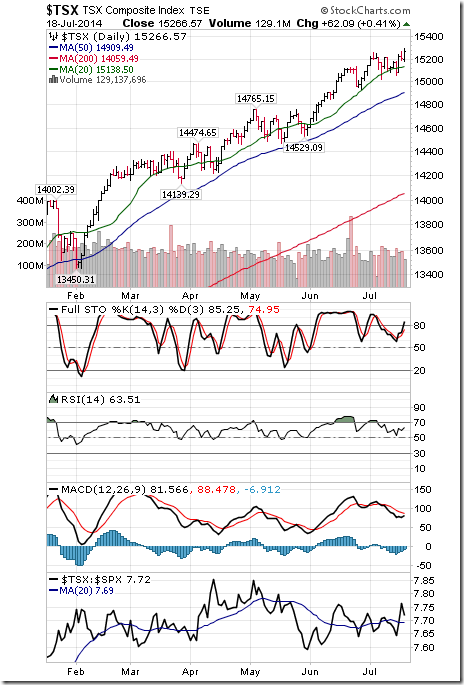

The TSX Composite Index added 141.17 points (0.93%) last week. Intermediate trend remains up. (Score: 1.0). The Index remains above its 20 day moving average (Score: 1.0). Strength relative to the S&P 500 Index changed from neutral to positive (Score: 1.0). Technical score based on the above indicators improved to 3.0 from 2.5 out of 3.0. Short term momentum indicators are trending down.

Percent of TSX stocks trading above their 50 day moving average increased last week to 58.02% from 53.50%. Percent remains intermediate overbought and trending down.

Percent of TSX stocks trading above their 200 day moving average slipped last week to 75.72% from 76.95%. Percent remains intermediate overbought and trending down.

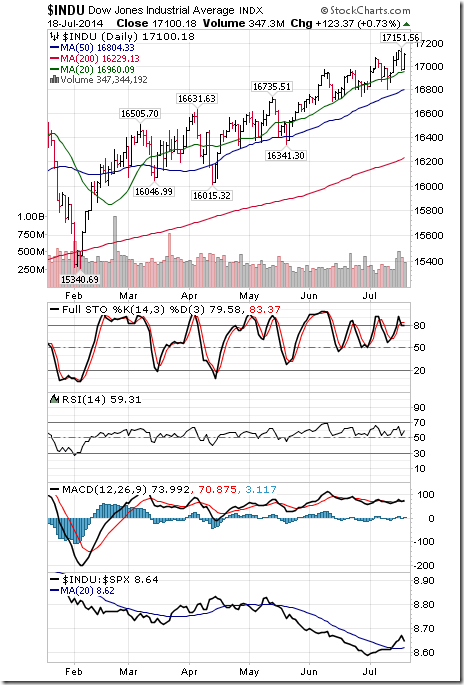

The Dow Jones Industrial Average added 156.37 points (0.92%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index changed to positive from negative. Technical score improved to 3.0 from 2.0 out of 3.0. Short term momentum indicators are mixed.

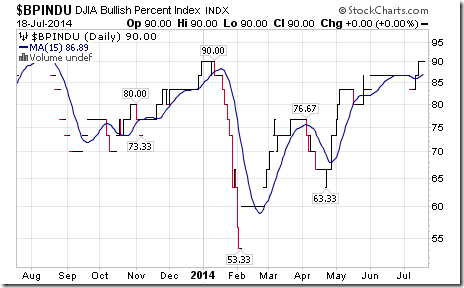

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 90.00% from 86.67% and moved back above their 15 day moving average. The Index remains intermediate overbought.

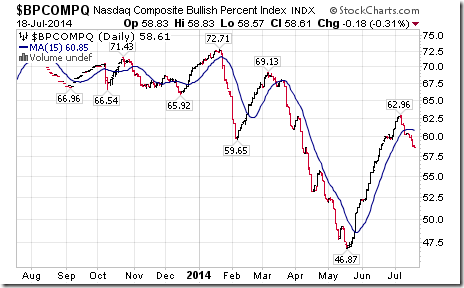

Bullish Percent Index for NASDAQ Composite stocks fell last week to 58.61% from 60.47% and remained below its 15 day moving average. The Index remains intermediate overbought and trending down.

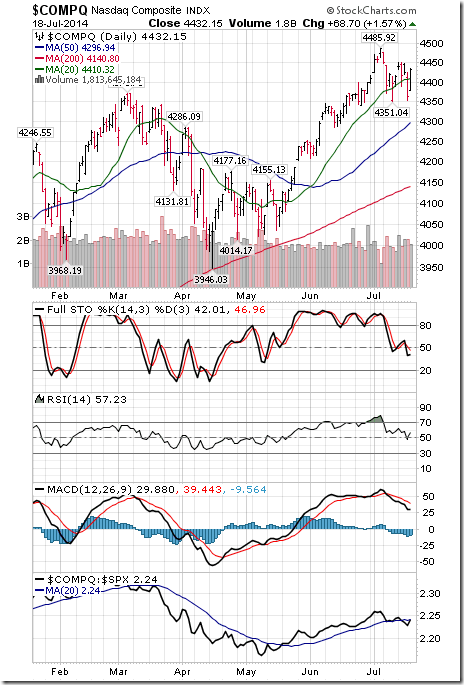

The NASDAQ Composite Index added 16.66 points (0.38%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 2.5 out of 3.0. Short term momentum indicators are trending down.

The Russell 2000 Index fell 8.32 points (0.71%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down.

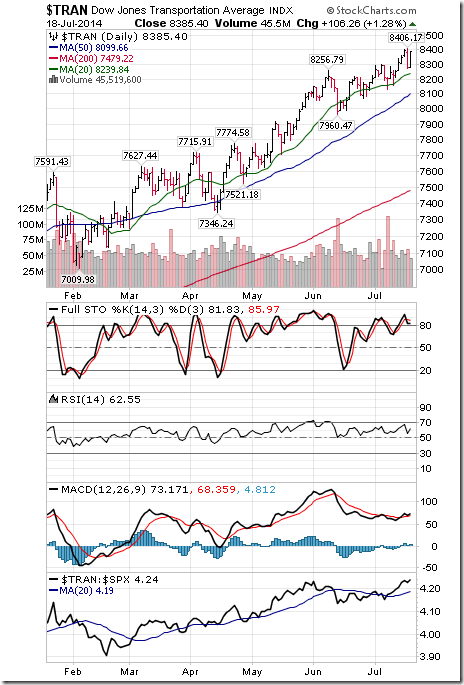

The Dow Jones Transportation Average gained 131.09 points (1.59%) last week. Intermediate trend remains up. The Average remains above its 20 day moving average. Strength relative to the S&P 500 Index remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are mixed

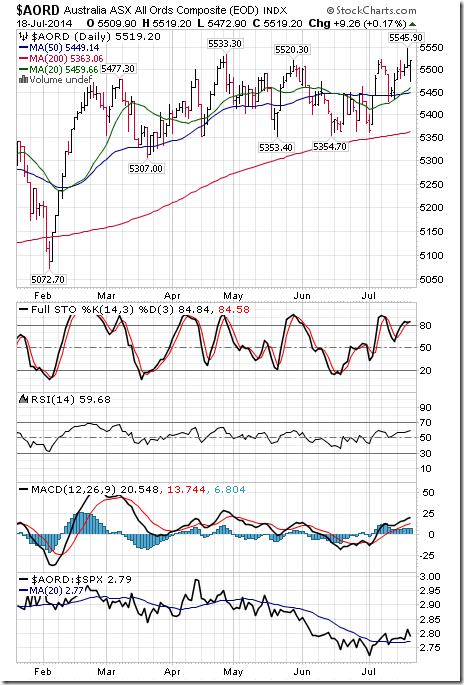

The Australia All Ordinaries Composite Index added 44.61 points (0.81%) last week. Intermediate trend changed from neutral to up on a move above 5,533.30. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from neutral to positive. Technical score improved to 3.0 from 2.0 out of 3.0. Short term momentum indicators are trending up.

The Nikkei Average gained 51.67 points (0.34%) last week. Intermediate trend remains up. The Average remains below its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score remains at 1.5 out of 3.0. Short term momentum indicators are trending down.

Europe 350 iShares added $0.14 (0.29%) last week. Trend remains down. Units remain below their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down.

The Shanghai Composite Index added 12.11 points (0.59%) last week. Intermediate trend remains up. The Index moved above its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score improved to 2.5 from 1.5 out of 3.0. Short term momentum indicators are mixed

iShares Emerging Markets added $0.27 (0.62%) last week. Intermediate trend remains up. Units remain above their 20 day moving average. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score slipped to 2.5 from 3.0 out of 3.0. Short term momentum indicators are trending down.

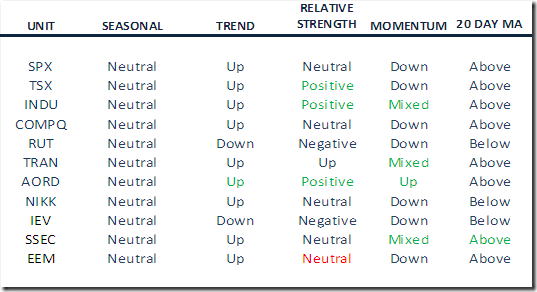

Summary of Weekly Seasonal/Technical Parameters for Equity Indices/ETFs

Key:

Seasonal: Positive, Negative or Neutral on a relative basis applying EquityClock.com charts

Trend: Up, Down or Neutral

Strength relative to the S&P 500 Index: Positive, Negative or Neutral

Momentum based on an average of Stochastics, RSI and MACD: Up, Down or Mixed

Twenty Day Moving Average: Above, Below

Green: Upgrade

Red: Downgrade

Currencies

The U.S. Dollar gained 0.39 (0.49%) last week. Intermediate trend remains neutral. The Dollar remains above its 20 day moving average. Short term momentum indicators are trending up.

The Euro fell 0.82 (0.60%) last week. Intermediate trend changed from neutral to down on a move on Friday below 135.03. The Euro remains below its 20 day moving average. Short term momentum indicators are trending down.

The Canadian Dollar was unchanged last week. Intermediate trend remains up. The Canuck buck fell remained below its 20 day moving average. Short term momentum indicators are trending down.

The Japanese Yen added 0.03 (0.03%) last week. Intermediate trend remains neutral. The Yen remains above its 20 day moving average. Short term momentum indicators are mixed.

Commodities

The CRB Index added 0.35 (1.18%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0.

Gasoline fell another $0.05 (1.72%) last week. Intermediate trend changed from up to down on a move below $2.87. Gas remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score fell to 0.0 from 1.0 out of 3.0.

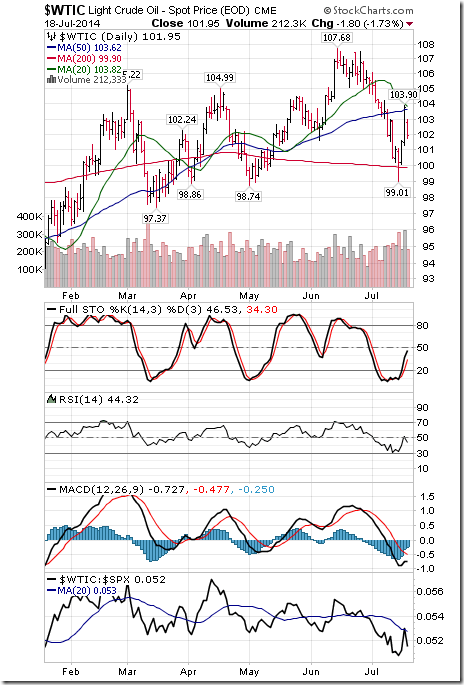

Crude Oil added $1.46 per barrel (1.45%) last week. Intermediate trend remains up. Crude remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are recovering from oversold levels.

Natural Gas fell another $0.19 per MBtu (4.59%) last week. Intermediate trend remains down. Natural gas remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down, but are oversold.

The S&P Energy Index added 4.67 points (0.65%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators were mixed.

The Philadelphia Oil Services Index added 3.02 points (1.00%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 1.0 out of 3.0. Short term momentum indicators are mixed.

Gold fell $30.60 per ounce (2.28%) last week. Intermediate trend remains up. Gold fell below its 20 day moving average. Strength relative to the S&P 500 Index remains neutral. Technical score fell to 2.0 from 3.0 out of 3.0. Short term momentum indicators are mixed.

Silver fell $0.61 per ounce (2.84%) last week. Intermediate trend remains up. Silver fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score dropped to 1.5 out of 3.0. Short term momentum indicators are mixed. Strength relative to Gold changed from positive to neutral.

The AMEX Gold Bug Index fell 4.19 points (1.70%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index and Gold remains positive. Technical score remains at 3.0 out of 3.0. Short term momentum indicators are mixed.

Platinum dropped $25.50 per ounce (1.68%) last week. Intermediate trend remains up. PLAT dropped below its 20 day MA. Strength relative to S&P 500 and Gold are neutral.

Palladium added $7.05 per ounce (0.81%) last week. Trend remains up. PALL remains above its 20 day MA. Strength relative to the S&P 500 and Gold is positive.

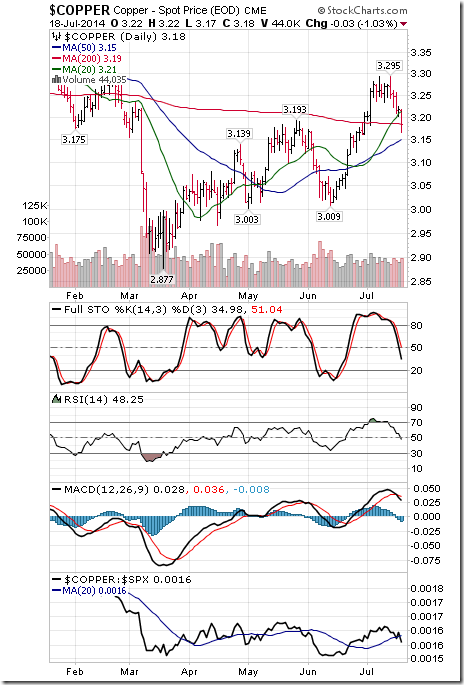

Copper dropped $0.09 per lb. (2.75%) last week. Intermediate trend is up. Copper fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to negative. Technical score dropped to 1.0 from 3.0 out of 3.0. Short term momentum indicators are trending down.

The TSX Metals and Mining Index dropped 34.55 points (3.73%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to neutral. Technical score fell to 1.5 from 3.0 out of 3.0. Short term momentum indicators are trending down.

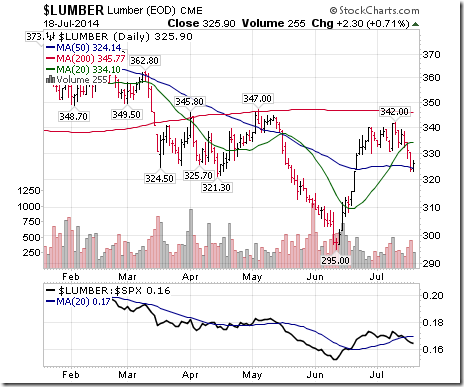

Lumber dropped $8.10- (2.43%) last week. Trend remains down. Lumber fell below its 20 day moving average. Strength relative to the S&P 500 Index changed from positive to negative.

The Grain ETN dropped another $10.12 (0.30%) last week. Trend remains down. Units remain below their 20 day moving average. Strength relative to the S&P 500 remains negative.

The Agriculture ETF added $0.05 (0.09%) last week. Trend remains down. Units remain below their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Technical score remains at 0.0 out of 3.0. Short term momentum indicators are trending down., but are oversold.

Interest Rates

The yield on 10 year Treasuries fell 3.6 basis points (1.43%) last week. Trend remains neutral. Yield remains below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF added $0.92 (0.81%) last week. Intermediate uptrend was confirmed on a move above $114.60. Units remain above their 20 day moving average.

Other Issues

The VIX Index slipped 0.02 (0.17%) last week despite a huge spike on Thursday. Trend remains up. The Index remains above its 20 day moving average.

Economic news this week is expected to be mixed

Second quarter results are a focus. This is the week for the largest number of reports. Responses to reports released to date have been less than impressive. Generally, earnings and revenues have slightly exceeded consensus estimates. With the exception of companies that report blow out results, traders are selling on news.

Liquidity in North American equity markets is expected to remain below normal.

Short to intermediate technical indicators for many equity markets and sectors remain overbought and trending down.

Surprising, non-recurring events will continue to roil equity markets (e.g. Shoot down of Malaysian flight 17).

International events are expected to continue to impact equity markets (e.g. the economic slowdown in Europe, conflicts in Ukraine and Palestine).

Seasonal influences of economic sensitive sectors turn negative between mid-July to October.

The Bottom Line

Caution in equity markets remains appropriate.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

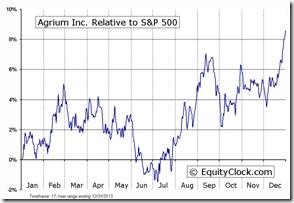

Following is an example:

AGU.TO Relative to the S&P 500  |

AGU.TO Relative to the Sector  |

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

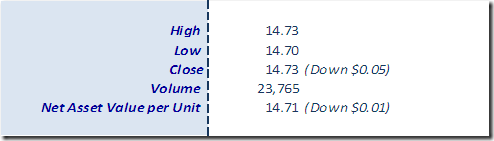

Horizons Seasonal Rotation ETF HAC July 18th 2014

Copyright © Don Vialoux, Jon Vialoux, Brooke Thackray